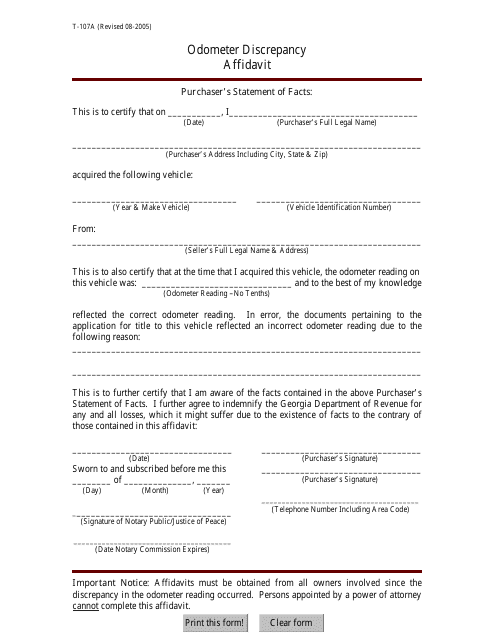

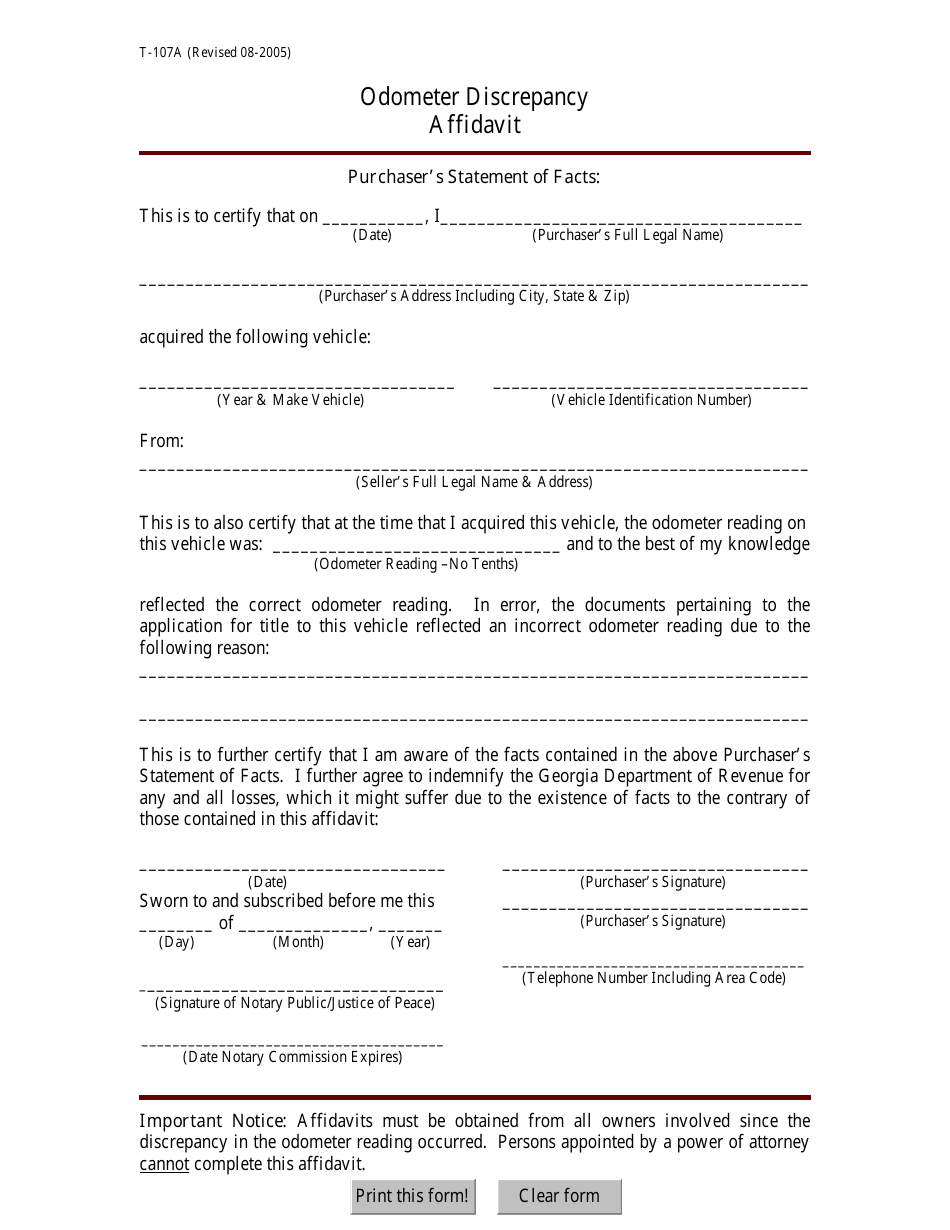

Form T-107A Odometer Discrepancy Affidavit - Georgia (United States)

What Is Form T-107A?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-107A?

A: Form T-107A is the Odometer Discrepancy Affidavit used in Georgia.

Q: What is the purpose of Form T-107A?

A: The purpose of Form T-107A is to declare an odometer discrepancy for a vehicle.

Q: When should Form T-107A be used?

A: Form T-107A should be used when there is a discrepancy in the reported mileage of a vehicle.

Q: Who needs to complete Form T-107A?

A: The person who discovers the odometer discrepancy or the seller of the vehicle needs to complete Form T-107A.

Q: Is there a fee for submitting Form T-107A?

A: No, there is no fee for submitting Form T-107A.

Q: What should I do with the completed Form T-107A?

A: The completed Form T-107A should be submitted to the Georgia Department of Revenue along with other required documentation.

Q: Are there any penalties for providing false information on Form T-107A?

A: Yes, providing false information on Form T-107A may result in penalties and legal consequences.

Q: Can Form T-107A be used for vehicles registered in other states?

A: No, Form T-107A is specific to Georgia and should not be used for vehicles registered in other states.

Q: Is there a deadline for submitting Form T-107A?

A: There is no specific deadline mentioned for submitting Form T-107A, but it should be submitted as soon as the odometer discrepancy is discovered.

Form Details:

- Released on August 1, 2005;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-107A by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.