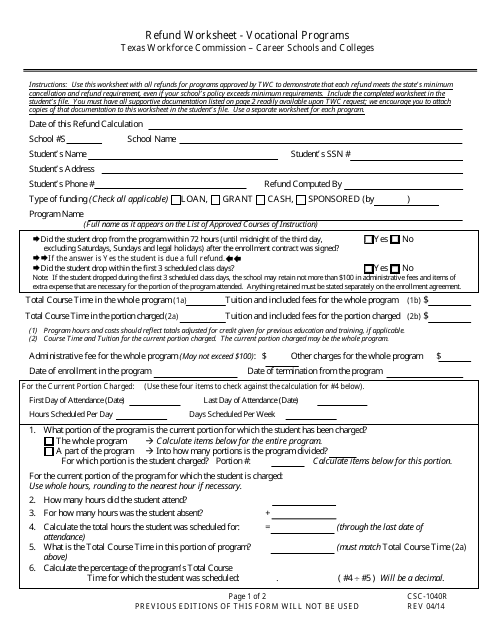

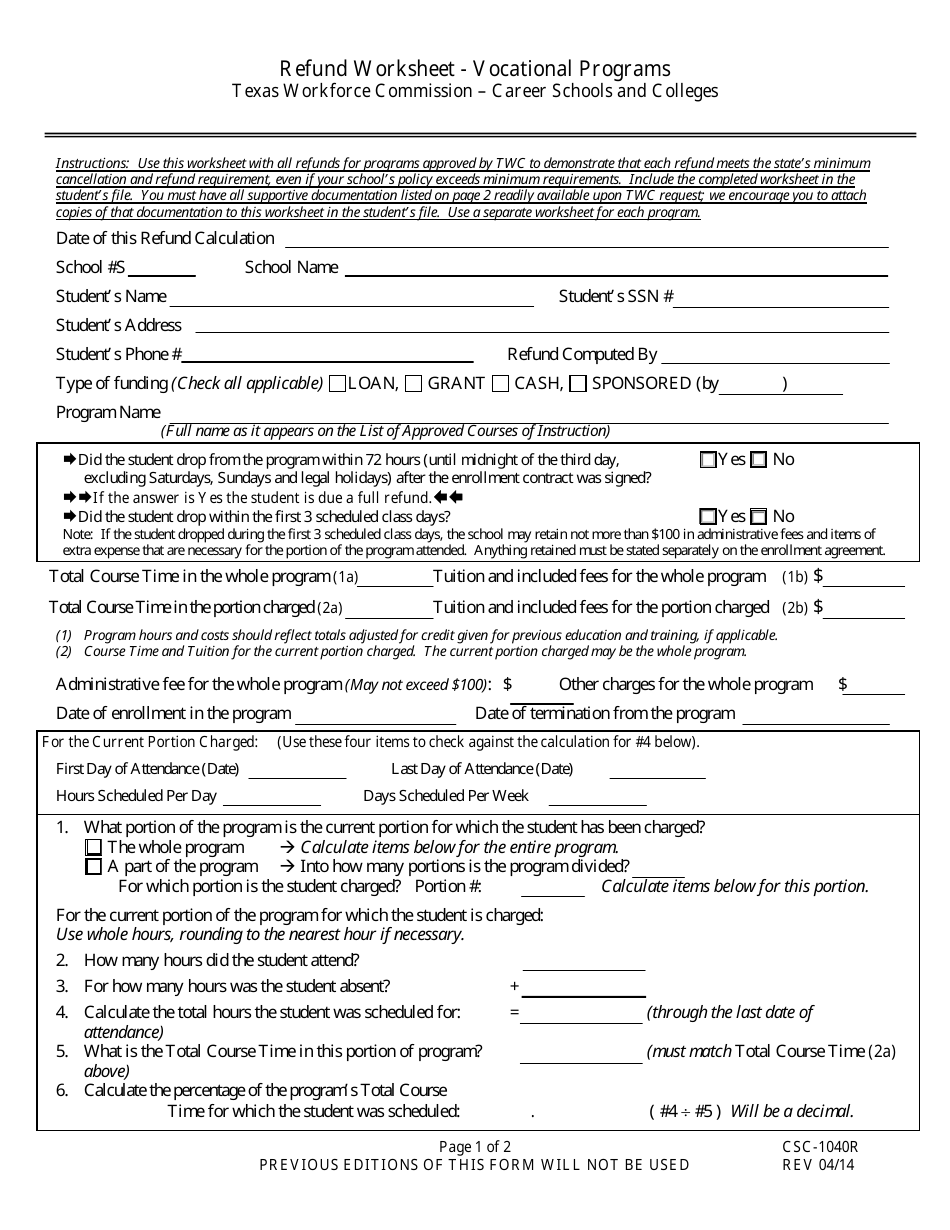

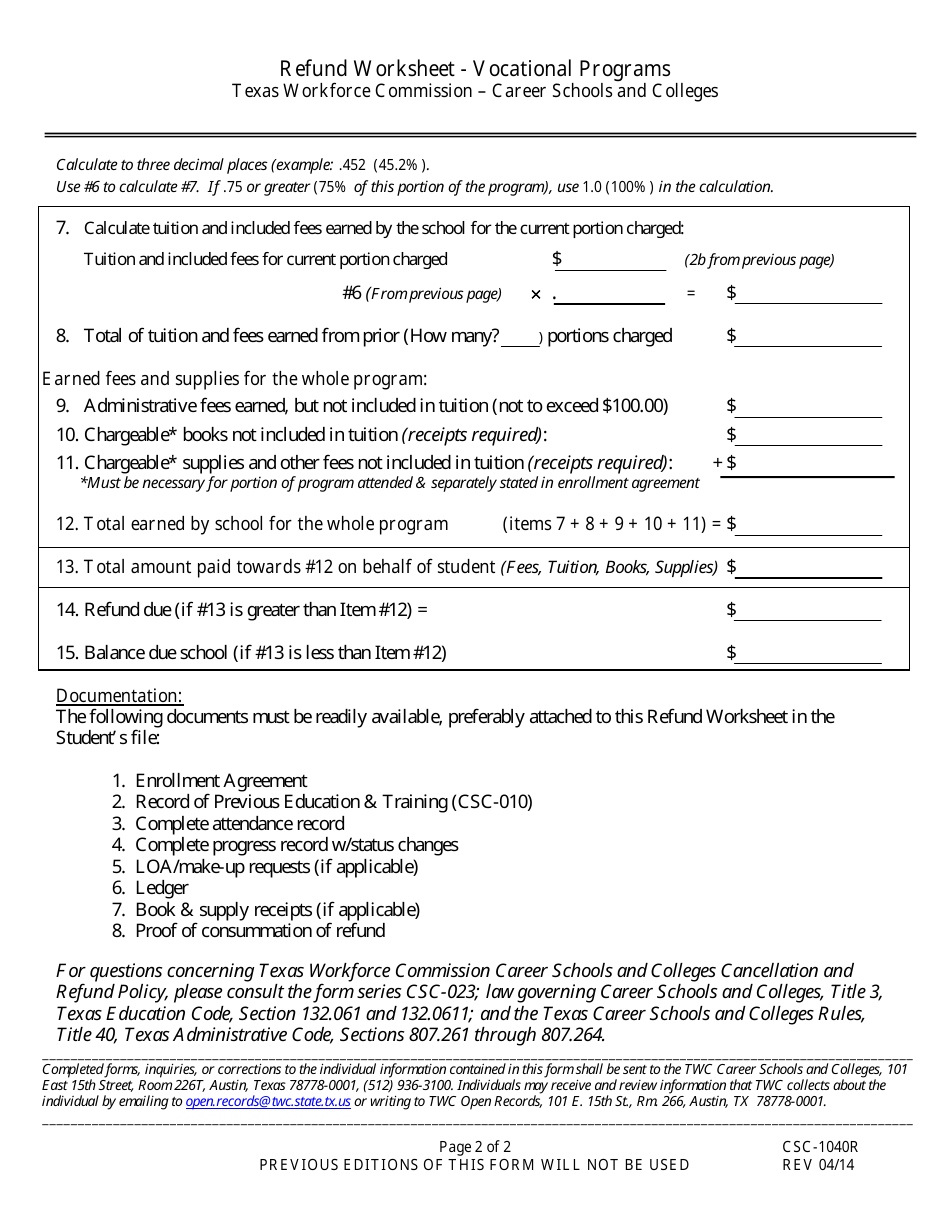

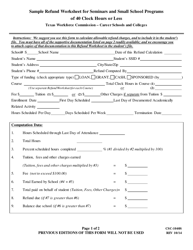

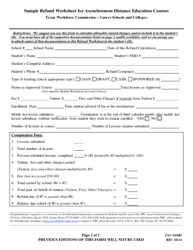

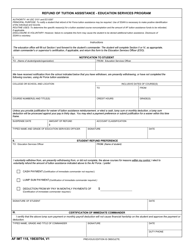

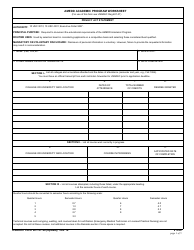

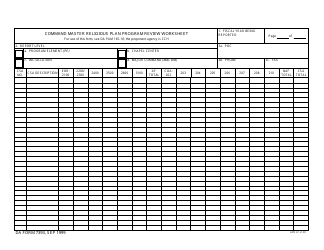

Form CSC-1040R Refund Worksheet - Vocational Programs - Texas

What Is Form CSC-1040R?

This is a legal form that was released by the Texas Workforce Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CSC-1040R?

A: Form CSC-1040R is a refund worksheet for vocational programs in Texas.

Q: What is the purpose of Form CSC-1040R?

A: The purpose of Form CSC-1040R is to calculate the refund amount for vocational programs in Texas.

Q: Who should use Form CSC-1040R?

A: Form CSC-1040R should be used by individuals enrolled in vocational programs in Texas.

Q: What information is required on Form CSC-1040R?

A: Form CSC-1040R requires information such as the program start and end dates, tuition and fees paid, and any applicable financial aid received.

Q: How do I fill out Form CSC-1040R?

A: To fill out Form CSC-1040R, you need to provide the requested information about your vocational program and financial details.

Q: Why do I need to fill out Form CSC-1040R?

A: Filling out Form CSC-1040R is necessary to determine the refund amount you are eligible for from your vocational program.

Q: When should I submit Form CSC-1040R?

A: You should submit Form CSC-1040R as soon as you decide to withdraw from or complete your vocational program.

Q: What happens after I submit Form CSC-1040R?

A: After submitting Form CSC-1040R, the vocational program institution will review the form and process your refund accordingly.

Q: Are there any deadlines for submitting Form CSC-1040R?

A: The specific deadline for submitting Form CSC-1040R may vary depending on the vocational program institution, so it is important to consult with them for the deadline.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Texas Workforce Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CSC-1040R by clicking the link below or browse more documents and templates provided by the Texas Workforce Commission.