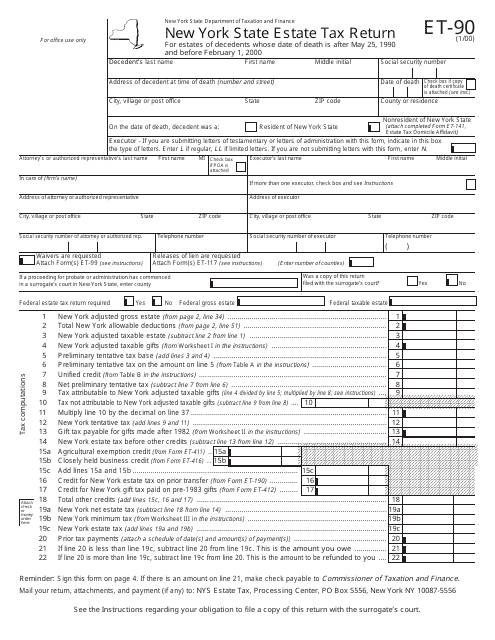

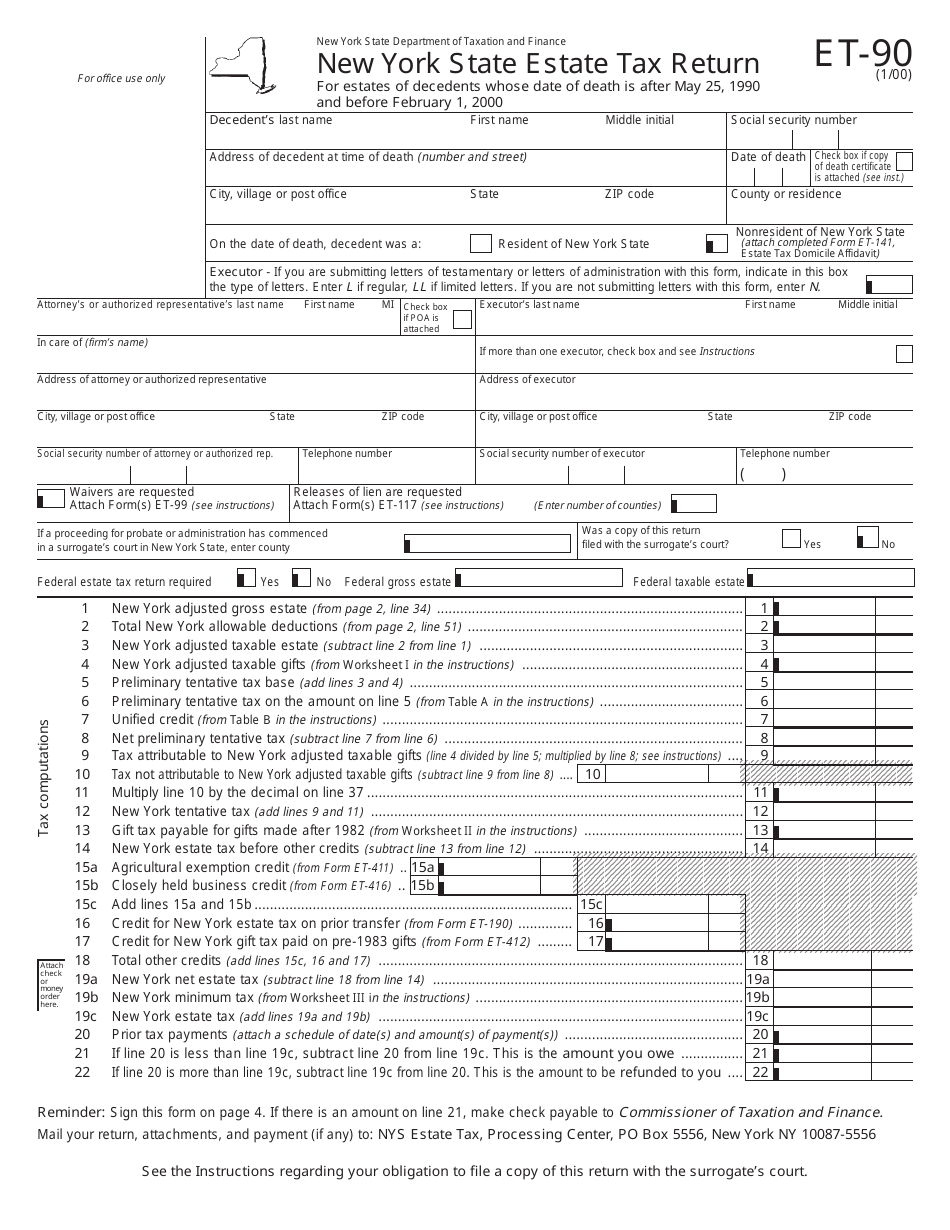

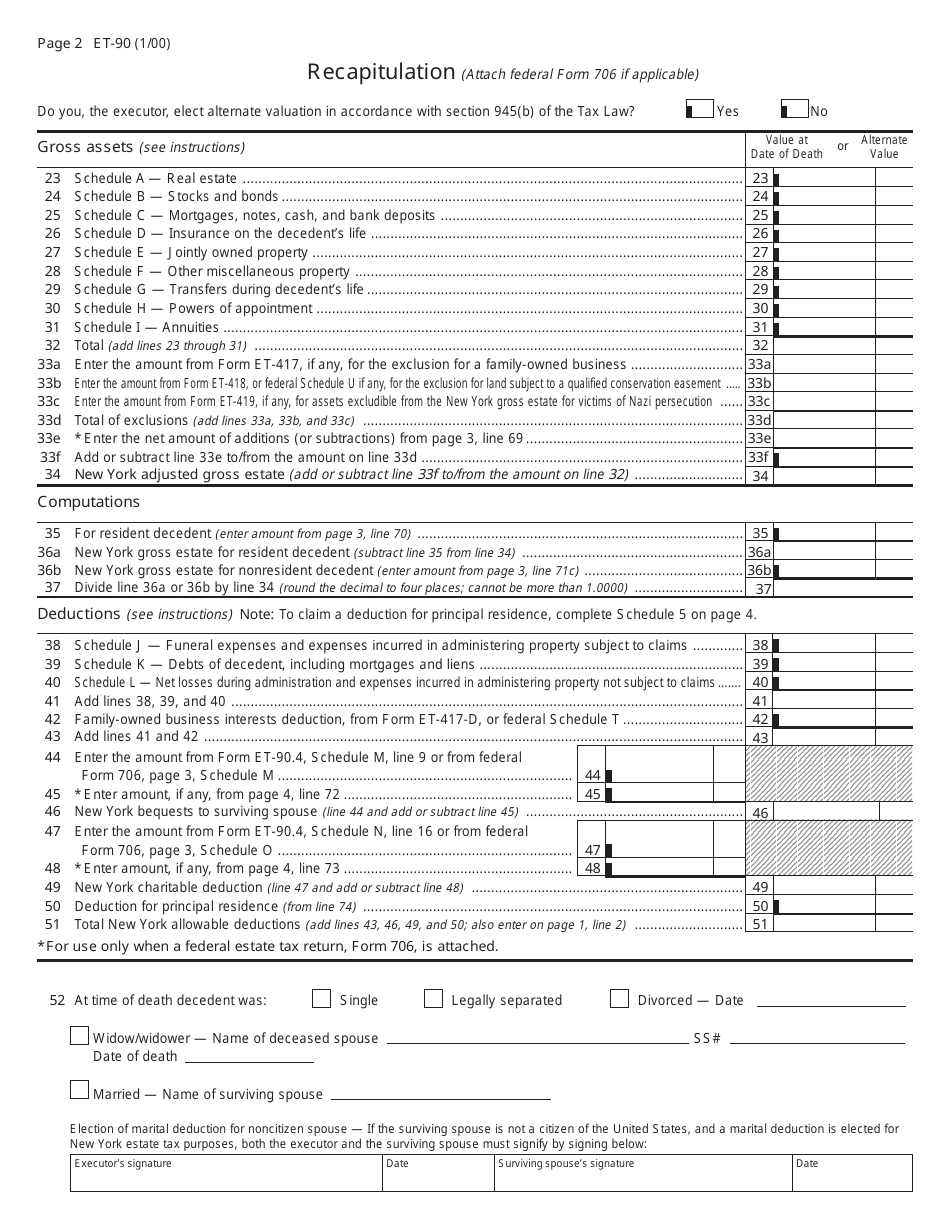

