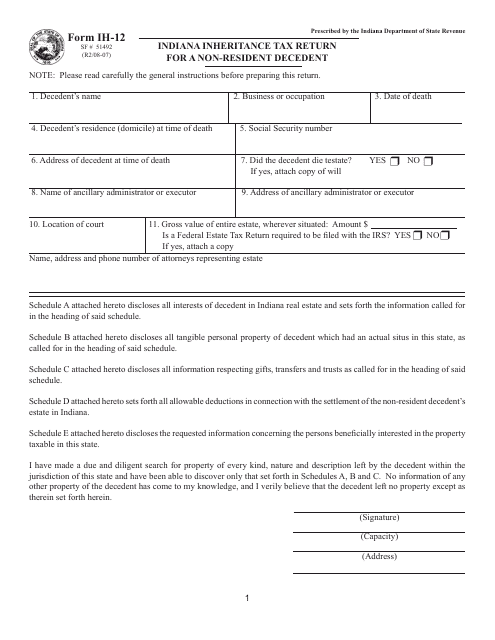

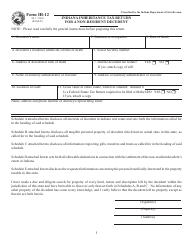

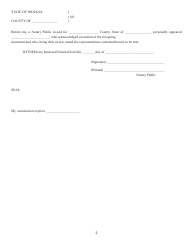

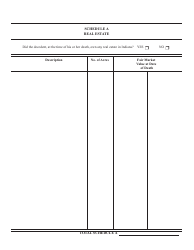

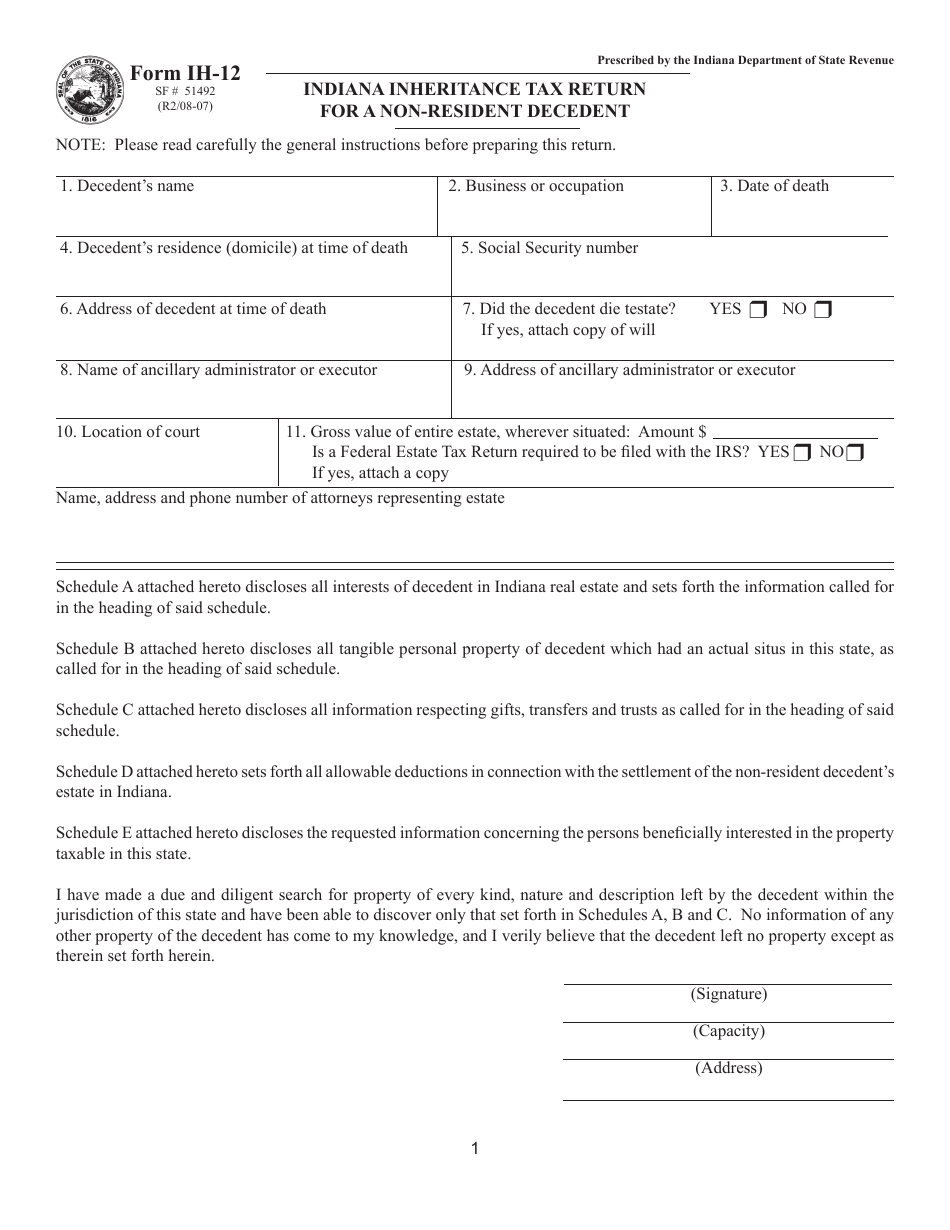

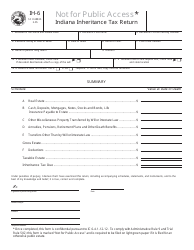

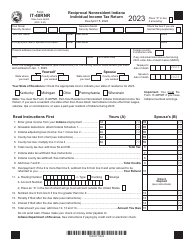

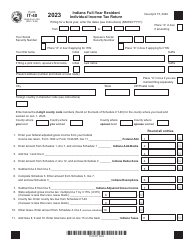

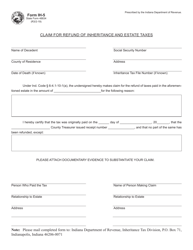

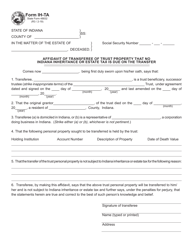

State Form 51492 (IH-12) Indiana Inheritance Tax Return for a Non-resident Decedent - Indiana

What Is State Form 51492 (IH-12)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is State Form 51492?

