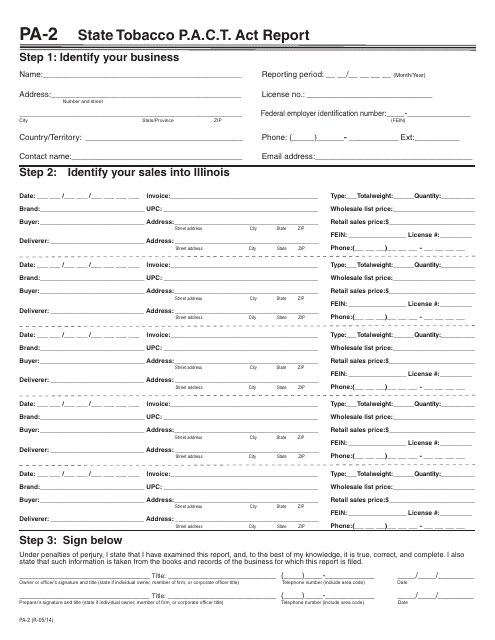

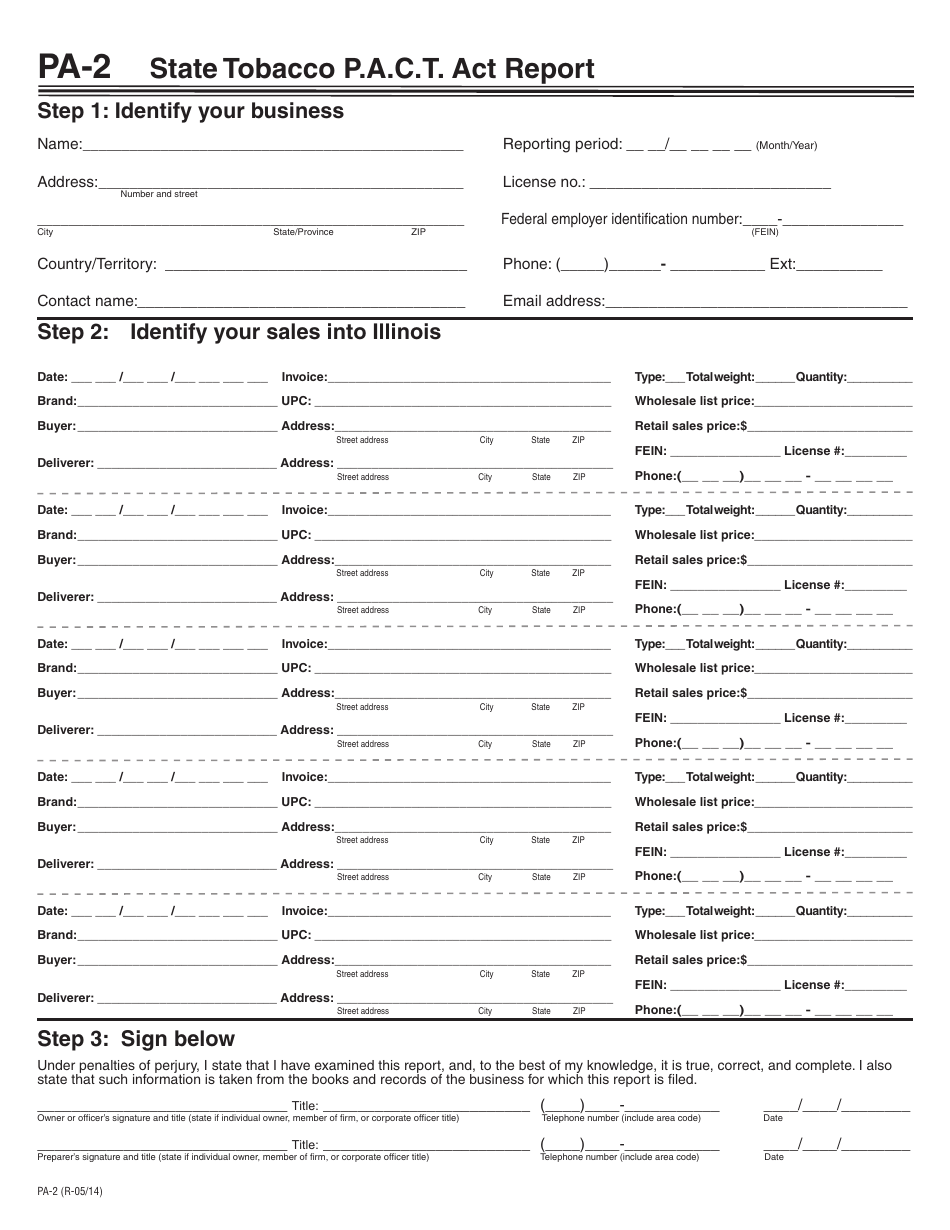

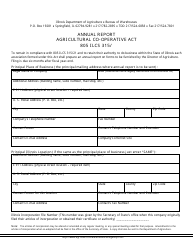

Form PA-2 State Tobacco P.a.c.t. Act Report - Illinois

What Is Form PA-2?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

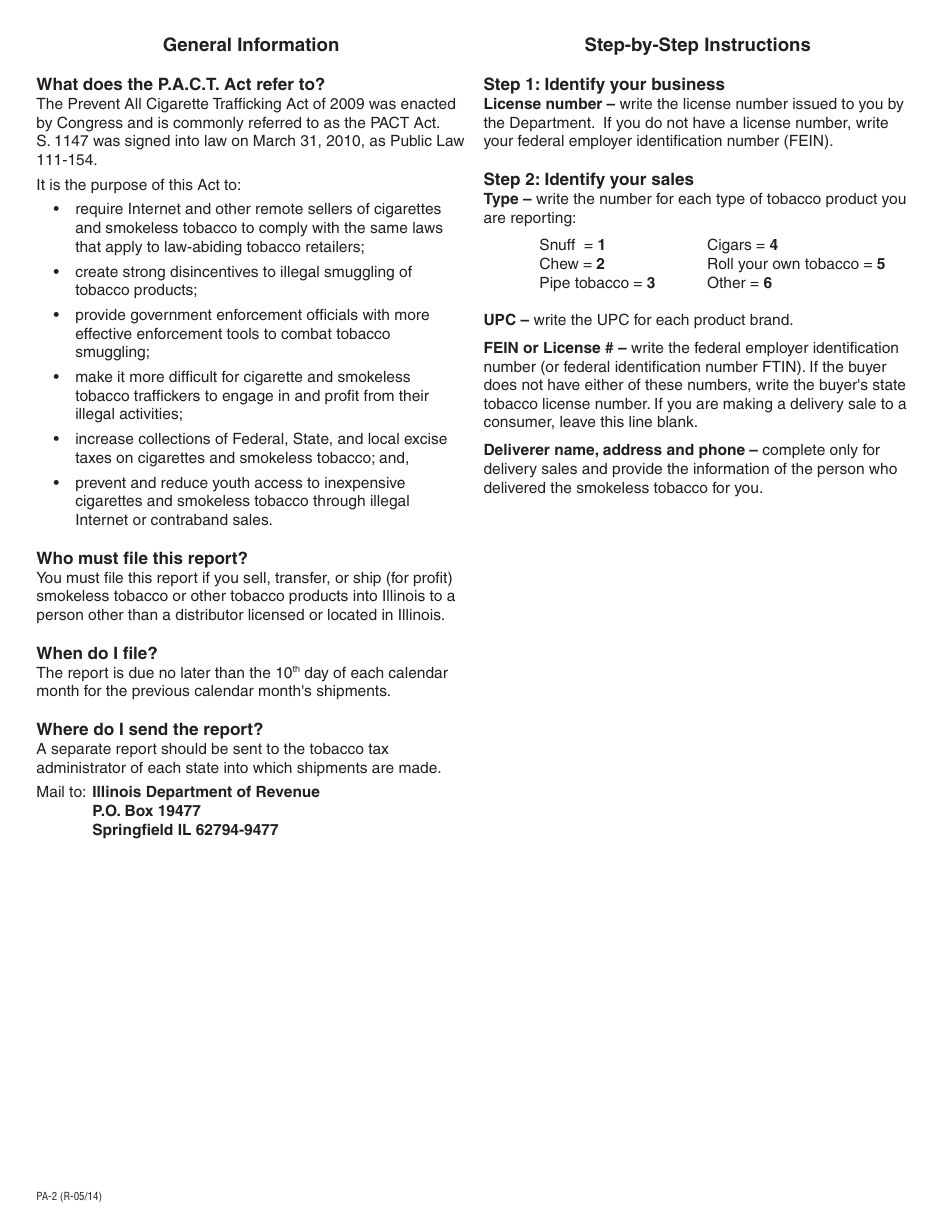

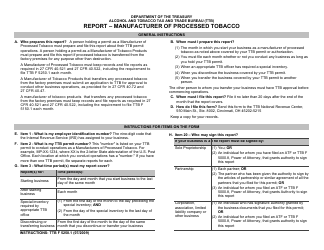

Q: What is the PA-2 State Tobacco P.A.C.T. Act Report?

A: The PA-2 State Tobacco P.A.C.T. Act Report is a form used to report tobacco sales and distributions in Illinois.

Q: What does P.A.C.T. stand for?

A: P.A.C.T. stands for Prevent All Cigarette Trafficking Act.

Q: Who needs to file the PA-2 State Tobacco P.A.C.T. Act Report?

A: Any person or entity engaged in the business of selling or distributing tobacco products in Illinois needs to file the report.

Q: When is the PA-2 State Tobacco P.A.C.T. Act Report due?

A: The report is due on the 10th day of the month following the end of the reporting period.

Q: What information is required on the PA-2 State Tobacco P.A.C.T. Act Report?

A: The report requires information such as total sales, total distributions, and detailed information about each tobacco product sold or distributed.

Q: Is there a penalty for late or non-filing of the PA-2 State Tobacco P.A.C.T. Act Report?

A: Yes, there may be penalties for late or non-filing, including monetary fines and license suspension.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-2 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.