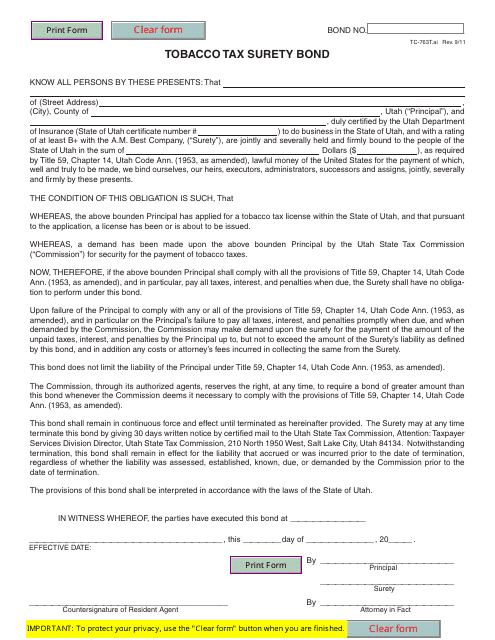

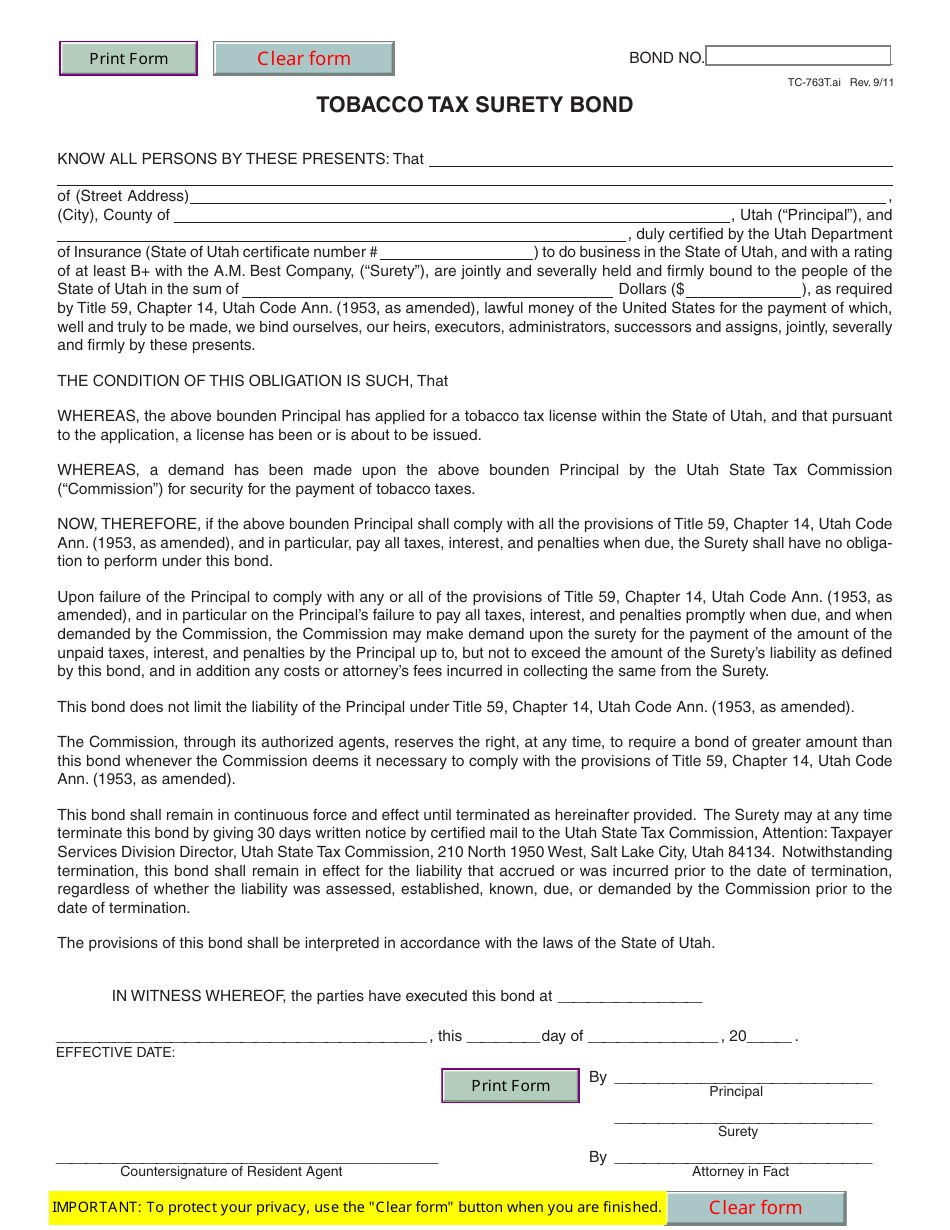

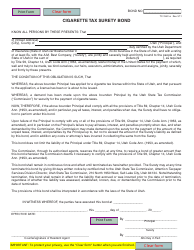

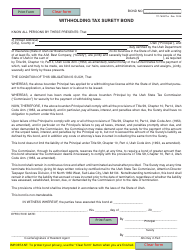

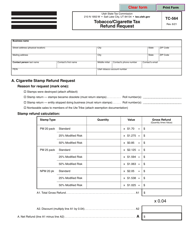

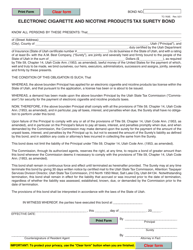

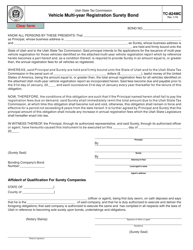

Form TC-763T Tobacco Tax Surety Bond - Utah

What Is Form TC-763T?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form TC-763T?

A: Form TC-763T is a Tobacco Tax Surety Bond used in the state of Utah.

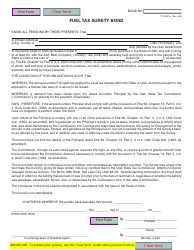

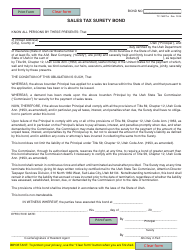

Q: What is the purpose of form TC-763T?

A: The purpose of form TC-763T is to provide a surety bond to the Utah State Tax Commission as a guarantee for payment of tobacco taxes.

Q: Who needs to file form TC-763T?

A: Any dealer or distributor of tobacco products in Utah may be required to file form TC-763T.

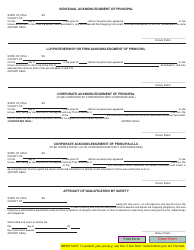

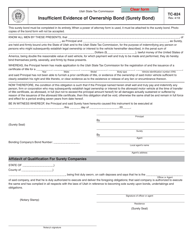

Q: What information is required on form TC-763T?

A: Form TC-763T requires information such as the name and address of the bonded principal, the surety company, and the bond amount.

Q: Are there any fees associated with filing form TC-763T?

A: Yes, there may be fees associated with filing form TC-763T. You should check with the Utah State Tax Commission for the current fee schedule.

Q: When is form TC-763T due?

A: Form TC-763T is typically due on the same date as the tobacco tax return for the corresponding period.

Q: What happens if I fail to file form TC-763T?

A: Failure to file form TC-763T may result in penalties and interest being assessed by the Utah State Tax Commission.

Q: Is form TC-763T specific to Utah?

A: Yes, form TC-763T is specific to the state of Utah and is not used in any other state.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-763T by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.