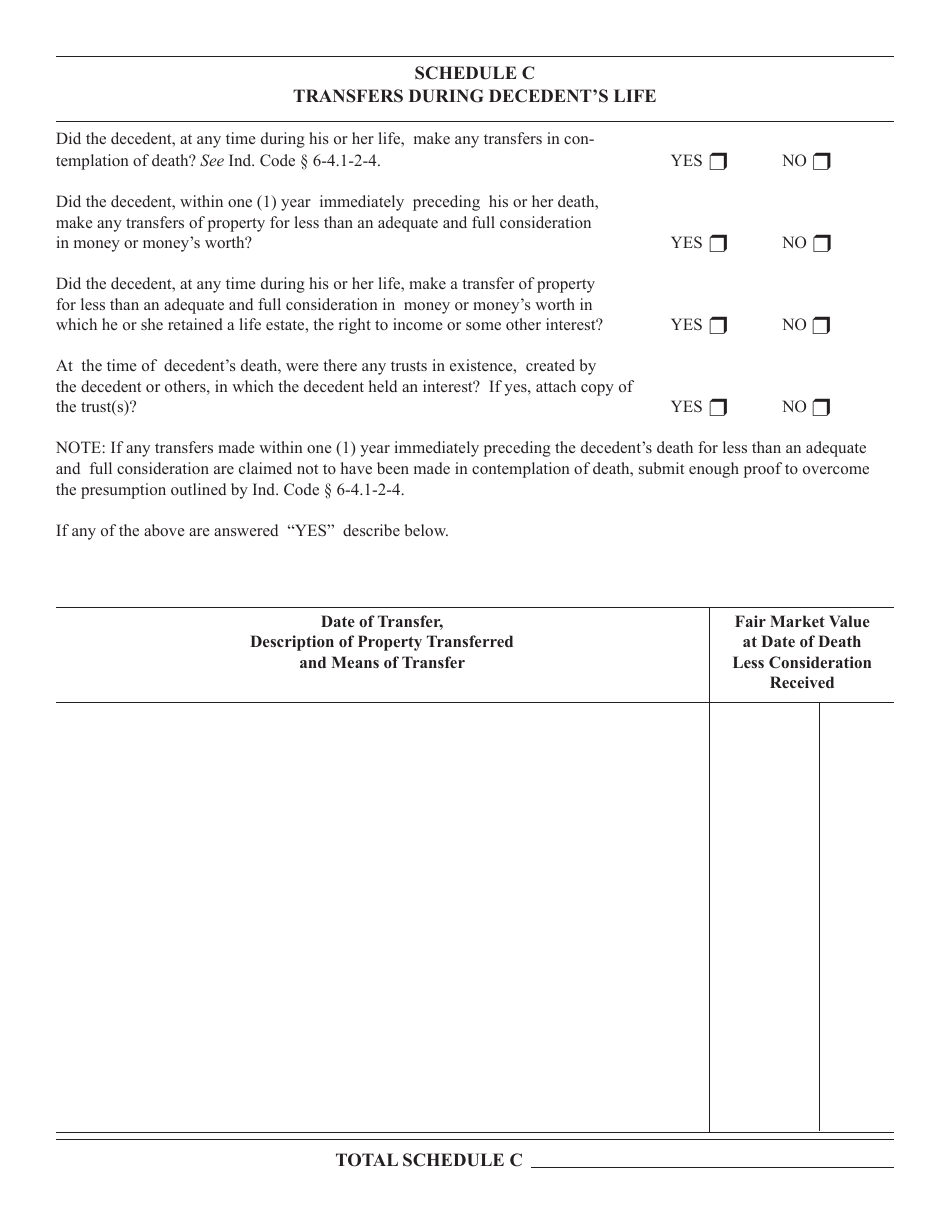

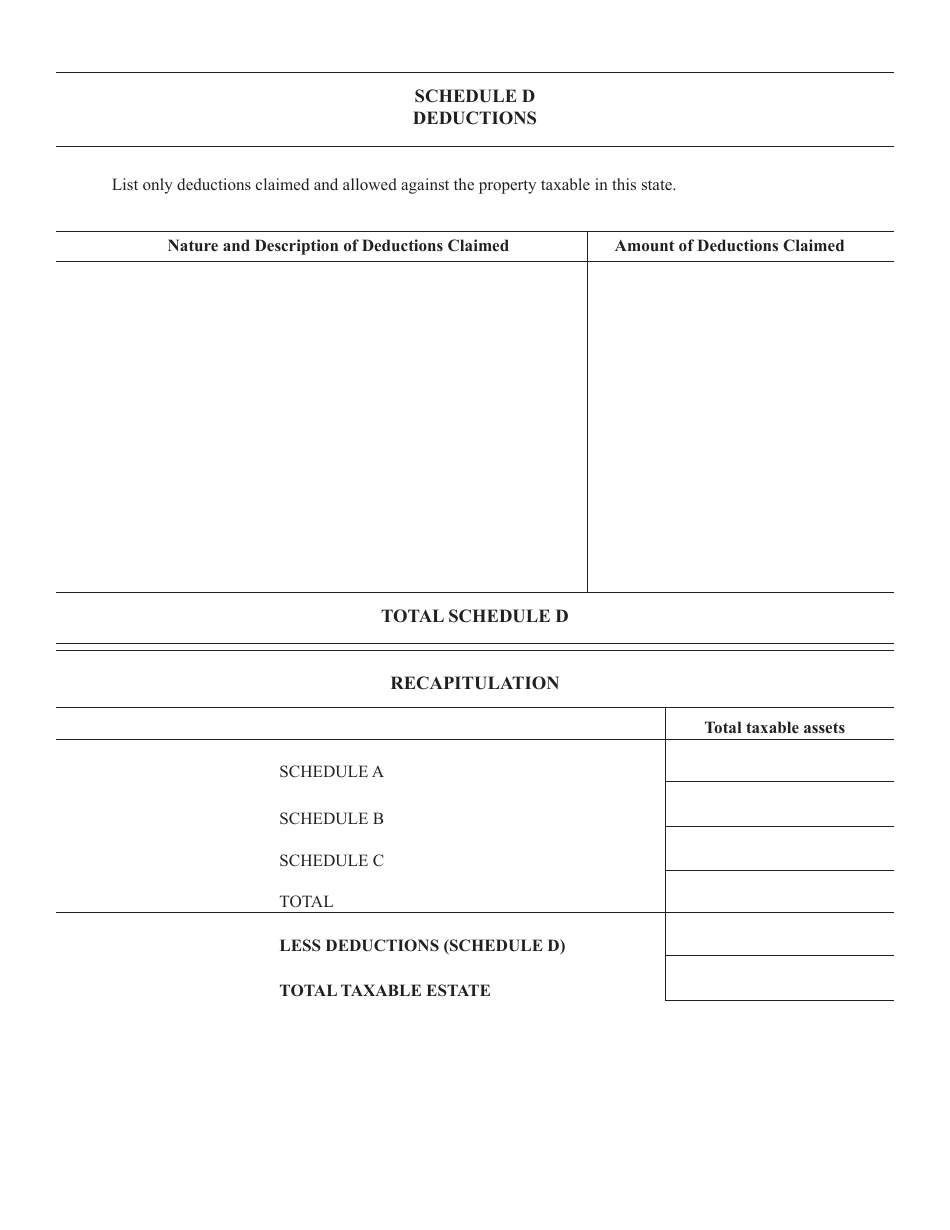

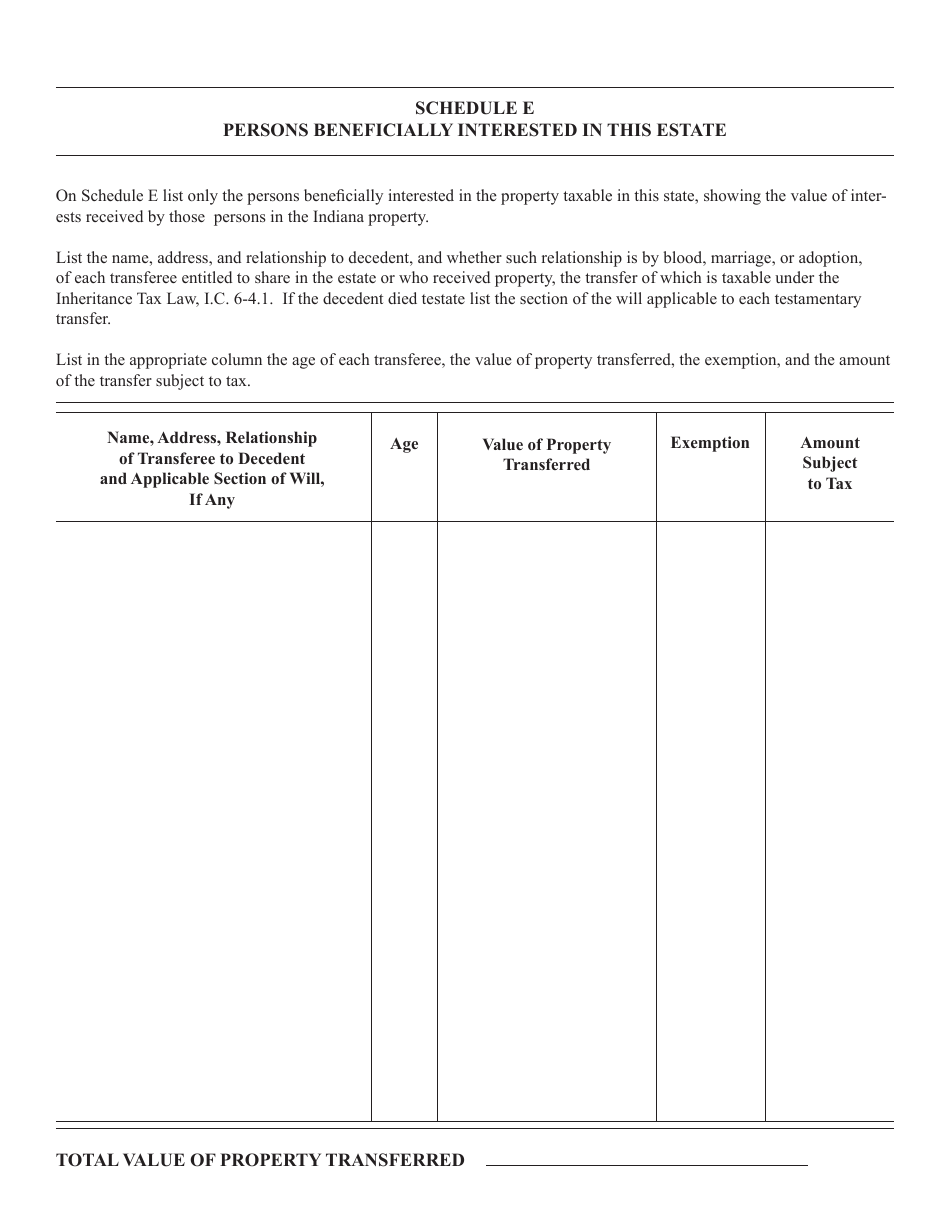

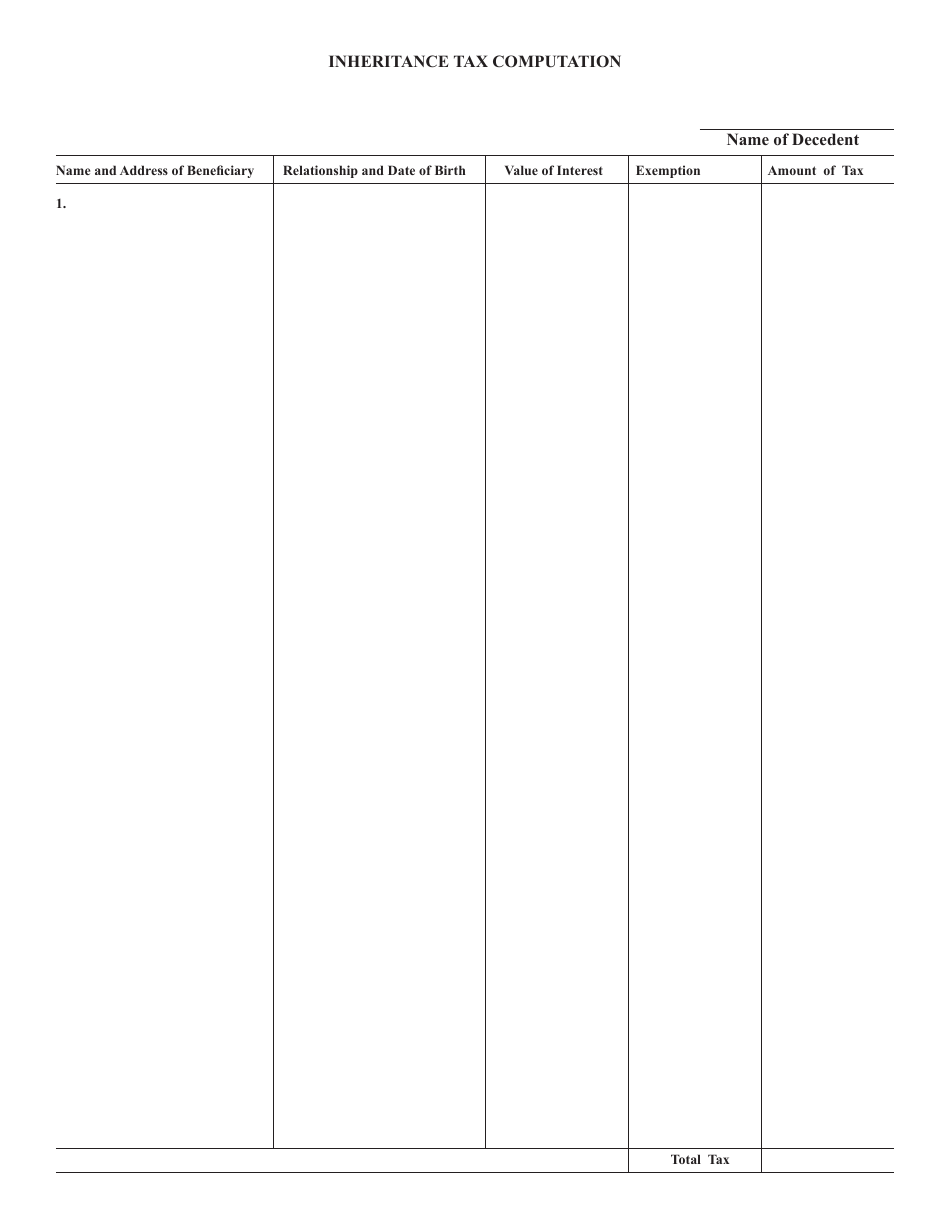

A: State Form 51492 (IH-12) is the Indiana Inheritance Tax Return for a non-resident decedent in Indiana.

Q: Who needs to file State Form 51492?

