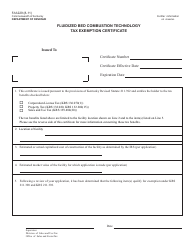

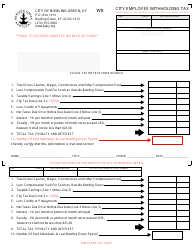

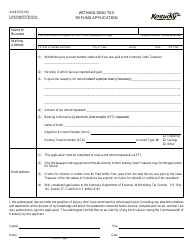

Form K-4M Nonresident Military Spouse Withholding Tax Exemption Certificate - Kentucky

What Is Form K-4M?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form K-4M?

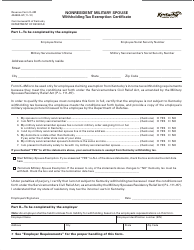

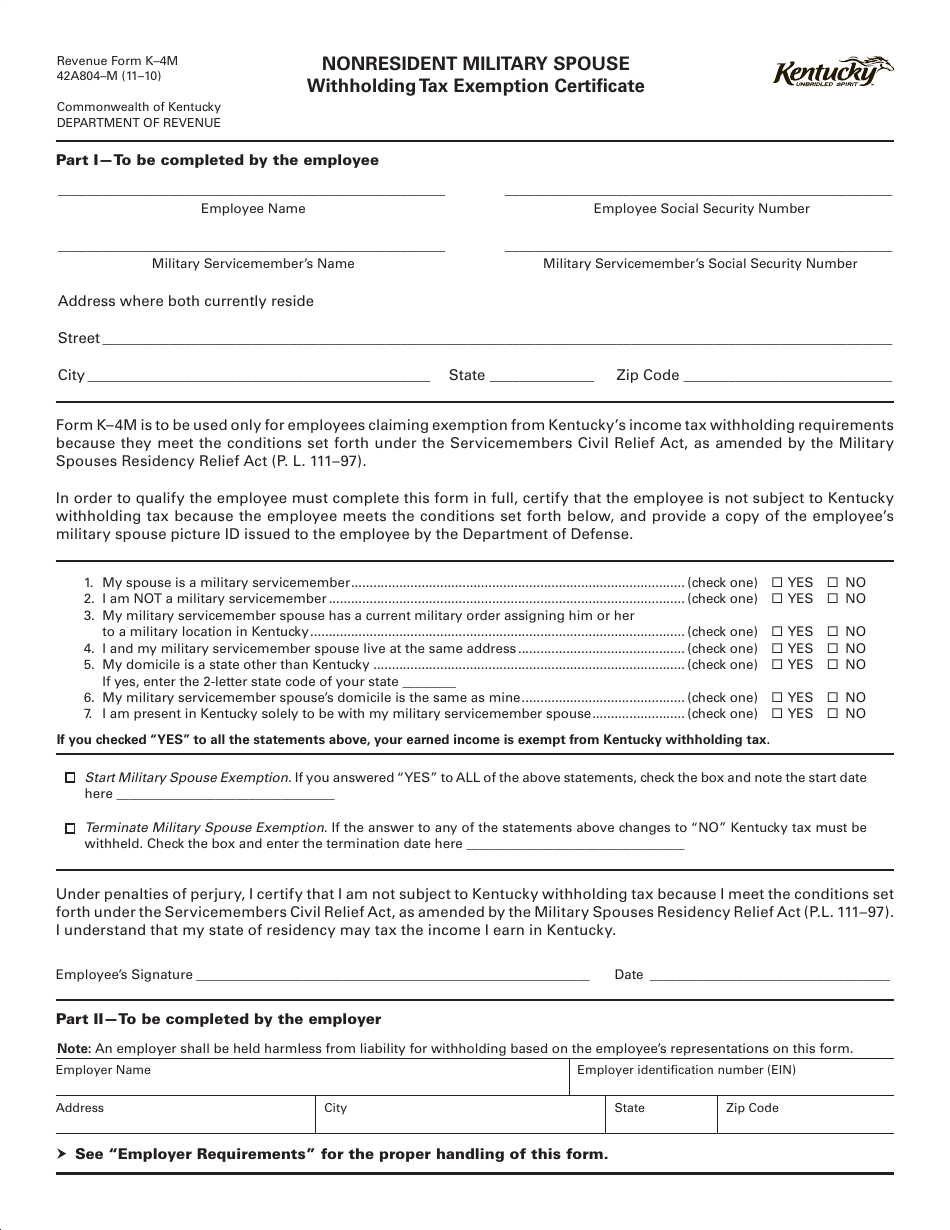

A: The Form K-4M is a Nonresident Military Spouse Withholding Tax Exemption Certificate used in Kentucky.

Q: Who is eligible to use the Form K-4M?

A: Nonresident military spouses can use the Form K-4M if they meet certain criteria in Kentucky.

Q: What is the purpose of the Form K-4M?

A: The purpose of the Form K-4M is to claim an exemption from withholding tax for nonresident military spouses in Kentucky.

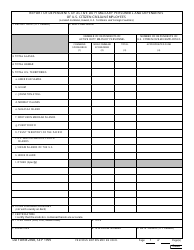

Q: How do I fill out the Form K-4M?

A: You must provide your personal information, including your name, address, and Social Security number, along with information about your military spouse and their income.

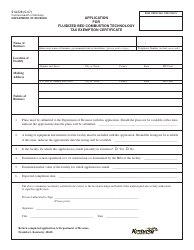

Q: What should I do with the completed Form K-4M?

A: You should give the completed Form K-4M to your employer so they can exempt your withholding tax in Kentucky.

Q: Is the Form K-4M only for military spouses stationed in Kentucky?

A: Yes, the Form K-4M is specifically for nonresident military spouses stationed in Kentucky.

Q: Do I need to file the Form K-4M every year?

A: No, you only need to file the Form K-4M once unless your circumstances change.

Q: Can I claim other exemptions on the Form K-4M?

A: No, the Form K-4M only exempts withholding tax for nonresident military spouses in Kentucky.

Q: Are there any penalties for incorrect information on the Form K-4M?

A: Yes, providing false or incorrect information on the Form K-4M may result in penalties imposed by the Kentucky Department of Revenue.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form K-4M by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.