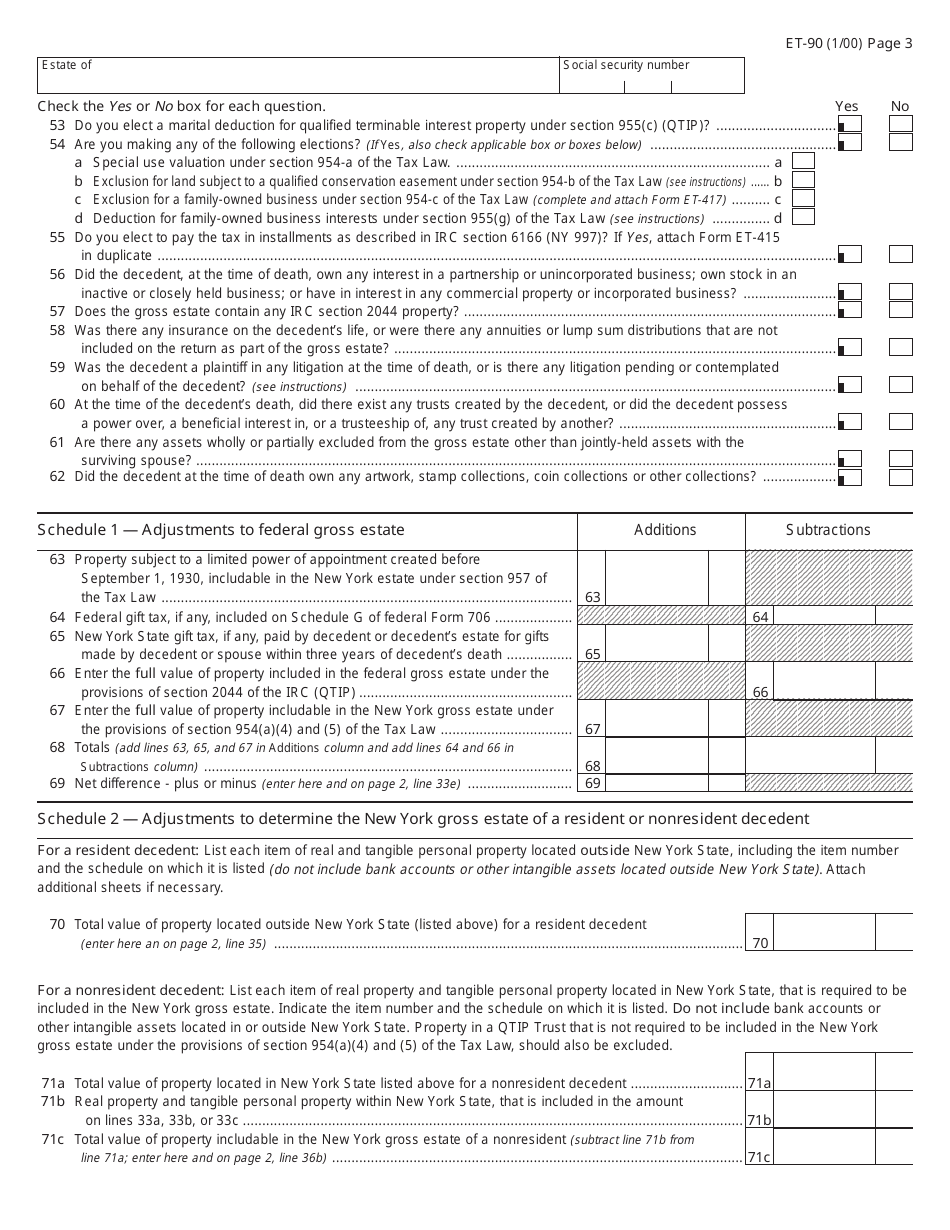

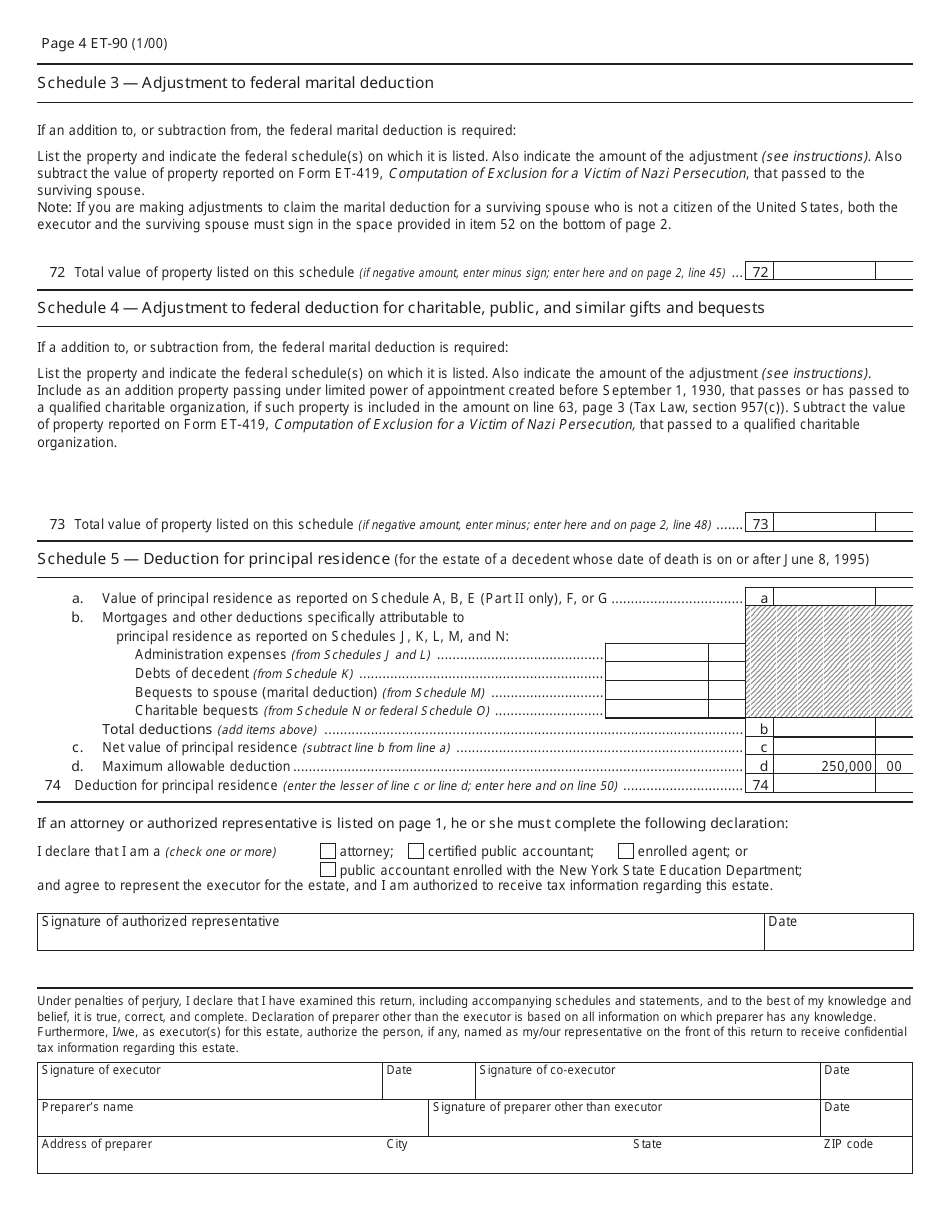

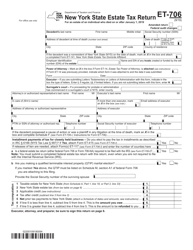

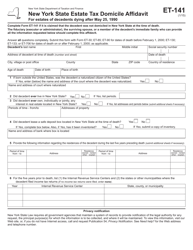

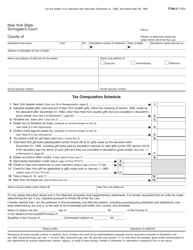

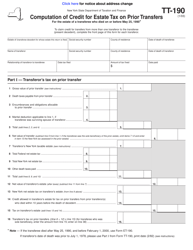

Form ET-90 New York State Estate Tax Return - New York

What Is Form ET-90?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-90?

