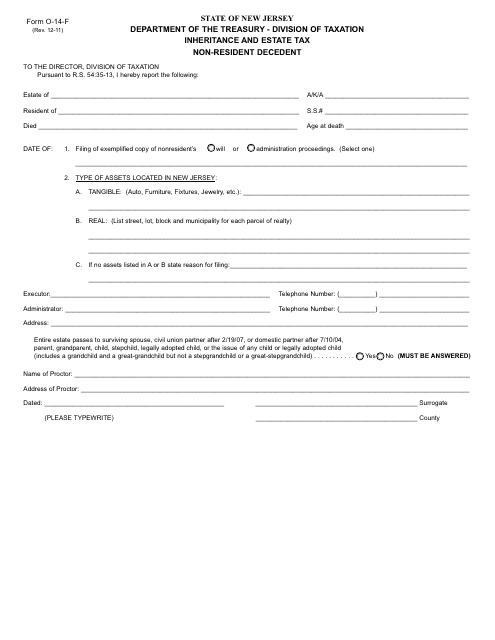

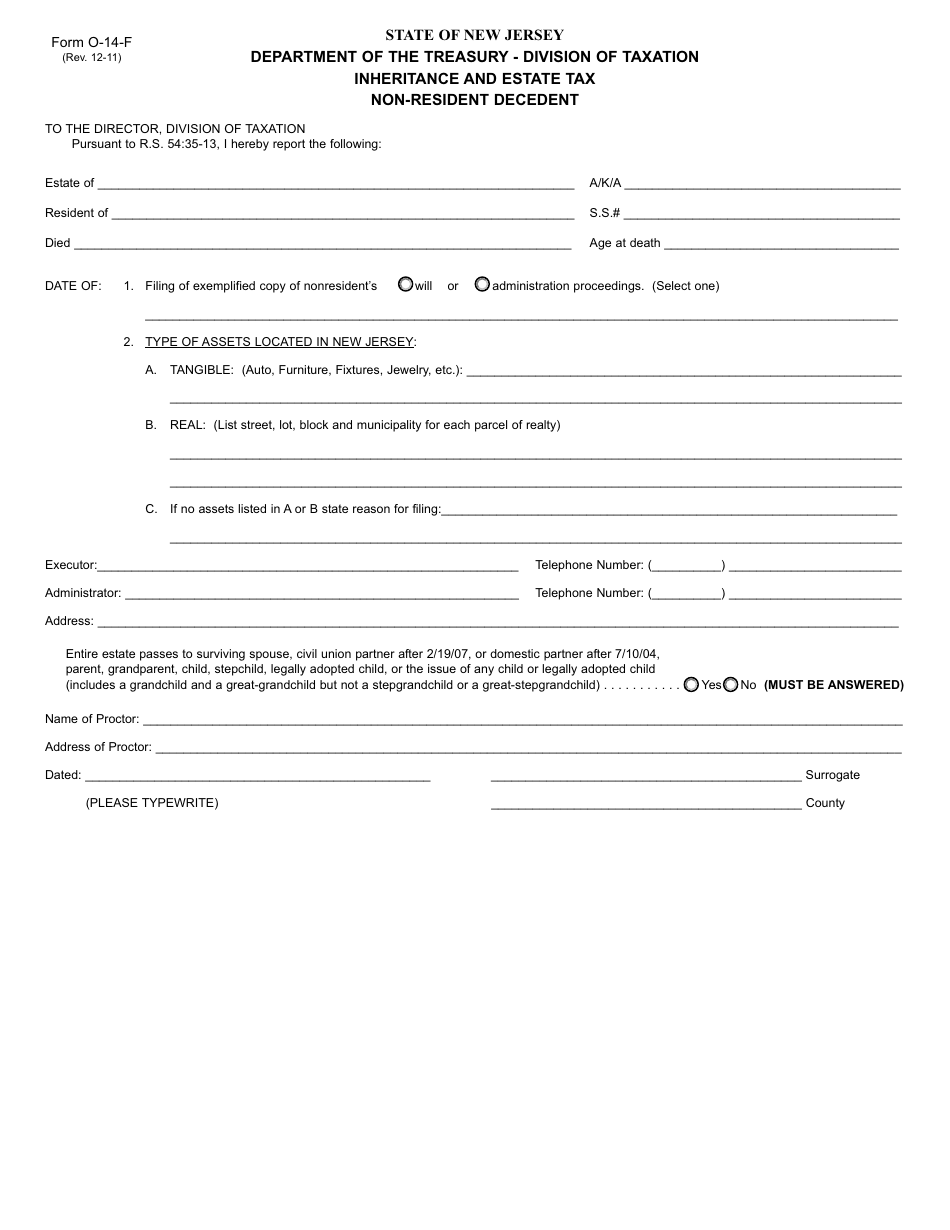

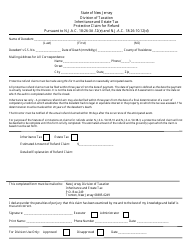

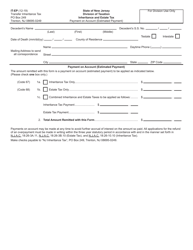

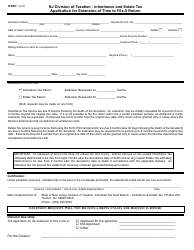

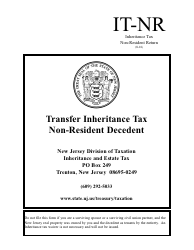

Form O-14-f Inheritance and Estate Tax Non-resident Decedent - New Jersey

What Is Form O-14-f?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

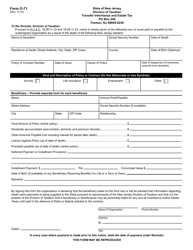

Q: What is Form O-14-f?

A: Form O-14-f is a tax form used in New Jersey for the Inheritance and Estate Tax of non-resident decedents.

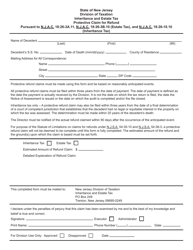

Q: Who needs to file Form O-14-f?

A: Non-resident decedents who owned property located in New Jersey are required to file Form O-14-f for Inheritance and Estate Tax purposes.

Q: What is the purpose of Form O-14-f?

A: The purpose of Form O-14-f is to report and determine the amount of Inheritance and Estate Tax owed by non-resident decedents in New Jersey.

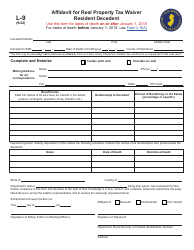

Q: What information is needed to complete Form O-14-f?

A: Form O-14-f requires information about the non-resident decedent, the property owned in New Jersey, and the value of the estate.

Q: When is Form O-14-f due?

A: Form O-14-f is due within eight months after the decedent's date of death.

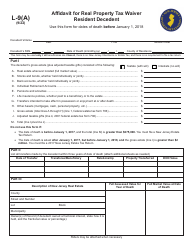

Q: Are there any exemptions or deductions available on Form O-14-f?

A: Yes, certain exemptions and deductions may apply on Form O-14-f, depending on the circumstances of the estate.

Q: What are the consequences of not filing Form O-14-f?

A: Failure to file Form O-14-f and pay the required Inheritance and Estate Tax may result in penalties and interest charges.

Q: Can I get assistance with completing Form O-14-f?

A: Yes, you can seek assistance from a qualified tax professional or directly contact the New Jersey Division of Taxation for guidance.

Q: Is Form O-14-f only for non-resident decedents?

A: Yes, Form O-14-f is specifically designed for non-resident decedents who owned property in New Jersey.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form O-14-f by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.