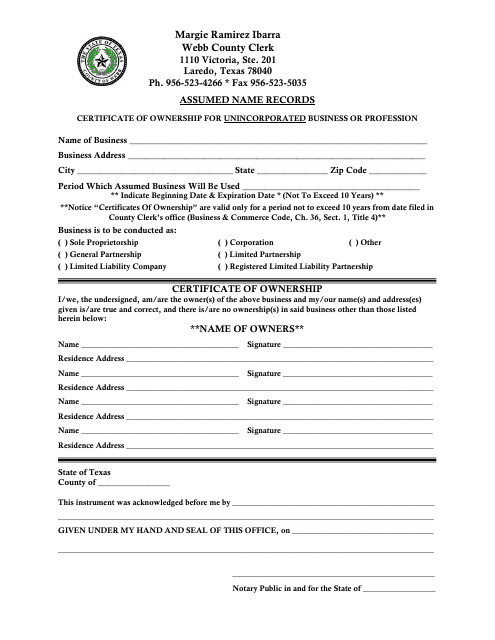

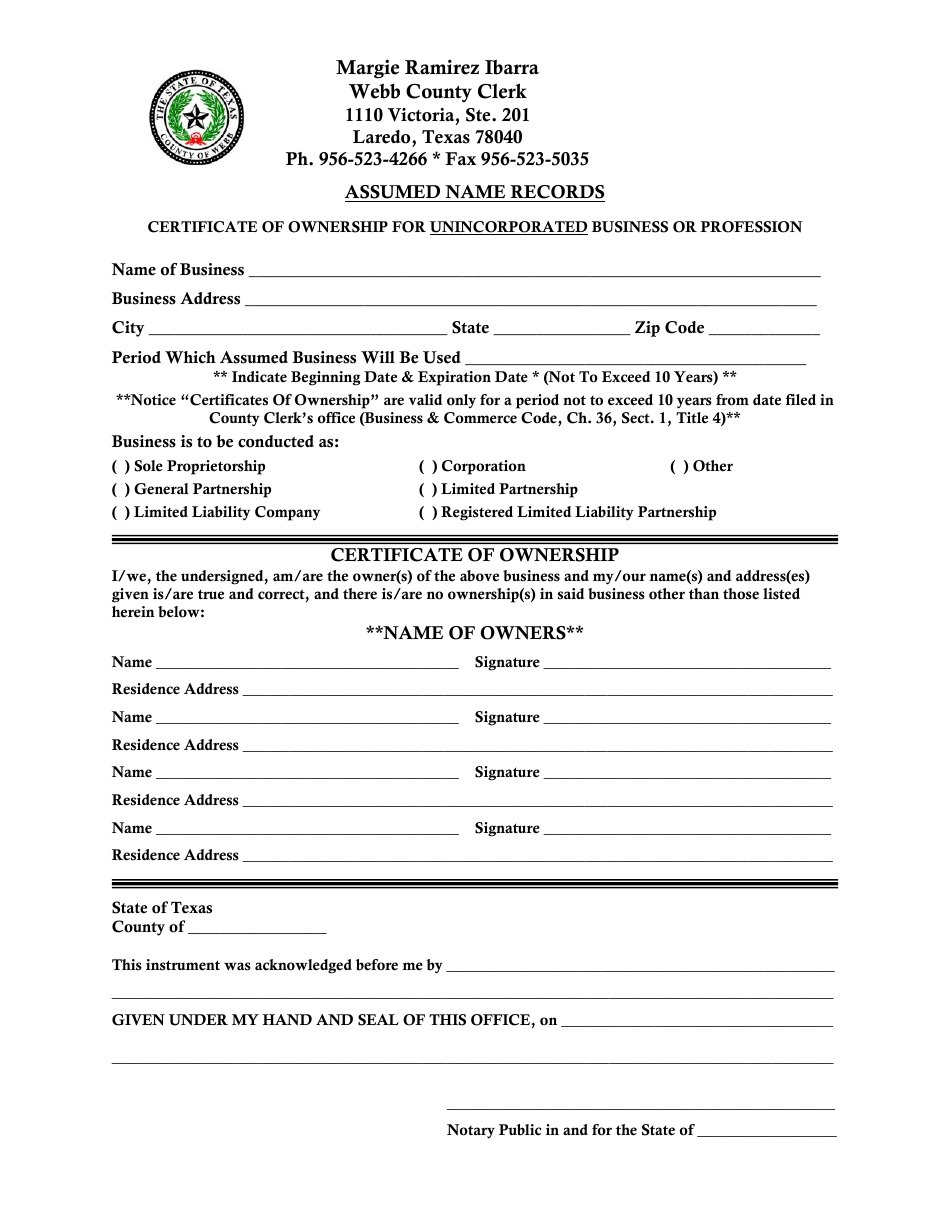

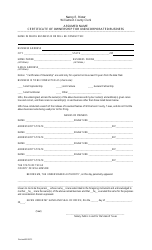

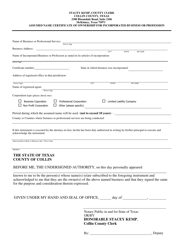

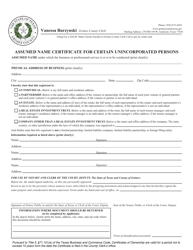

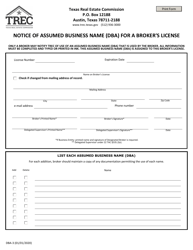

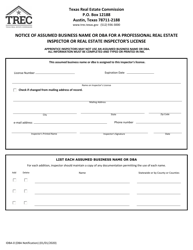

Assumed Name Records - Certificate of Ownership for Unincorporated Business or Profession - Webb County, Texas

Assumed Name Records - Certificate of Ownership for Unincorporated Business or Profession is a legal document that was released by the Clerk’s Office - Webb County, Texas - a government authority operating within Texas. The form may be used strictly within Webb County.

FAQ

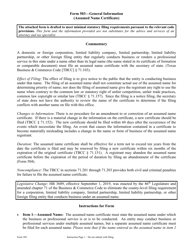

Q: What is an assumed name record?

A: An assumed name record is a certificate of ownership for an unincorporated business or profession.

Q: What is the purpose of an assumed name record?

A: The purpose of an assumed name record is to provide legal recognition and disclosure of the business or profession operating under a different name than the owner's legal name.

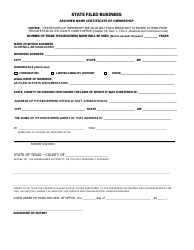

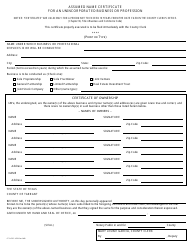

Q: Who needs to file an assumed name record?

A: Any individual or partnership conducting business or a profession under a name other than their own legal name needs to file an assumed name record.

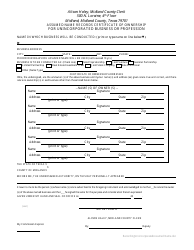

Q: What information is included in an assumed name record?

A: An assumed name record typically includes the business or professional name, owner's name and address, and the date the name began being used.

Q: Is there a fee to file an assumed name record?

A: Yes, there is usually a fee associated with filing an assumed name record. The exact fee varies by jurisdiction.

Q: How long is an assumed name record valid?

A: The validity period of an assumed name record varies by jurisdiction. In Webb County, Texas, it is valid for 10 years.

Q: What happens if I don't file an assumed name record?

A: Failing to file an assumed name record may result in legal consequences, including fines and the loss of certain legal protections for your business or profession.

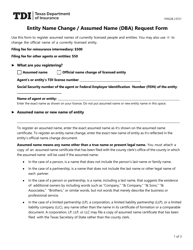

Q: Can I change the information on an assumed name record?

A: Yes, you can generally update the information on an assumed name record by filing an amended record with the relevant county.

Form Details:

- The latest edition currently provided by the Clerk’s Office - Webb County, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Clerk’s Office - Webb County, Texas.