A: Form ET-90 is the New York State Estate Tax Return.

Q: Who needs to file Form ET-90?

A: Form ET-90 must be filed by the executor or administrator of a deceased person's estate if the estate is subject to New York State estate tax.

Q: When is Form ET-90 due?

A: Form ET-90 is due within 9 months after the decedent's date of death.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

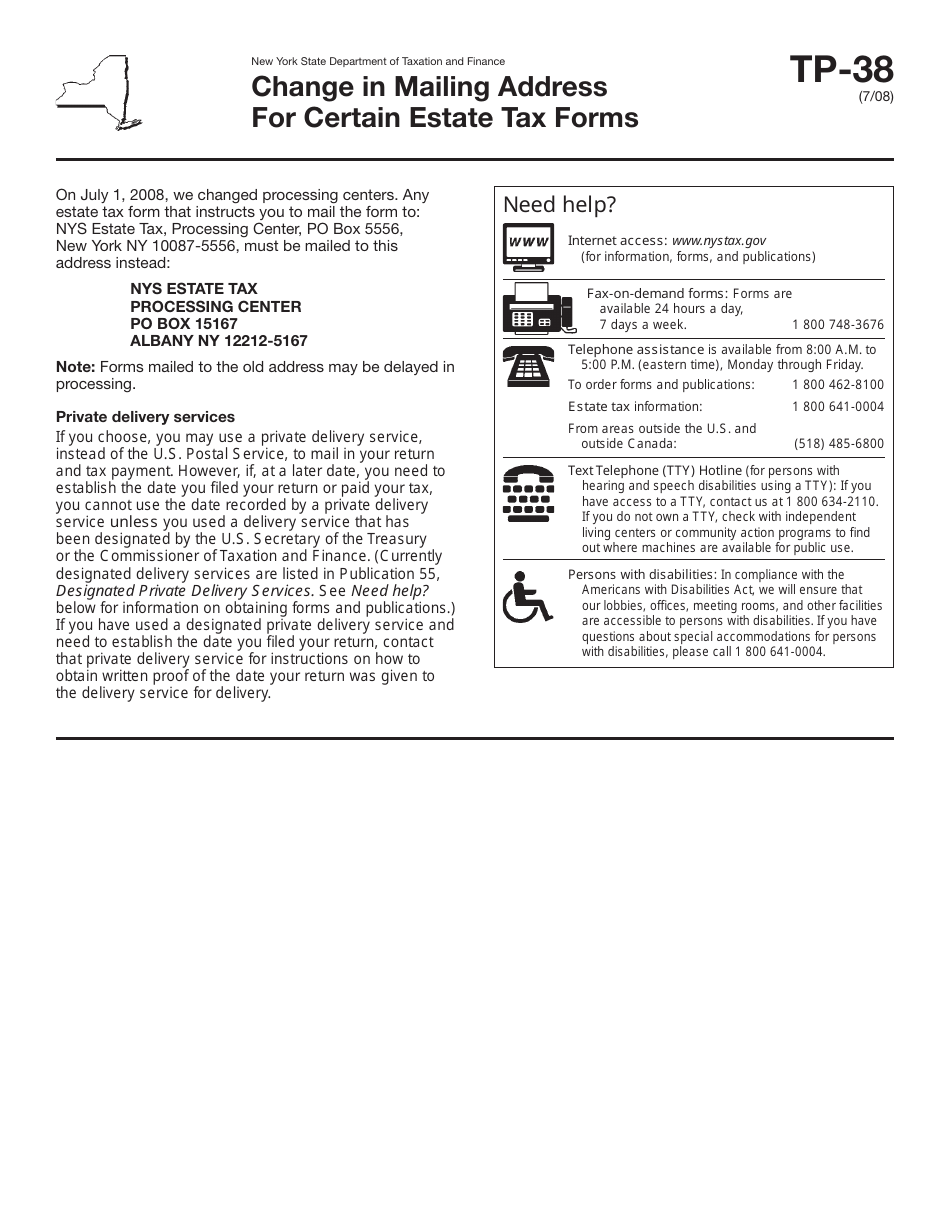

Download a printable version of Form ET-90 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.