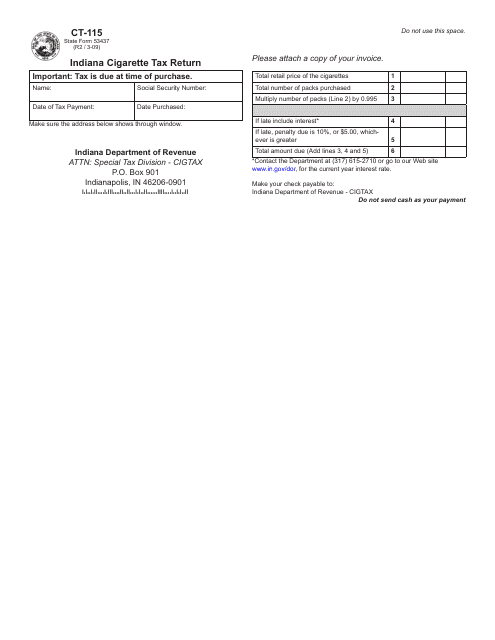

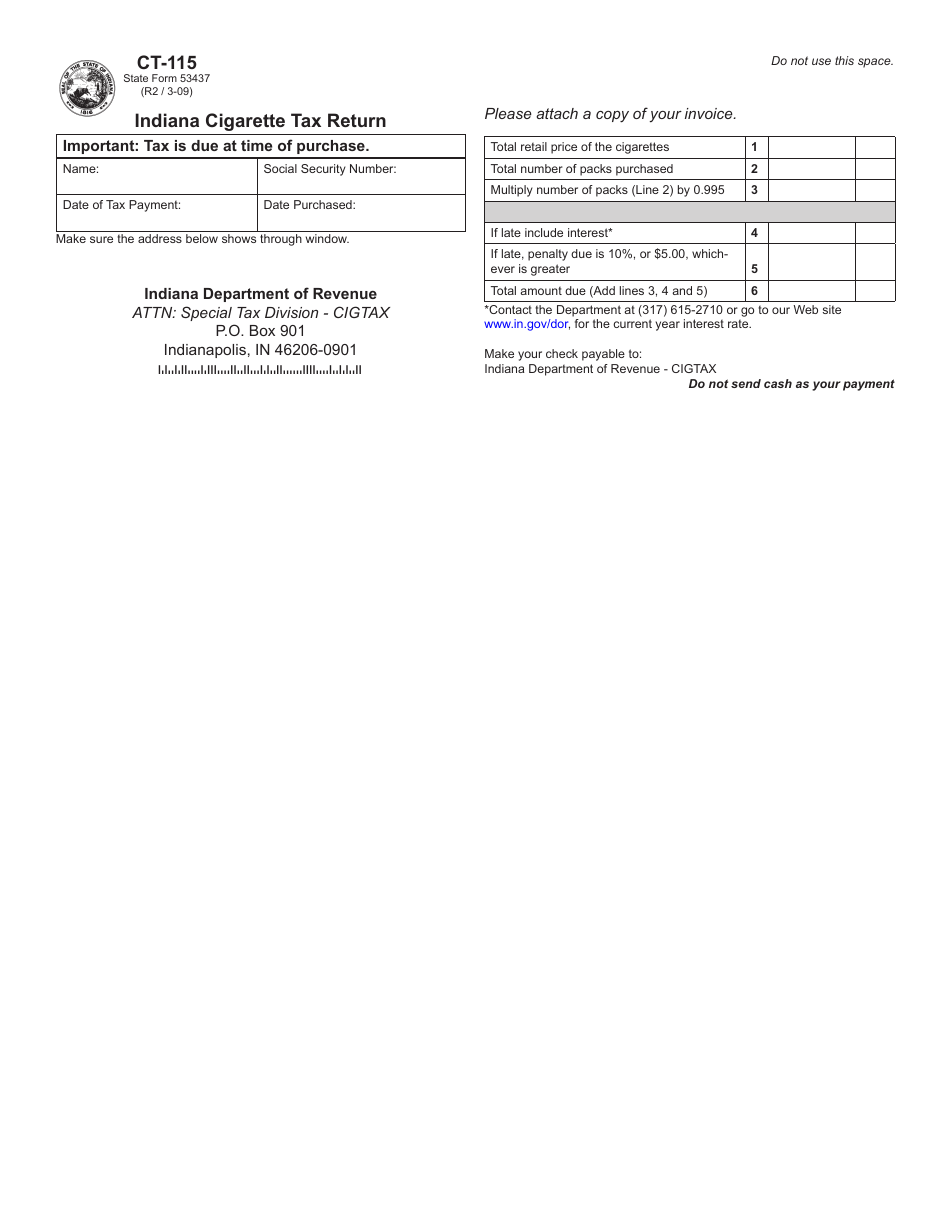

Form CT-115 (State Form 53437) Indiana Cigarette Tax Return - Indiana

What Is Form CT-115 (State Form 53437)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-115?

A: Form CT-115 is the Indiana Cigarette Tax Return.

Q: What is the purpose of Form CT-115?

A: The purpose of Form CT-115 is to report and pay the cigarette tax owed by a business in Indiana.

Q: Who needs to file Form CT-115?

A: Businesses engaged in the sale of cigarettes in Indiana need to file Form CT-115.

Q: When is Form CT-115 due?

A: Form CT-115 is due on a monthly basis, and the due date depends on the reporting period.

Q: What information is required on Form CT-115?

A: Form CT-115 requires the business to provide information about their sales, purchases, and other relevant details related to cigarette tax.

Q: Is there a penalty for late filing of Form CT-115?

A: Yes, there are penalties for late filing of Form CT-115, so it's important to submit it on time.

Q: Can I e-file Form CT-115?

A: Yes, businesses have the option to e-file Form CT-115.

Q: Are there any exemptions or deductions available?

A: There may be certain exemptions or deductions available, and businesses should consult the instructions accompanying the form for more details.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-115 (State Form 53437) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.