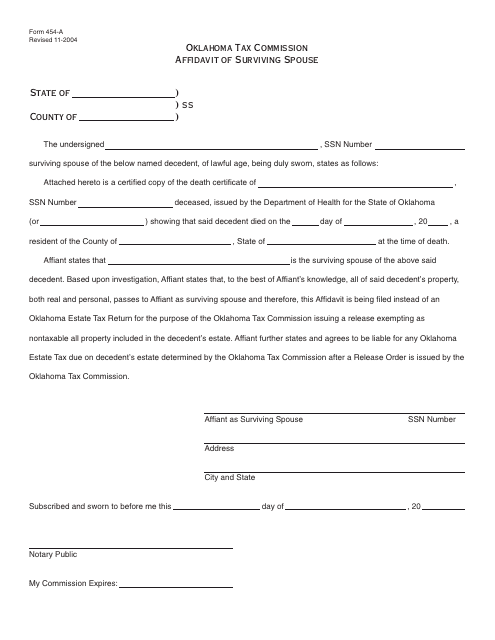

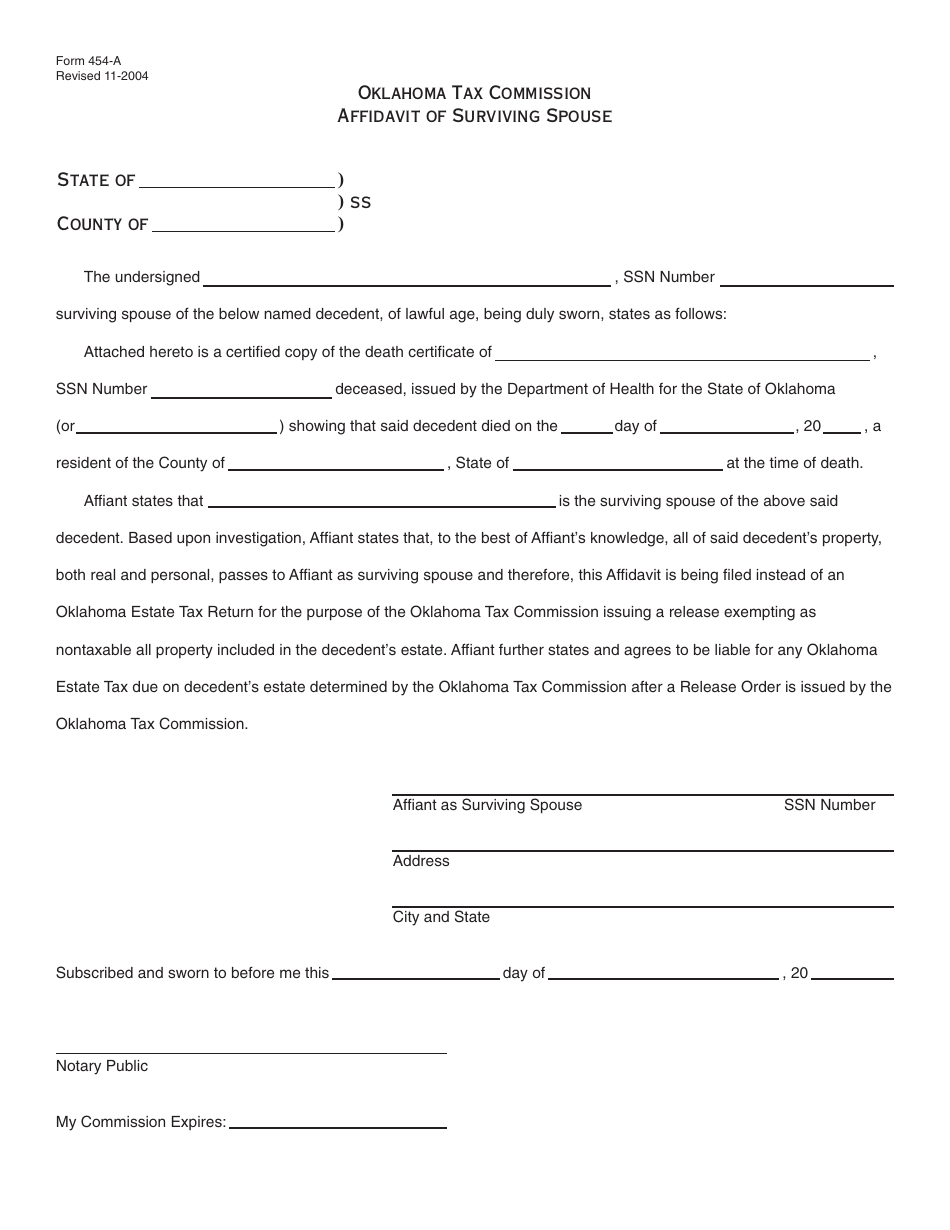

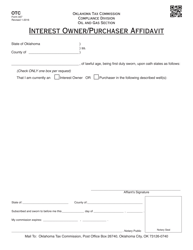

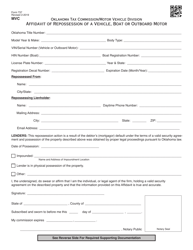

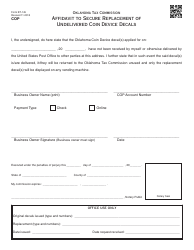

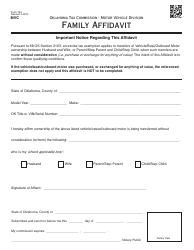

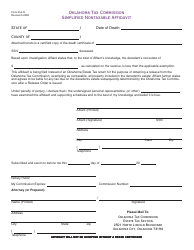

OTC Form 454-A Affidavit of Surviving Spouse - Oklahoma

What Is OTC Form 454-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 454-A?

