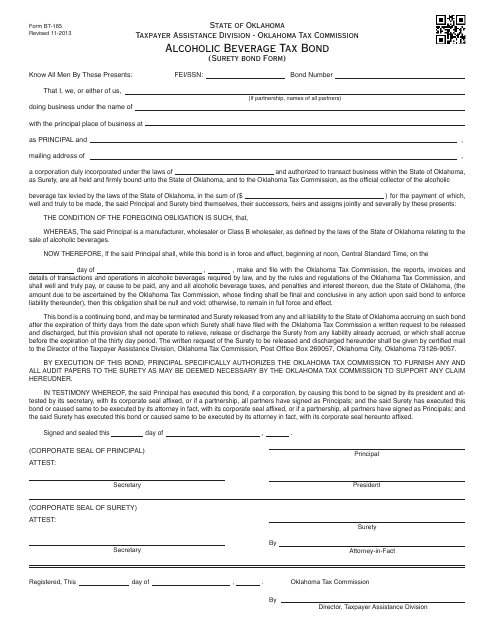

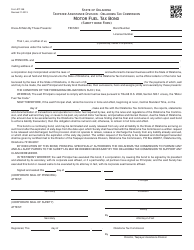

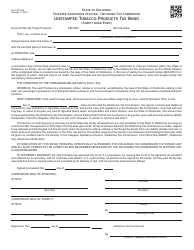

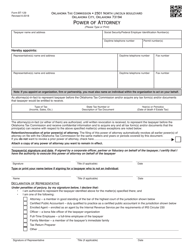

OTC Form BT-165 Alcoholic Beverage Tax Bond (Surety Bond Form) - Oklahoma

What Is OTC Form BT-165?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form BT-165?

A: The OTC Form BT-165 is the Alcoholic Beverage Tax Bond (Surety Bond Form) issued by the Oklahoma Tax Commission.

Q: What is the purpose of the OTC Form BT-165?

A: The purpose of the OTC Form BT-165 is to ensure payment of alcoholic beverage taxes in Oklahoma.

Q: Who needs to file the OTC Form BT-165?

A: Any business involved in the sale, distribution, or manufacture of alcoholic beverages in Oklahoma needs to file the OTC Form BT-165.

Q: What does the OTC Form BT-165 require?

A: The OTC Form BT-165 requires the business to obtain a surety bond as a guarantee of payment for the alcoholic beverage taxes.

Q: How often is the OTC Form BT-165 filed?

A: The OTC Form BT-165 needs to be filed annually.

Q: What happens if I don't file the OTC Form BT-165?

A: Failure to file the OTC Form BT-165 can result in penalties and fines, as well as the suspension or revocation of the business's alcoholic beverage license.

Q: Can I cancel the OTC Form BT-165?

A: Yes, the OTC Form BT-165 can be canceled by providing a written notice to the Oklahoma Tax Commission.

Q: Is the OTC Form BT-165 required for all types of alcoholic beverages?

A: Yes, the OTC Form BT-165 is required for all types of alcoholic beverages, including beer, wine, and spirits.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form BT-165 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.