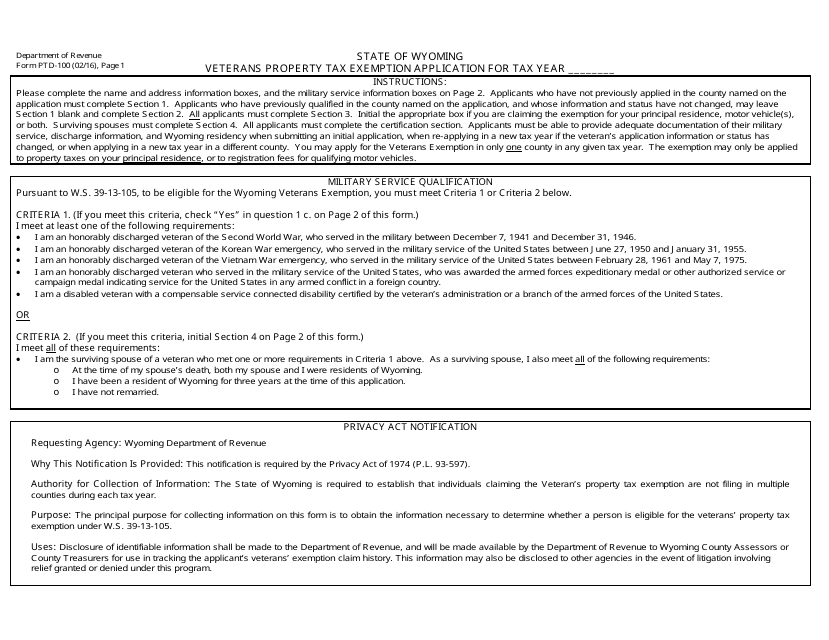

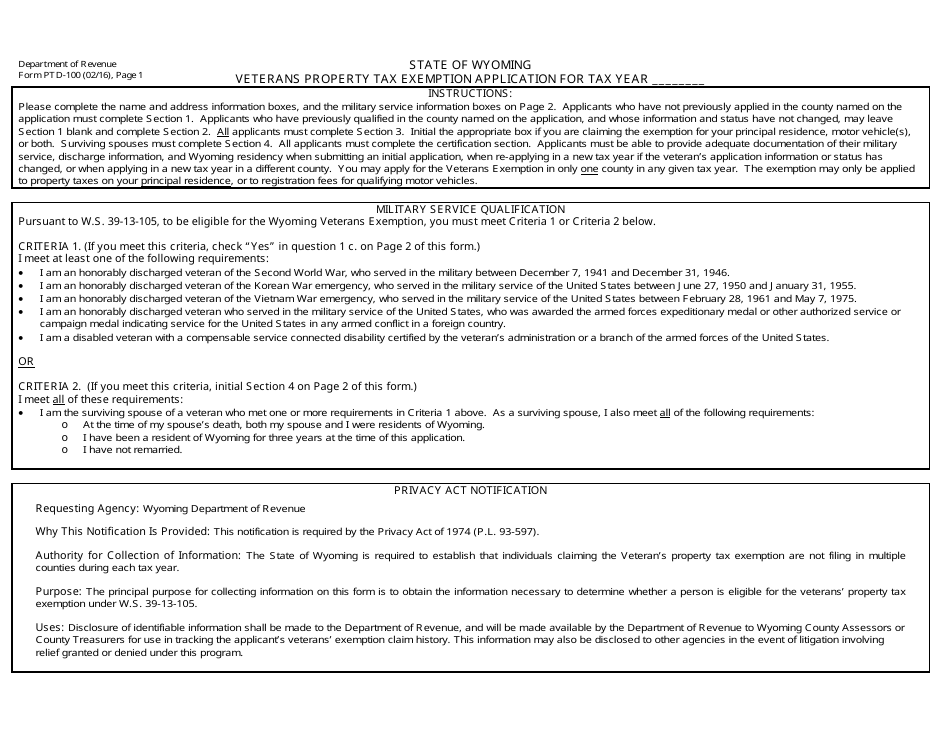

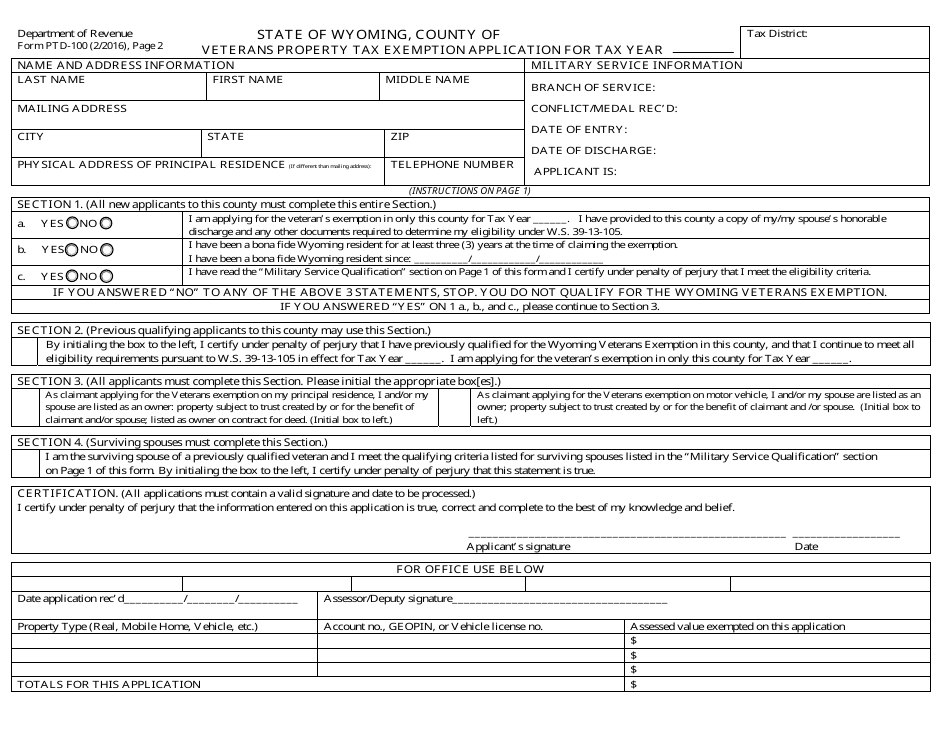

Form PTD-100 Veterans Property Tax Exemption Application - Wyoming

What Is Form PTD-100?

This is a legal form that was released by the Wyoming Department of Revenue - a government authority operating within Wyoming. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTD-100?

A: Form PTD-100 is the Veterans Property Tax Exemption Application in Wyoming.

Q: What is the purpose of Form PTD-100?

A: The purpose of Form PTD-100 is to apply for the Veterans Property Tax Exemption in Wyoming.

Q: Who is eligible for the Veterans Property Tax Exemption in Wyoming?

A: To be eligible for the Veterans Property Tax Exemption in Wyoming, you must have served in the military and meet certain criteria.

Q: Are there any fees associated with filing Form PTD-100?

A: No, there are no fees associated with filing Form PTD-100.

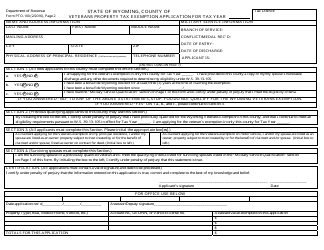

Q: What documents do I need to submit with Form PTD-100?

A: You will need to submit proof of your military service and other supporting documents as specified in the application instructions.

Q: What is the deadline for submitting Form PTD-100?

A: The deadline for submitting Form PTD-100 is usually on or before January 31st of the year for which you are applying.

Q: Is the Veterans Property Tax Exemption a one-time benefit?

A: No, the Veterans Property Tax Exemption is an annual benefit, and you will need to reapply each year.

Q: What are the benefits of the Veterans Property Tax Exemption?

A: The Veterans Property Tax Exemption can provide a reduction in property taxes for eligible veterans in Wyoming.

Q: Are surviving spouses eligible for the Veterans Property Tax Exemption?

A: Yes, surviving spouses of veterans may be eligible for the Veterans Property Tax Exemption in certain circumstances. Please refer to the application instructions for more information.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Wyoming Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTD-100 by clicking the link below or browse more documents and templates provided by the Wyoming Department of Revenue.