A: OTC Form 454-A is an Affidavit of Surviving Spouse specific to the state of Oklahoma.

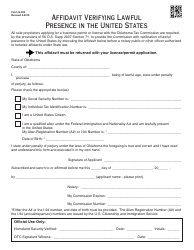

Q: Who can use OTC Form 454-A?

A: OTC Form 454-A can be used by the surviving spouse of an estate in Oklahoma.

Q: What is the purpose of OTC Form 454-A?

A: OTC Form 454-A is used to establish the right of a surviving spouse to claim certain exemptions and benefits.

Q: Are there any fees associated with filing OTC Form 454-A?

A: No, there are no fees associated with filing OTC Form 454-A.

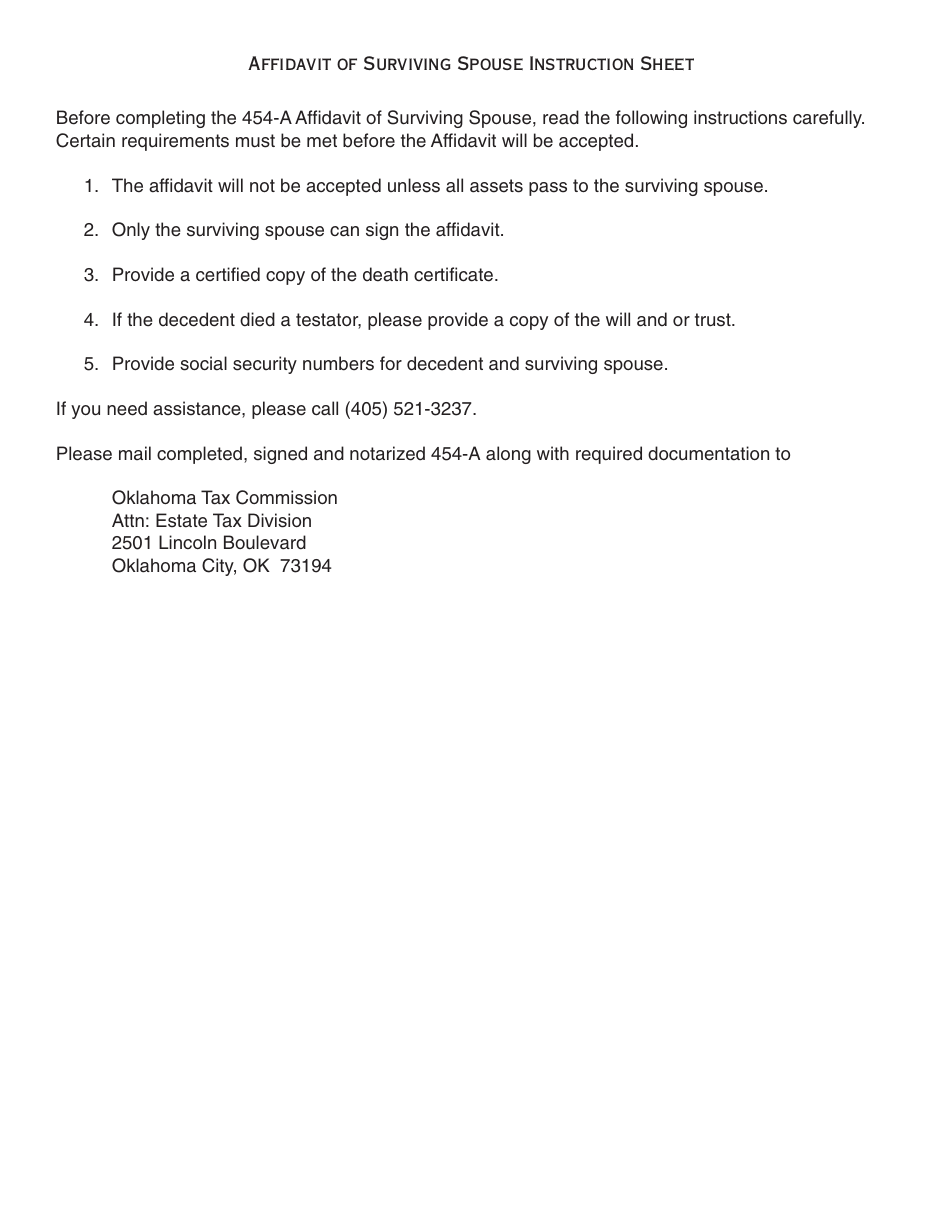

Q: What documents do I need to submit with OTC Form 454-A?

A: You will need to submit a copy of the decedent's death certificate and any other supporting documents as required by the Oklahoma Tax Commission.

Q: Are there any deadlines for filing OTC Form 454-A?

A: Yes, OTC Form 454-A must be filed within 9 months from the date of death of the decedent.

Q: What happens after I submit OTC Form 454-A?

A: After submitting OTC Form 454-A, the Oklahoma Tax Commission will review your application and determine your eligibility for the claimed exemptions and benefits.

Form Details:

- Released on November 1, 2004;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 454-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.