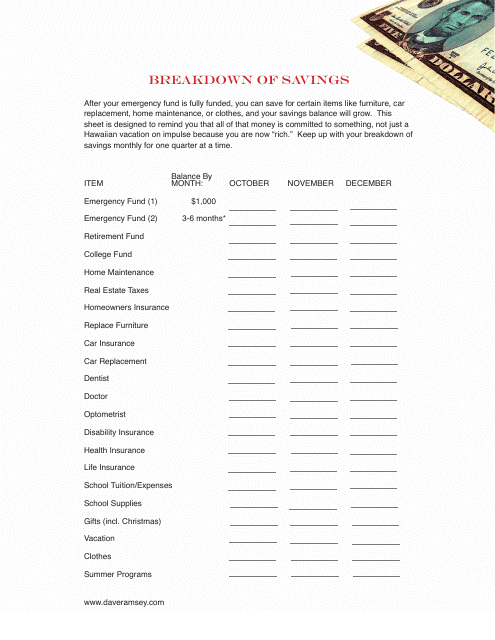

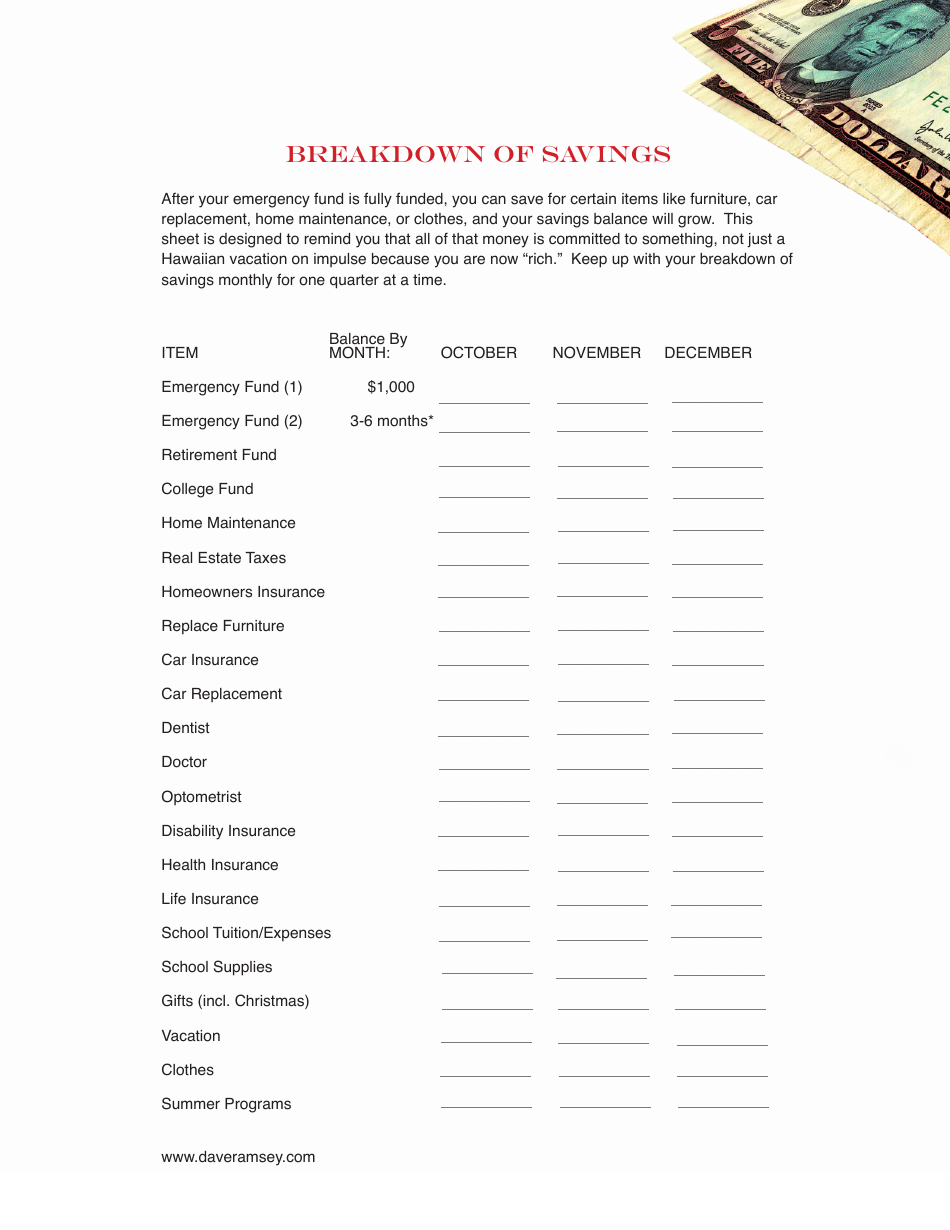

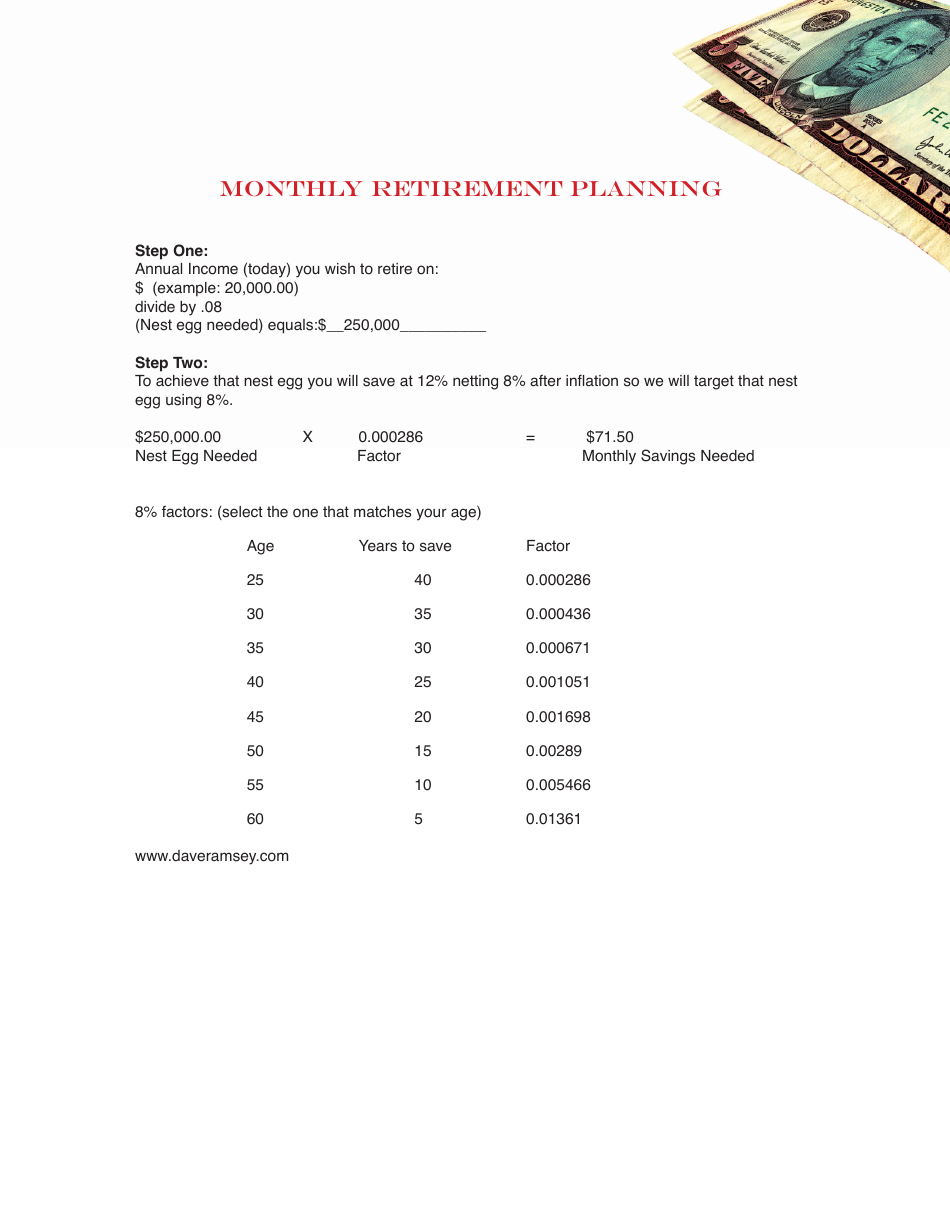

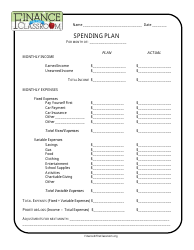

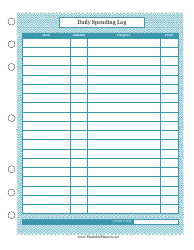

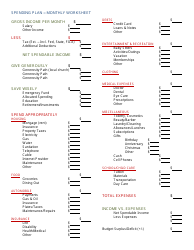

Savings Breakdown Spreadsheet

The Savings Breakdown Spreadsheet is a tool used to track and analyze your savings. It helps you keep track of your income, expenses, and savings goals. It allows you to see how much you are saving and where you can potentially make adjustments to save more.

The individual or organization responsible for managing the savings breakdown spreadsheet typically files it.

FAQ

Q: What is a savings breakdown spreadsheet?

A: A savings breakdown spreadsheet is a document used to track and categorize your savings.

Q: How can I create a savings breakdown spreadsheet?

A: You can create a savings breakdown spreadsheet using a spreadsheet software like Microsoft Excel or Google Sheets.

Q: Why would I need a savings breakdown spreadsheet?

A: A savings breakdown spreadsheet can help you keep track of your savings goals, expenses, and progress towards financial targets.

Q: What information should I include in a savings breakdown spreadsheet?

A: You should include categories for income, expenses, savings goals, and any other relevant financial information.