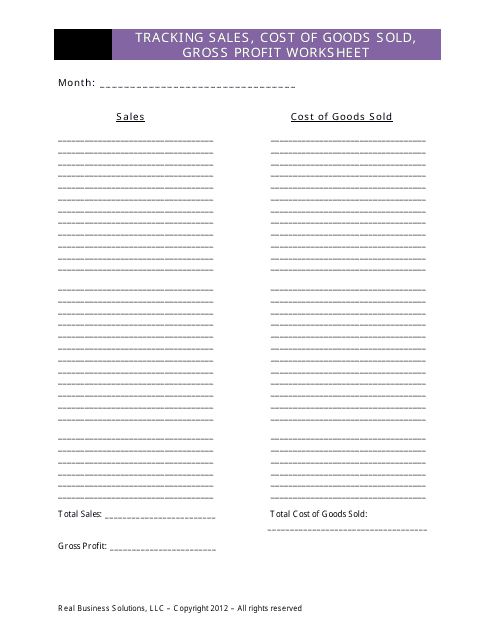

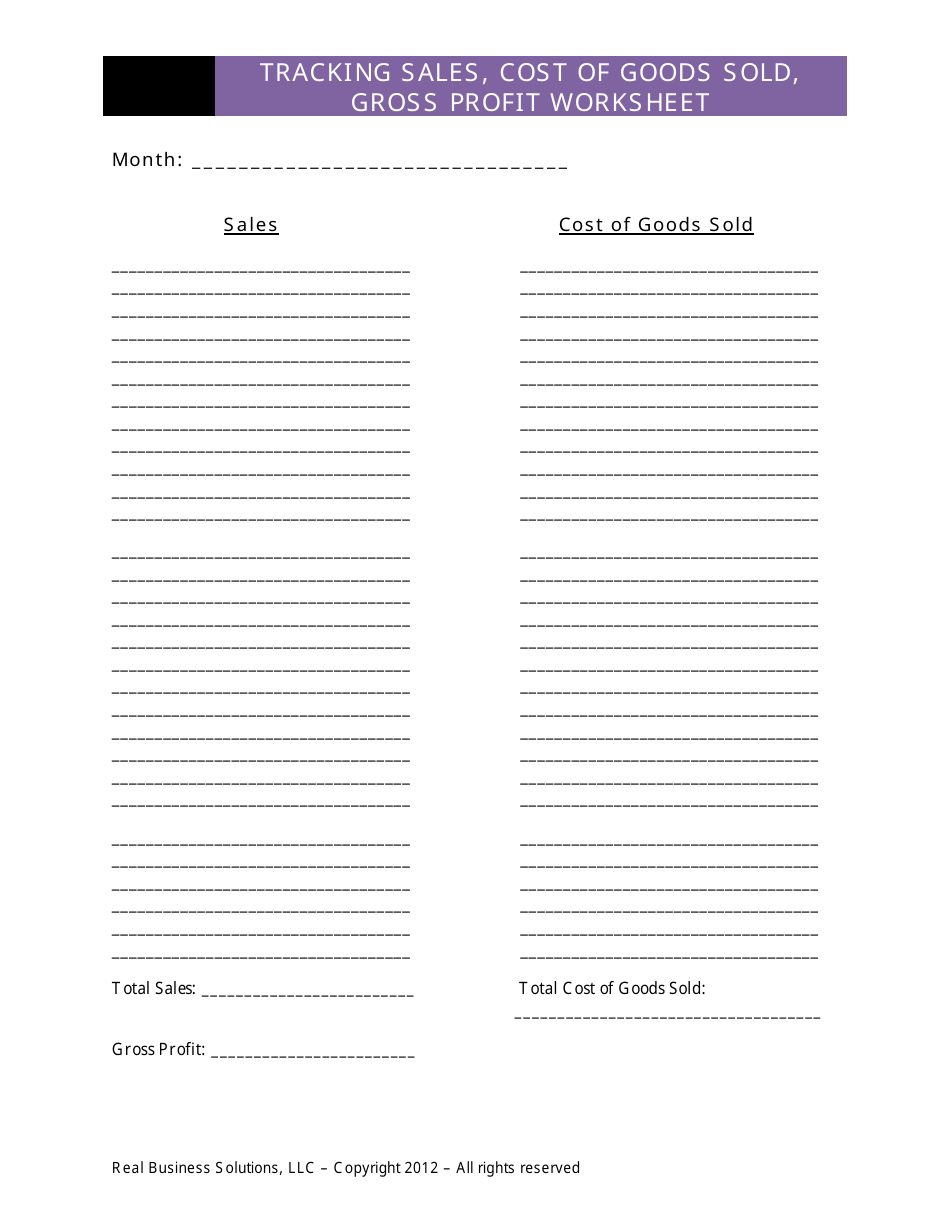

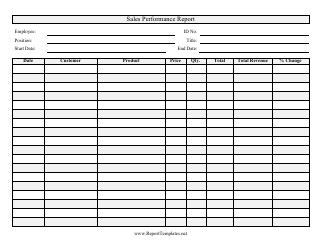

Sales and Cogs Worksheet - Real Business Solutions

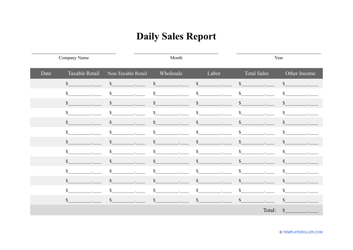

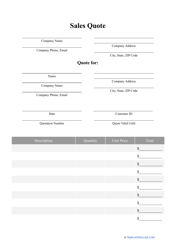

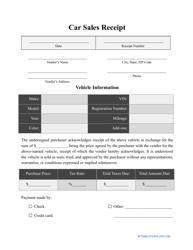

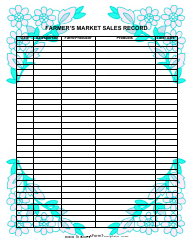

The Sales and Cogs Worksheet - Real Business Solutions is a tool used by businesses to track their sales revenue and cost of goods sold (COGS). It helps them analyze and calculate their profitability.

FAQ

Q: What is a Sales and Cogs Worksheet?

A: A Sales and Cogs Worksheet is a document used by businesses to track and calculate their sales revenue and cost of goods sold.

Q: Why is a Sales and Cogs Worksheet important?

A: A Sales and Cogs Worksheet is important for businesses to have a clear understanding of their sales and cost of goods sold, which are key factors for determining their profitability.

Q: What is sales revenue?

A: Sales revenue is the total amount of money a business earns from selling its products or services.

Q: What is cost of goods sold (COGS)?

A: Cost of goods sold (COGS) is the direct cost incurred by a business to produce the goods or services it sells.

Q: How is the sales revenue calculated?

A: Sales revenue is calculated by multiplying the number of units sold by the selling price per unit.

Q: How is the cost of goods sold (COGS) calculated?

A: Cost of goods sold (COGS) is calculated by adding up the costs of materials, labor, and overhead expenses directly related to the production of goods or services.

Q: What is the formula for gross profit?

A: Gross profit is calculated by subtracting the cost of goods sold (COGS) from the sales revenue.

Q: What can businesses learn from a Sales and Cogs Worksheet?

A: Businesses can learn how much revenue they are generating from their sales, how much it costs to produce and sell their products or services, and their gross profit.

Q: How often should a Sales and Cogs Worksheet be updated?

A: A Sales and Cogs Worksheet should be updated regularly, such as monthly or quarterly, to reflect the most recent sales and cost of goods sold data.

Q: Can a Sales and Cogs Worksheet help with financial planning?

A: Yes, a Sales and Cogs Worksheet can help businesses with financial planning by providing insight into revenue and cost trends, which can be used to forecast future profitability.