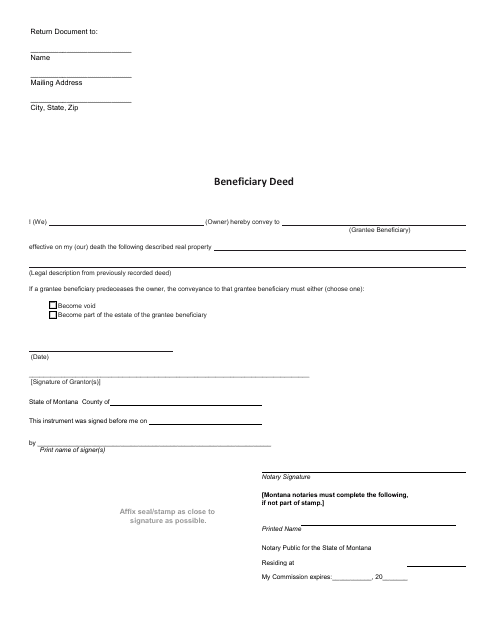

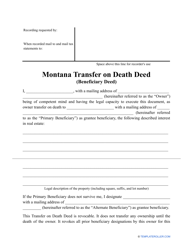

Beneficiary Deed Form - Montana

A Beneficiary Deed Form in Montana is used to transfer real estate property to a named beneficiary upon the owner's death, avoiding the need for probate.

In Montana, the beneficiary deed form is filed by the property owner or grantor.

FAQ

Q: What is a Beneficiary Deed?

A: A Beneficiary Deed is a legal document that allows a property owner to pass on their property to a designated beneficiary upon their death.

Q: How does a Beneficiary Deed work in Montana?

A: In Montana, a Beneficiary Deed must be properly executed, signed, and recorded with the county clerk and recorder in order to be valid.

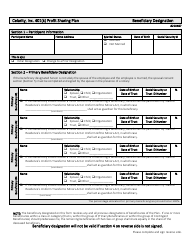

Q: Who can be named as a beneficiary in a Beneficiary Deed?

A: Any person or entity, such as a family member, friend, or organization, can be named as a beneficiary in a Beneficiary Deed.

Q: Can a Beneficiary Deed be revoked or changed?

A: Yes, a Beneficiary Deed can be revoked or changed by the property owner at any time before their death by executing and recording a new document.

Q: Does a Beneficiary Deed avoid probate?

A: Yes, a property transferred through a properly executed Beneficiary Deed will generally avoid probate in Montana.

Q: Is a Beneficiary Deed the same as a will?

A: No, a Beneficiary Deed is not the same as a will. A will is a legal document that specifies how a person's property should be distributed after their death, while a Beneficiary Deed only transfers the property to a designated beneficiary.

Q: Is it recommended to consult an attorney when creating a Beneficiary Deed?

A: Yes, it is recommended to consult an attorney when creating a Beneficiary Deed to ensure that all legal requirements are met and the document is properly executed.

Q: Are there any specific legal requirements for a Beneficiary Deed in Montana?

A: Yes, in Montana, a Beneficiary Deed must be signed by the property owner, witnessed by two individuals, and notarized.

Q: Can a property with a mortgage have a Beneficiary Deed?

A: Yes, a property with a mortgage can have a Beneficiary Deed, but it is important to consult with the mortgage lender to understand any implications or restrictions.