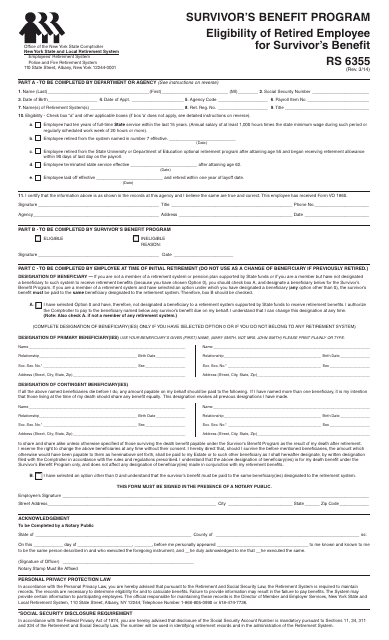

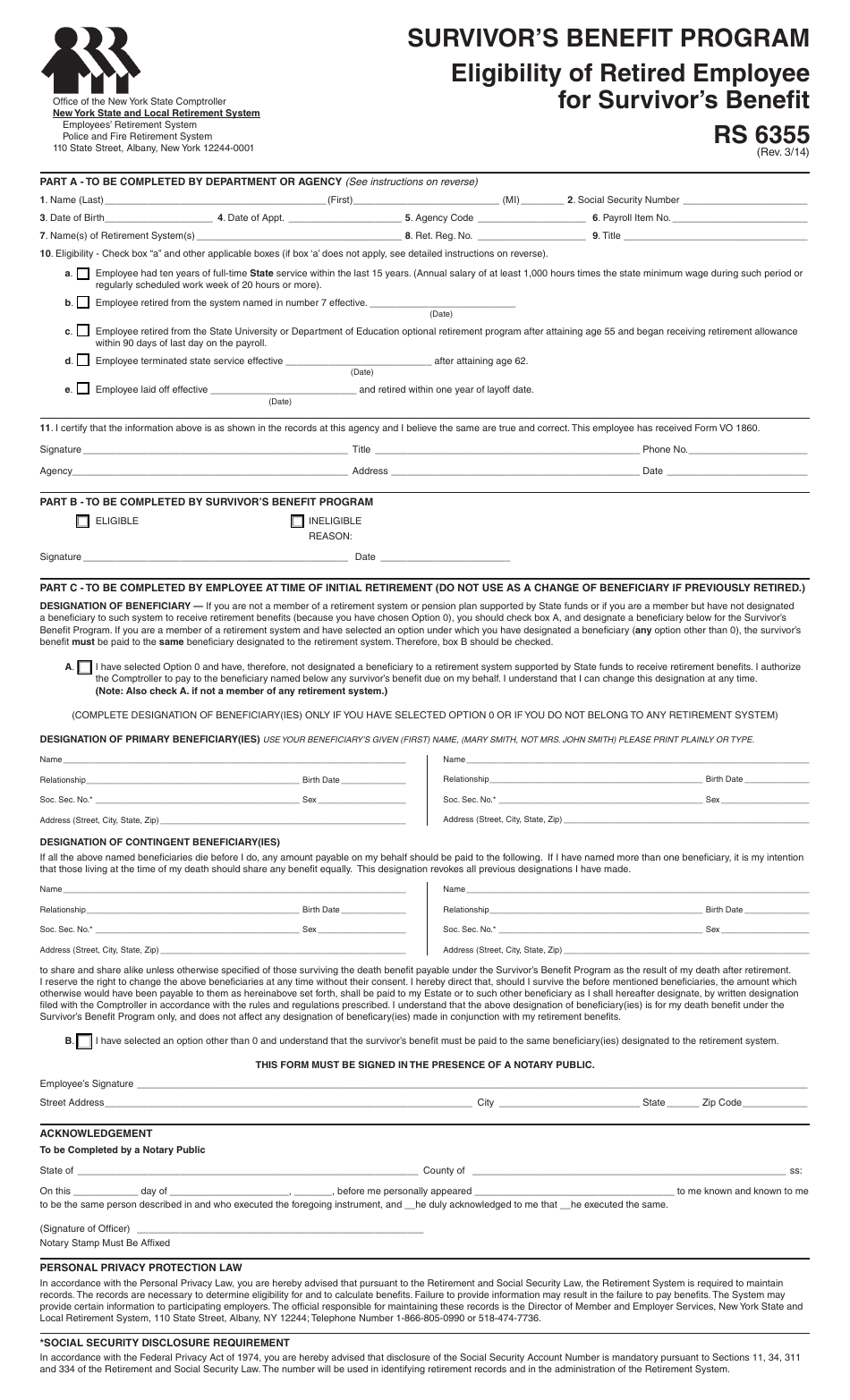

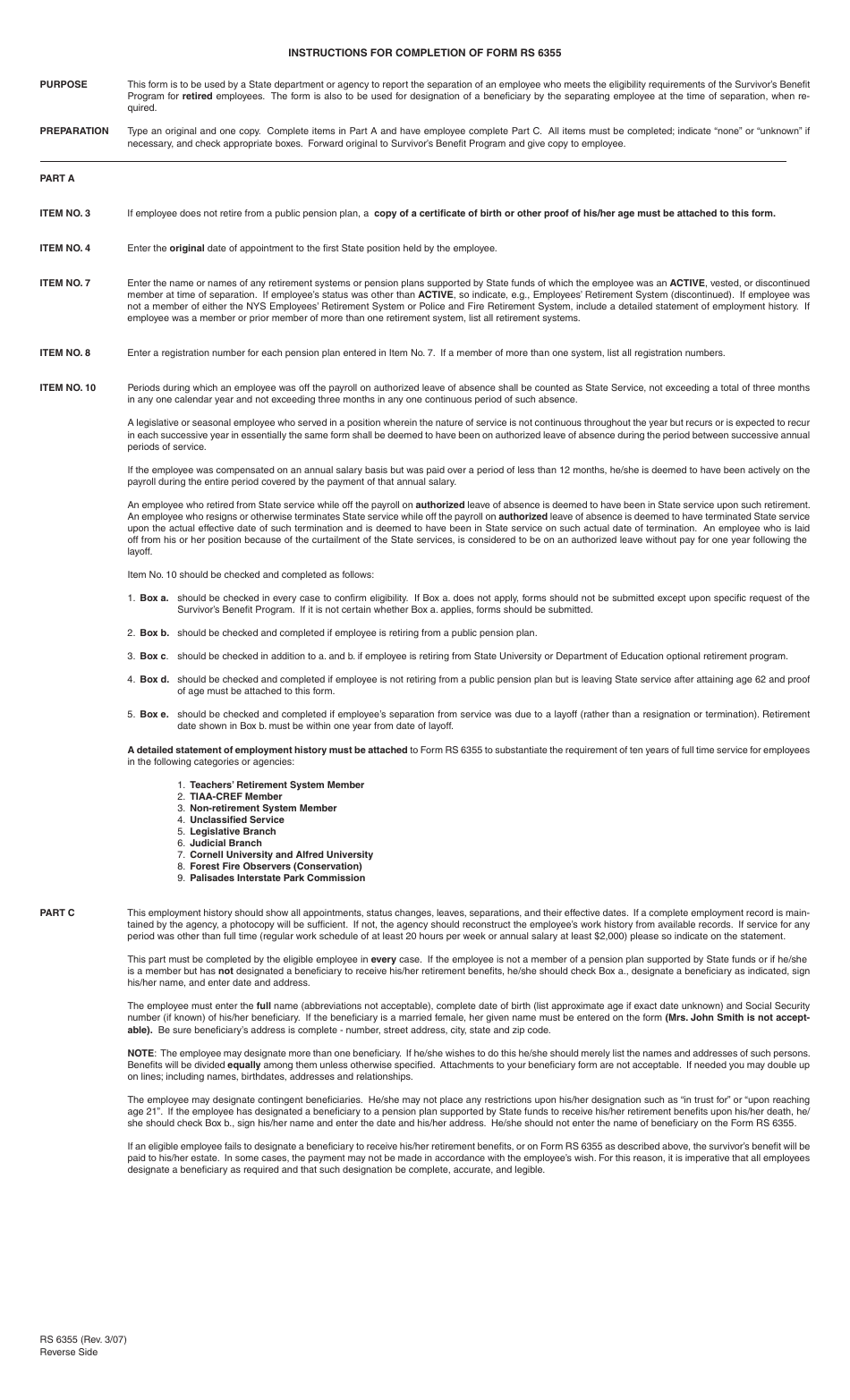

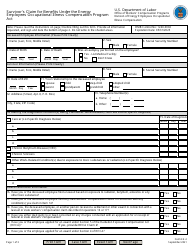

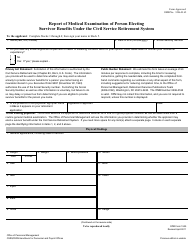

Form RS6355 Survivor's Benefit Program Eligibility of Retired Employee for Survivor's Benefit - New York

What Is Form RS6355?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

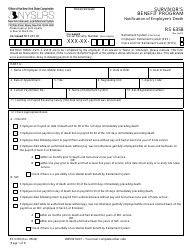

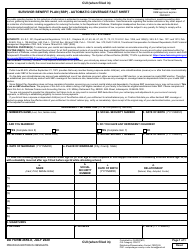

Q: What is the Survivor's Benefit Program?

A: The Survivor's Benefit Program provides financial support to eligible survivors of retired employees in New York.

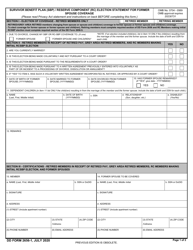

Q: Who is eligible for the Survivor's Benefit Program?

A: Only the survivors of retired employees in New York are eligible for the program.

Q: What is the eligibility requirement for the Survivor's Benefit Program?

A: The retired employee must have been enrolled in the Survivor's Benefit Program at the time of retirement.

Q: How does the Survivor's Benefit Program work?

A: Upon the death of a retired employee, eligible survivors may receive a monthly income based on a percentage of the employee's retirement benefit.

Q: What is the purpose of the Survivor's Benefit Program?

A: The program aims to provide financial support to the surviving family members of retired employees in New York.

Q: Is the Survivor's Benefit Program available to active employees?

A: No, the program is only available to the survivors of retired employees.

Q: Are there any specific rules or regulations for the Survivor's Benefit Program?

A: Yes, the retired employee must have elected survivor's benefits during the retirement process.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RS6355 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.