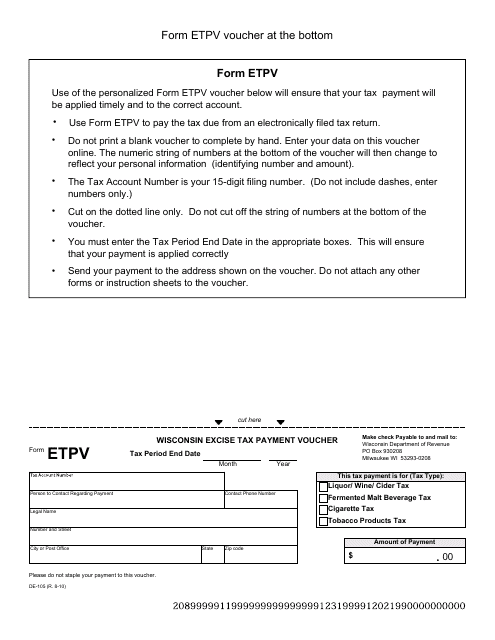

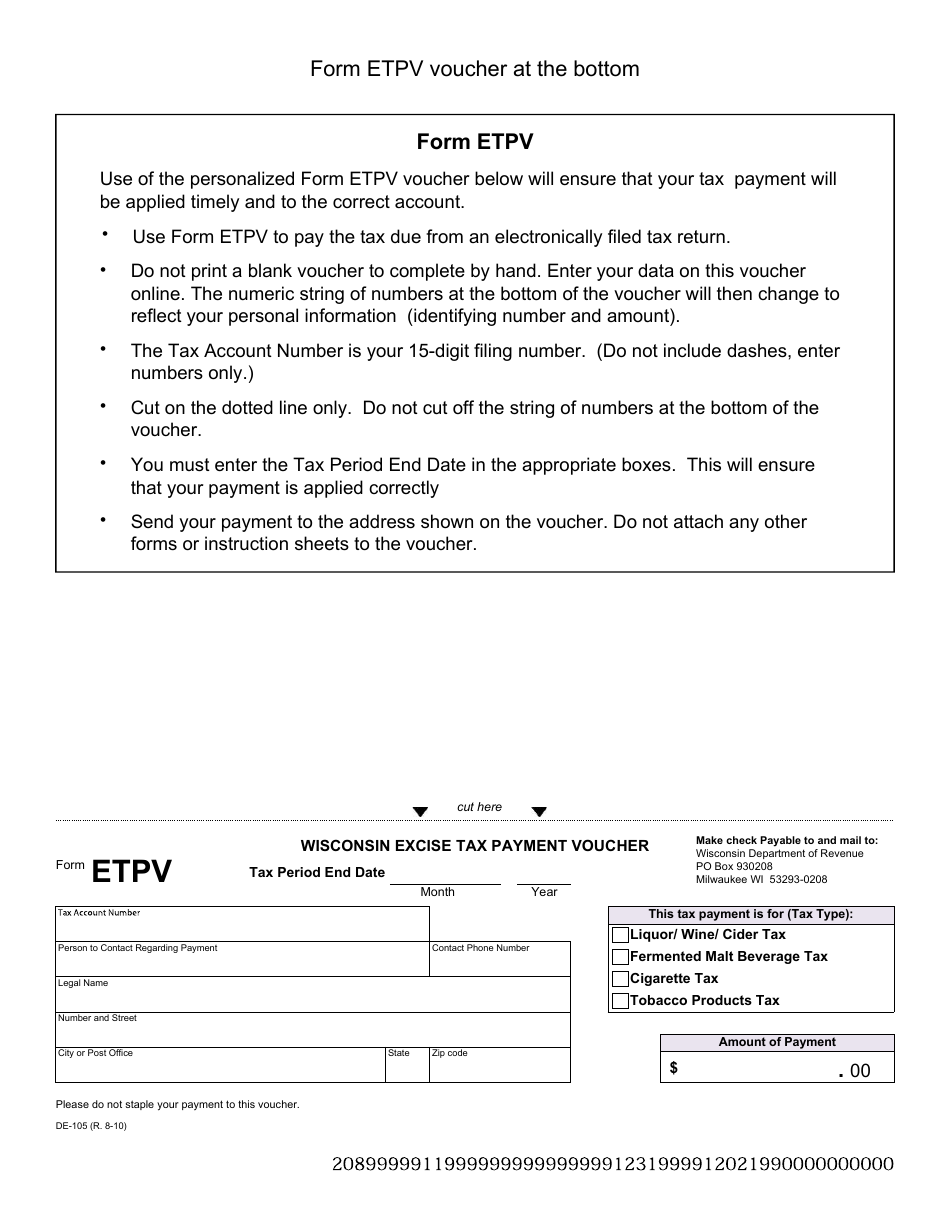

Form DE-105 (ETPV) Wisconsin Excise Tax Payment Voucher - Wisconsin

What Is Form DE-105 (ETPV)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE-105?

A: Form DE-105 is the Wisconsin Excise Tax Payment Voucher.

Q: What is the purpose of Form DE-105?

A: The purpose of Form DE-105 is to make a payment for Wisconsin excise taxes.

Q: Who needs to use Form DE-105?

A: Anyone who owes Wisconsin excise taxes and needs to make a payment.

Q: Is Form DE-105 specific to Wisconsin?

A: Yes, Form DE-105 is specific to Wisconsin and is used for making excise tax payments in the state.

Q: What information is required on Form DE-105?

A: Form DE-105 requires the taxpayer's identifying information, the type and amount of excise tax being paid, and any related payment details.

Q: When is Form DE-105 due?

A: The due date for Form DE-105 depends on the specific tax and payment period. It is important to check with the Wisconsin Department of Revenue for the correct due date.

Q: What happens if I don't file Form DE-105?

A: If you fail to file Form DE-105 or make the required payment, you may be subject to penalties and interest charges.

Q: Are there any additional forms or documents that need to be submitted with Form DE-105?

A: It depends on the specific tax and payment requirements. It is recommended to review the instructions provided with Form DE-105 for any additional documentation needed.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE-105 (ETPV) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.