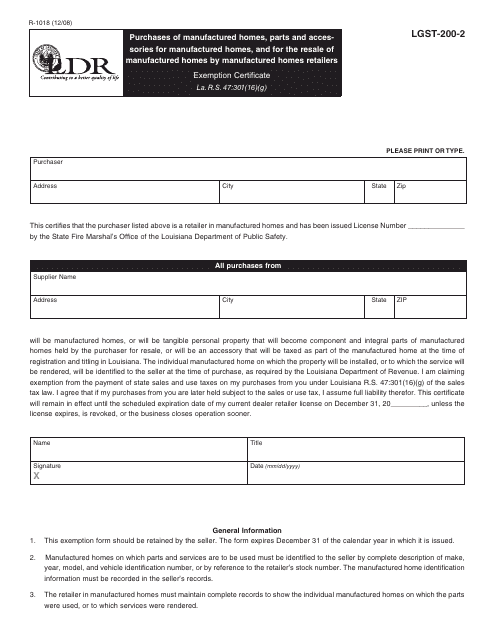

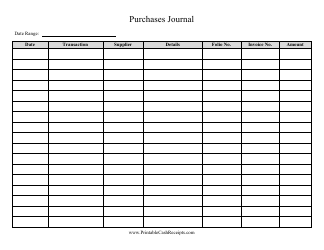

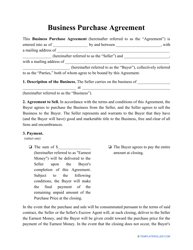

Form R-1018 Purchases of Manufactured Homes, Parts and Accessories for Manufactured Homes, and for the Resale of Manufactured Homes by Manufactured Homes Retailers Exemption Certificate - Louisiana

What Is Form R-1018?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1018?

A: Form R-1018 is the Purchases of Manufactured Homes, Parts and Accessories for Manufactured Homes, and for the Resale of Manufactured Homes by Manufactured Homes Retailers Exemption Certificate in Louisiana.

Q: What is the purpose of Form R-1018?

A: The purpose of Form R-1018 is to claim an exemption from sales and use tax when purchasing manufactured homes, parts, and accessories or for the resale of manufactured homes by retailers in Louisiana.

Q: Who can use Form R-1018?

A: Manufactured homes retailers in Louisiana can use Form R-1018 to claim the exemption.

Q: What items can be exempt using Form R-1018?

A: Form R-1018 can be used to exempt purchases of manufactured homes, parts, accessories, and for the resale of manufactured homes in Louisiana.

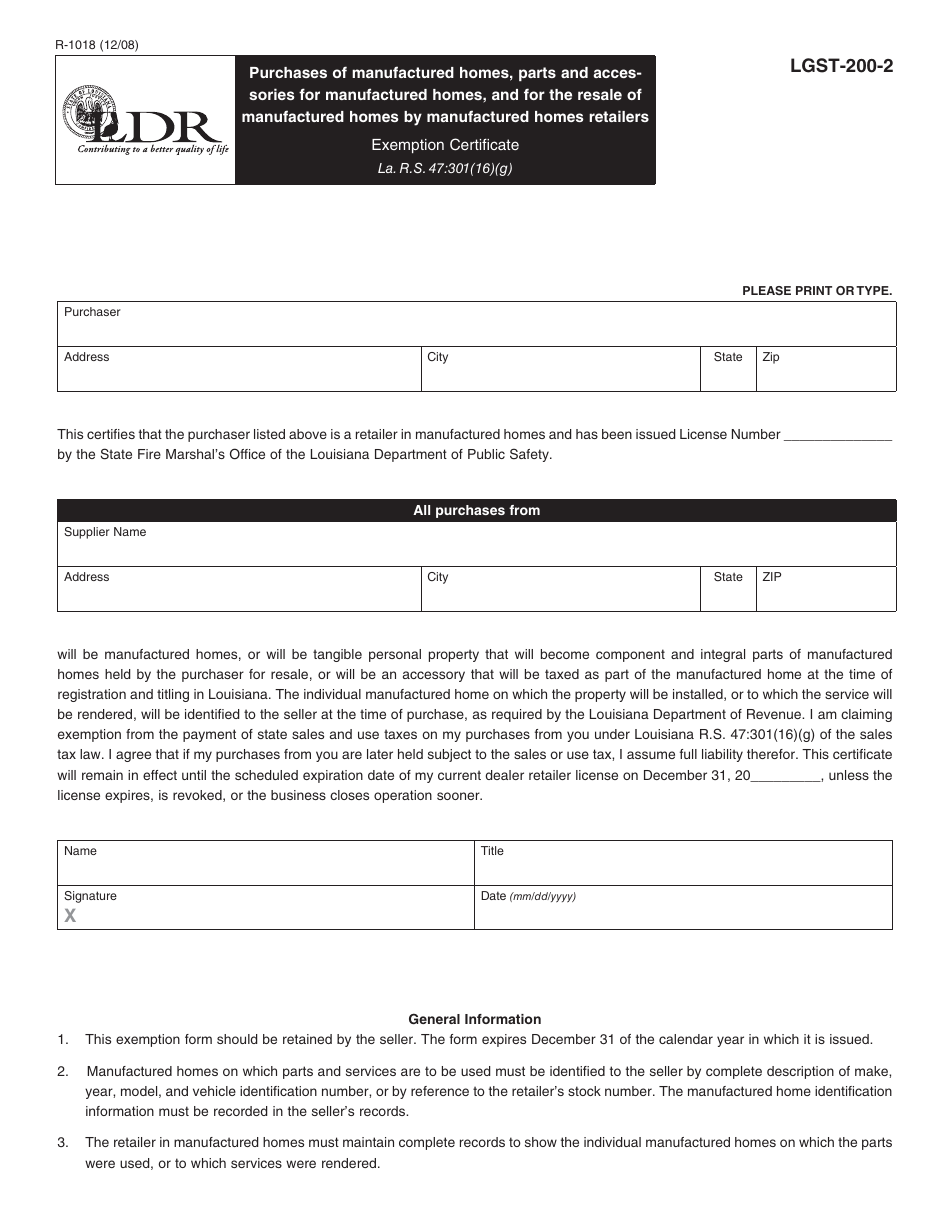

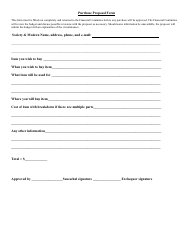

Q: What information is required on Form R-1018?

A: Form R-1018 requires the retailer's information, the purchaser's information, details of the purchases, and a statement of resale.

Q: What is the deadline for submitting Form R-1018?

A: Form R-1018 must be submitted within 60 days from the date of purchase.

Q: Are there any penalties for late or incorrect submission of Form R-1018?

A: Yes, late or incorrect submission of Form R-1018 may result in penalties and interest.

Form Details:

- Released on December 1, 2008;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1018 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.