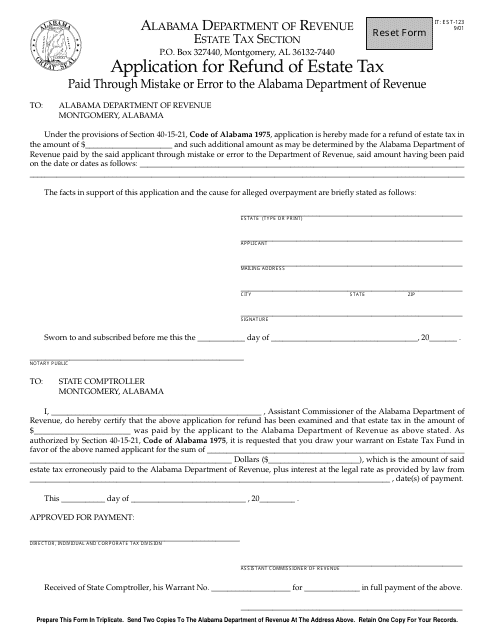

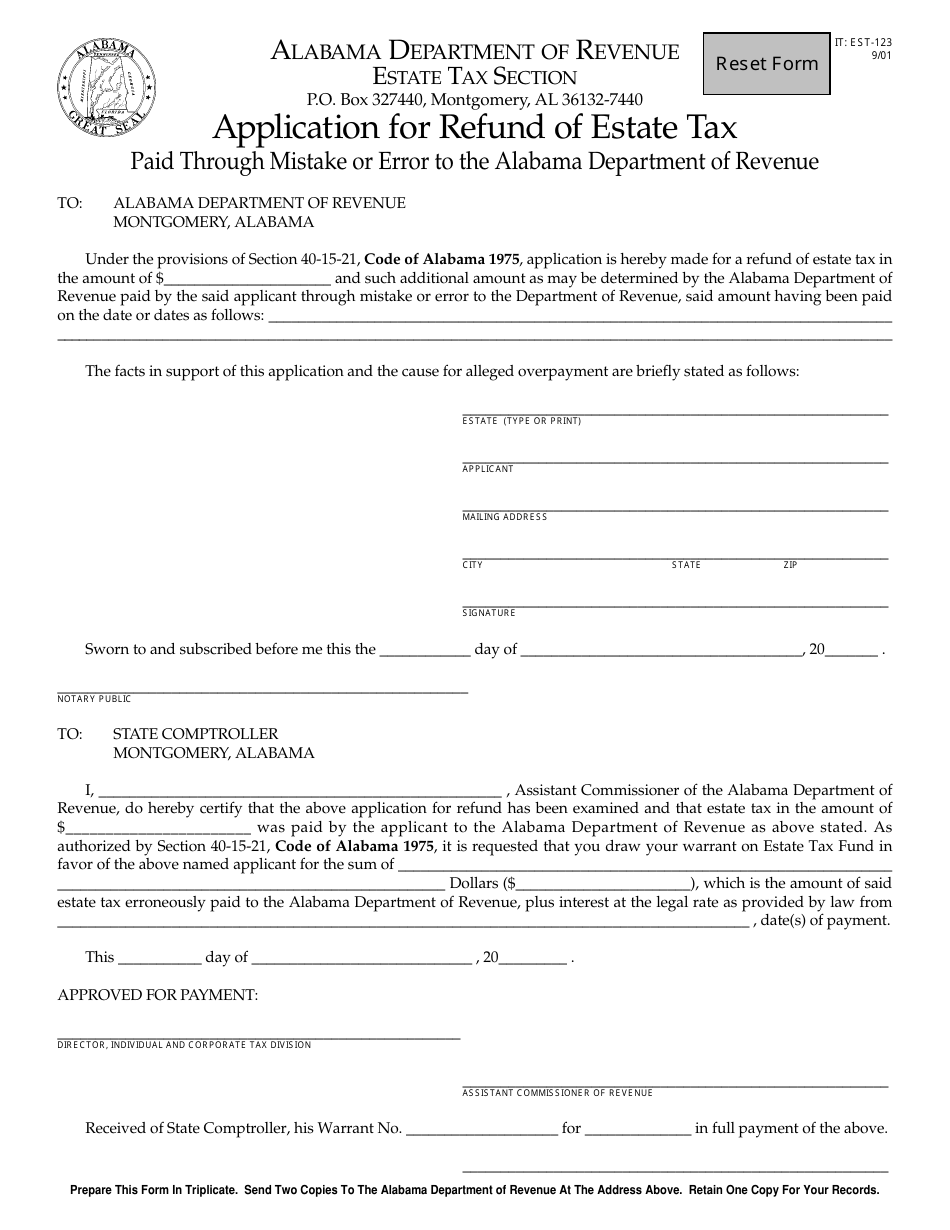

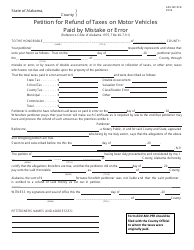

Form IT: EST-123 Application for Refund of Estate Tax - Alabama

What Is Form IT: EST-123?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT: EST-123?

A: Form IT: EST-123 is an application for refund of estate tax in the state of Alabama.

Q: Who can use Form IT: EST-123?

A: Anyone who wants to apply for a refund of estate tax in Alabama can use Form IT: EST-123.

Q: What information is required on Form IT: EST-123?

A: Form IT: EST-123 requires information such as the decedent's name, social security number, date of death, and details of the estate.

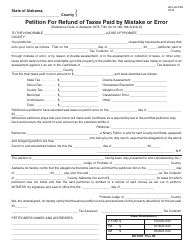

Q: Is there a deadline for submitting Form IT: EST-123?

A: Yes, there is a deadline for submitting Form IT: EST-123. It is generally within one year from the date of the tax payment or the date the return was due, whichever is later.

Q: How long does it take to receive a refund after submitting Form IT: EST-123?

A: Generally, it takes several weeks to process the application and issue a refund.

Q: Are there any fees for filing Form IT: EST-123?

A: No, there are no fees for filing Form IT: EST-123.

Q: Can I file Form IT: EST-123 electronically?

A: No, currently electronic filing is not available for Form IT: EST-123.

Q: What should I do if I need assistance with Form IT: EST-123?

A: If you need assistance with Form IT: EST-123, you can contact the Alabama Department of Revenue for guidance.

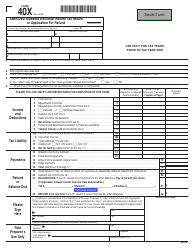

Form Details:

- Released on September 1, 2001;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT: EST-123 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.