A: State Form 51492 should be filed by the executor or administrator of the estate of a non-resident decedent who owned property in Indiana.

Q: What is the purpose of filing State Form 51492?

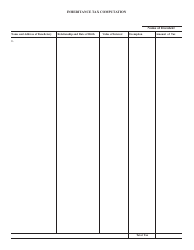

A: The purpose of filing State Form 51492 is to report and pay any inheritance tax owed to the state of Indiana on the assets of a non-resident decedent.

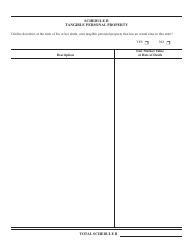

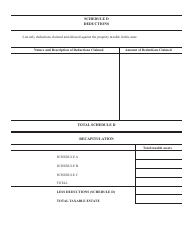

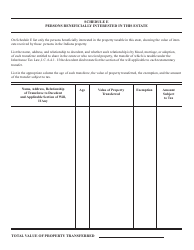

Q: What information is required on State Form 51492?

A: State Form 51492 requires information about the decedent, the estate, and the assets held in Indiana, as well as details of any tax owed.

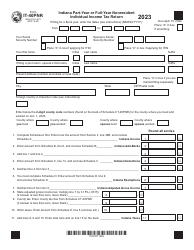

Form Details:

- Released on August 1, 2007;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51492 (IH-12) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.