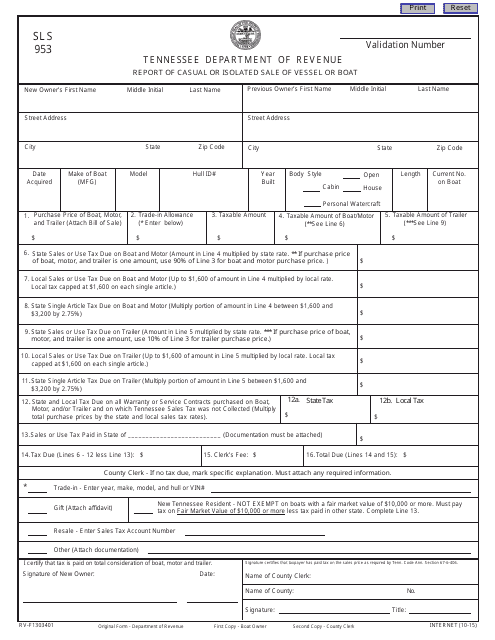

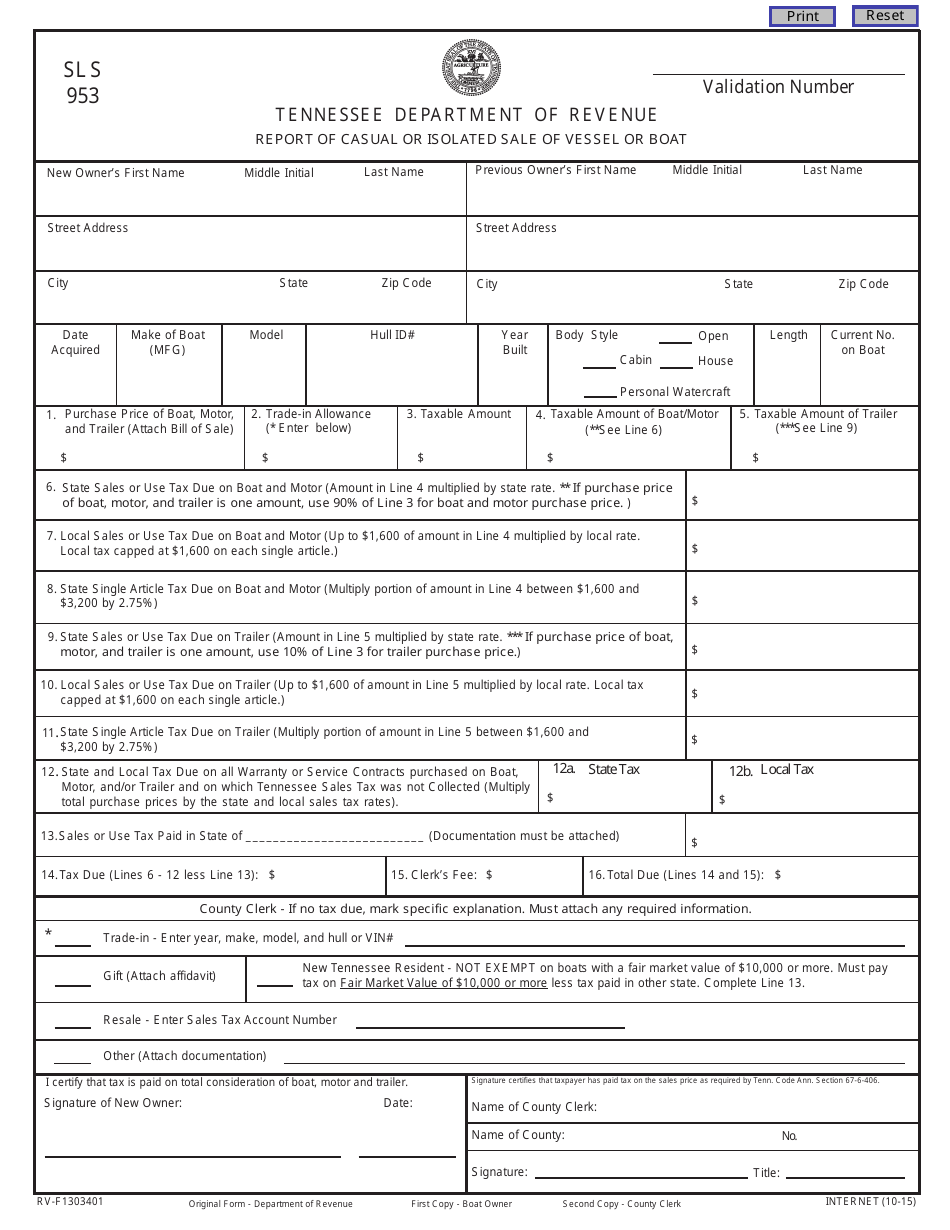

Form SLS953 Report of Casual or Isolated Sale of Vessel or Boat - Tennessee

What Is Form SLS953?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SLS953?

A: Form SLS953 is a report that is used to document the casual or isolated sale of a vessel or boat in Tennessee.

Q: Who needs to file Form SLS953?

A: Anyone who is involved in a casual or isolated sale of a vessel or boat in Tennessee needs to file Form SLS953.

Q: What is considered a casual or isolated sale of a vessel or boat?

A: A casual or isolated sale of a vessel or boat is a one-time sale where the seller is not regularly engaged in the business of selling vessels or boats.

Q: Why do I need to file Form SLS953?

A: Filing Form SLS953 is required by the Tennessee Department of Revenue to ensure that proper sales tax is collected on the sale of vessels or boats.

Q: Is there a deadline for filing Form SLS953?

A: Yes, Form SLS953 must be filed within 10 days of the completion of the sale of the vessel or boat.

Q: What information is required on Form SLS953?

A: Form SLS953 requires information about the buyer and seller, details of the vessel or boat, and the sale price.

Q: Are there any fees associated with filing Form SLS953?

A: No, there are no fees associated with filing Form SLS953.

Q: What should I do after filing Form SLS953?

A: After filing Form SLS953, you should keep a copy of the form for your records and ensure that any required sales tax is remitted to the Tennessee Department of Revenue.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SLS953 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.