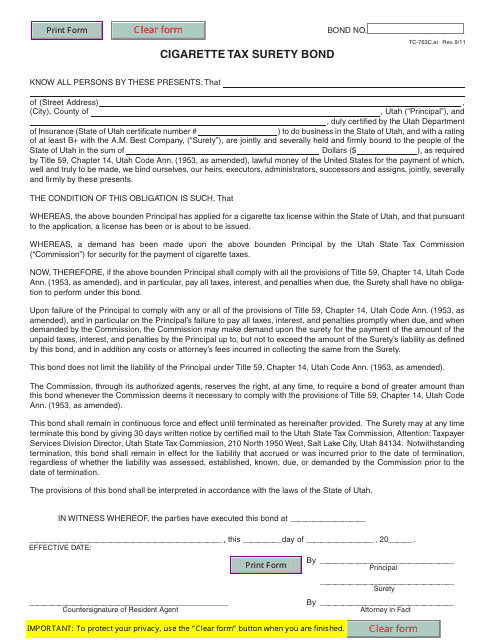

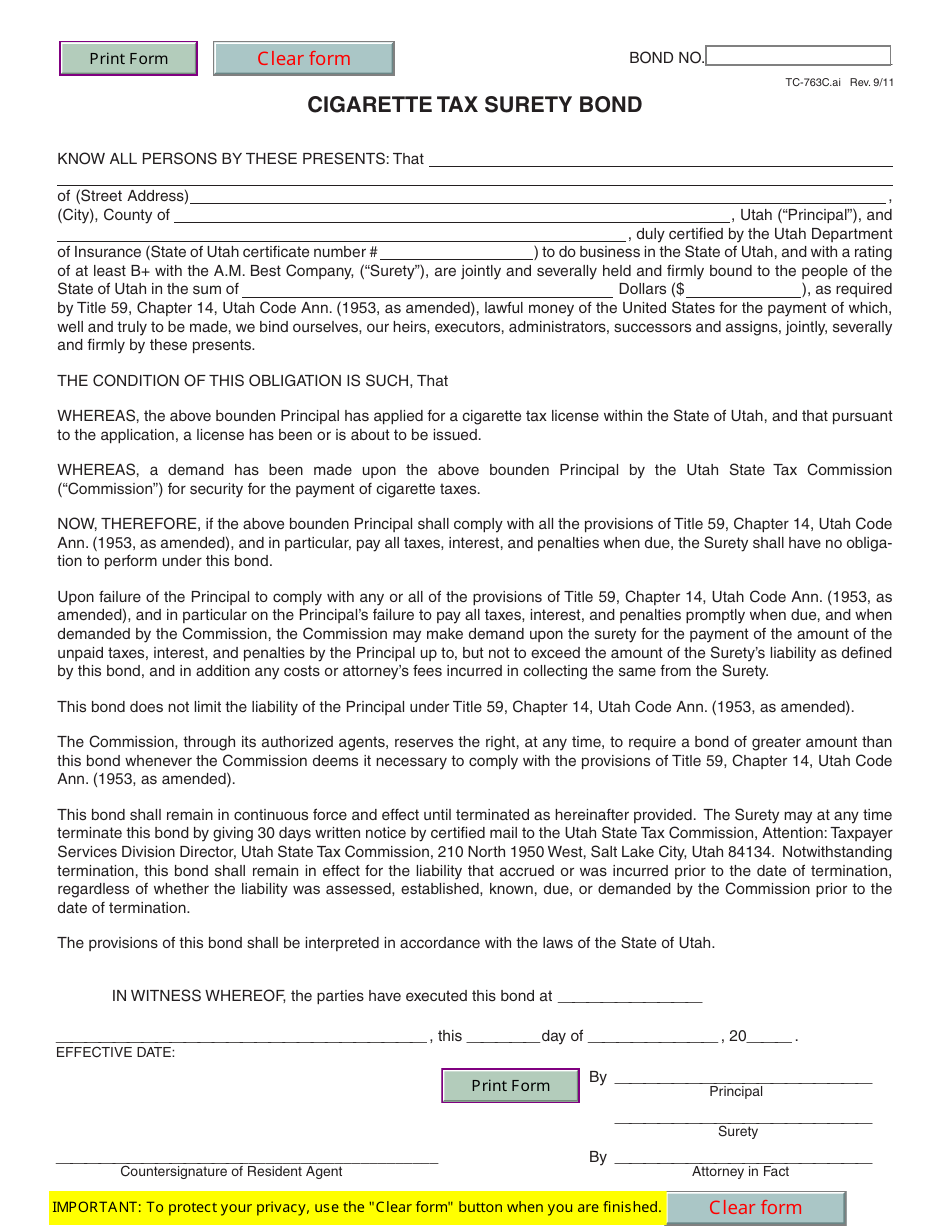

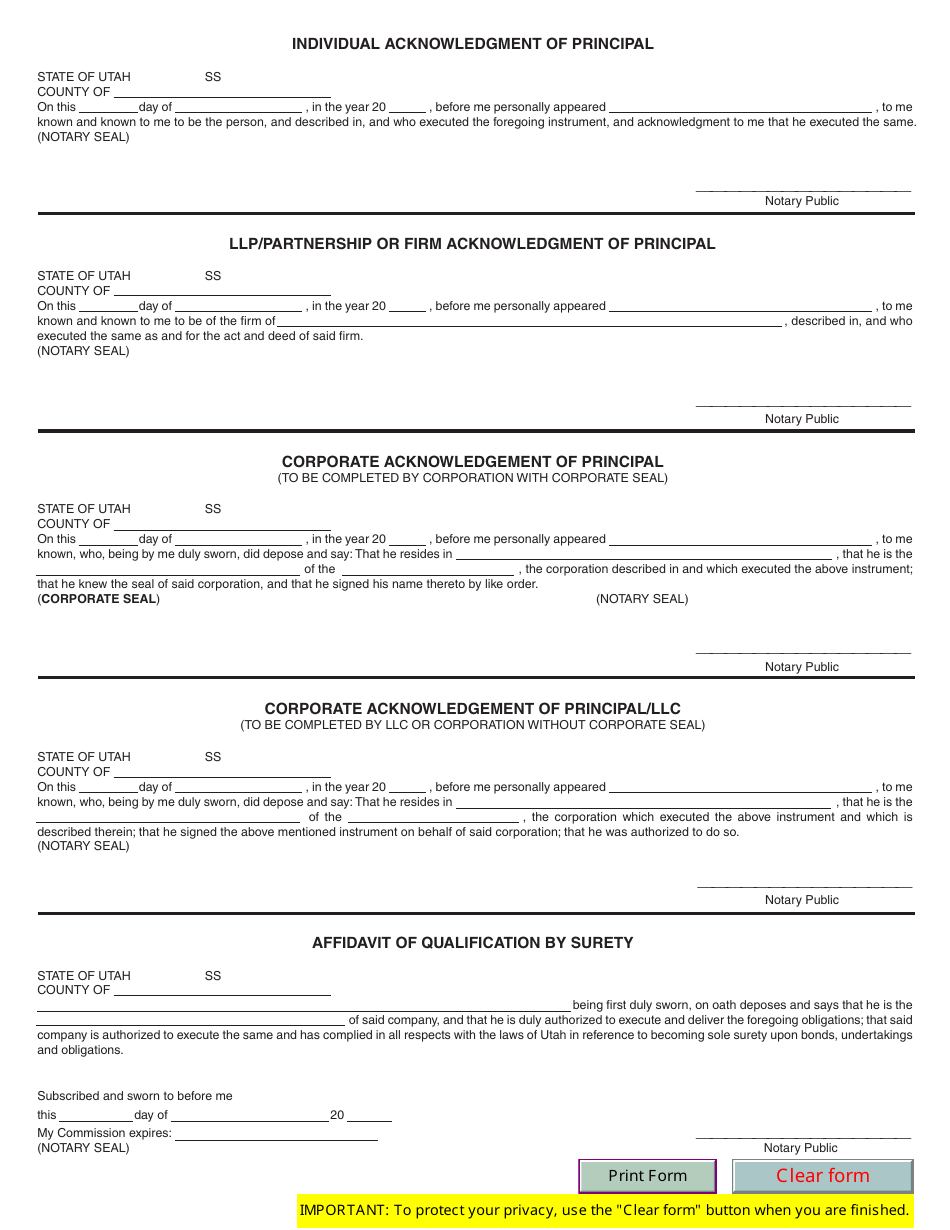

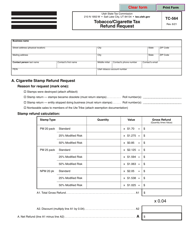

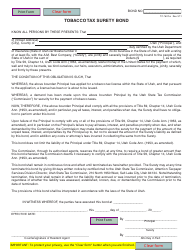

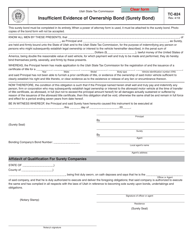

Form TC-763C Cigarette Tax Surety Bond - Utah

What Is Form TC-763C?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-763C?

A: Form TC-763C is a Cigarette Tax Surety Bond used in Utah.

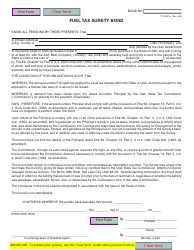

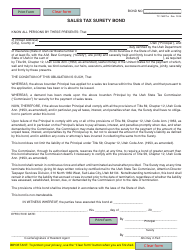

Q: What is a Cigarette Tax Surety Bond?

A: A Cigarette Tax Surety Bond is a form of financial guarantee required by the state of Utah to ensure that cigarette taxes are paid.

Q: Why is a Cigarette Tax Surety Bond required?

A: A Cigarette Tax Surety Bond is required to protect the state of Utah from any potential losses in unpaid cigarette taxes.

Q: Who needs to fill out Form TC-763C?

A: Anyone who sells cigarettes in Utah and is required to hold a cigarette license may need to fill out Form TC-763C.

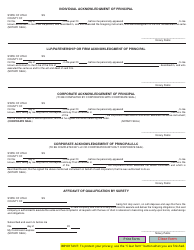

Q: How do I fill out Form TC-763C?

A: The form requires information about the business, including name, address, and contact information, as well as the amount of the surety bond.

Q: Are there any fees associated with Form TC-763C?

A: Yes, there may be fees associated with obtaining a Cigarette Tax Surety Bond.

Q: What happens if I don't submit Form TC-763C?

A: Failure to submit Form TC-763C or provide a Cigarette Tax Surety Bond may result in penalties or the revocation of the cigarette license.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-763C by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.