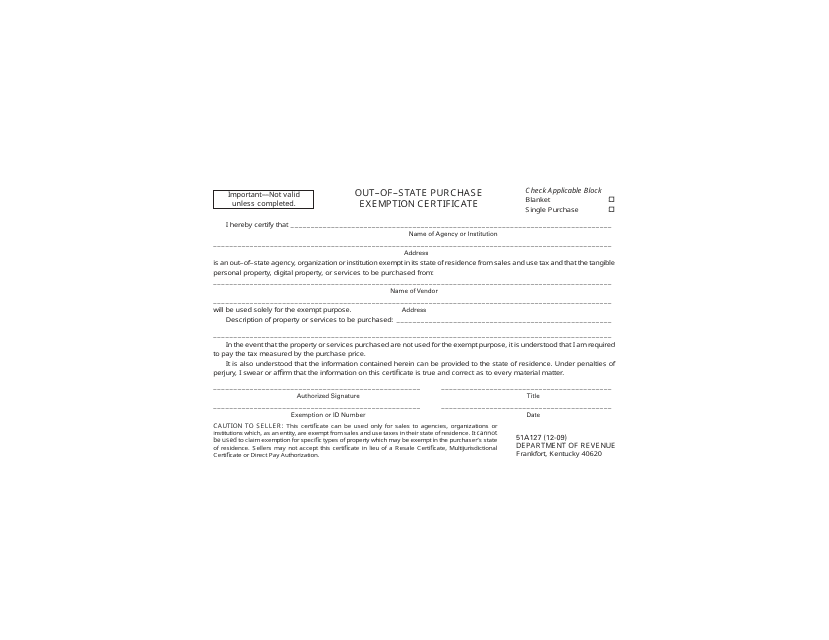

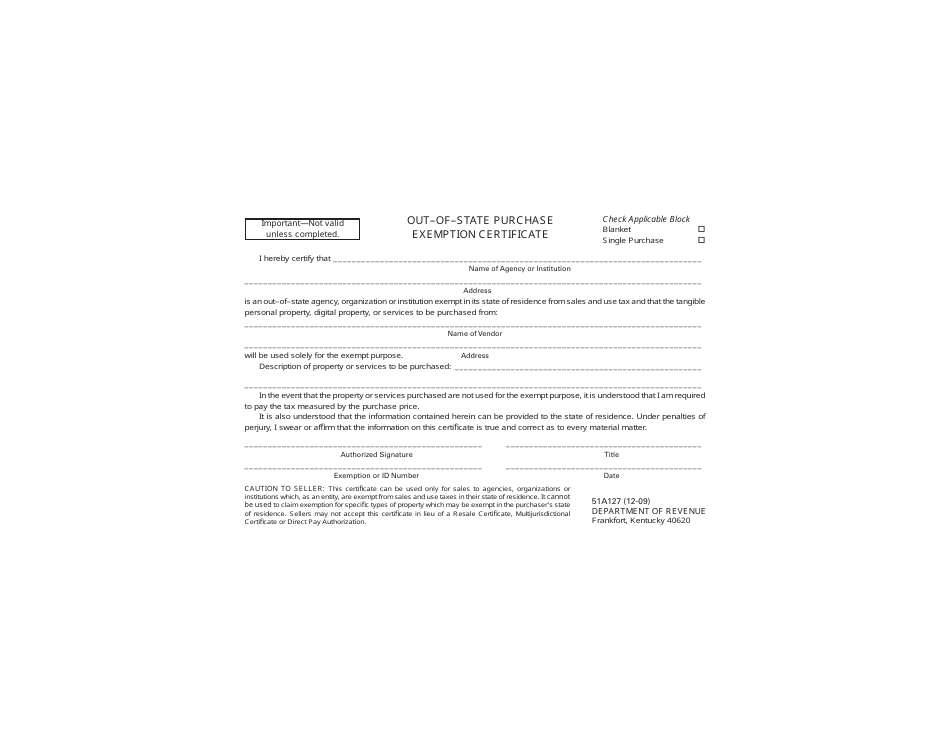

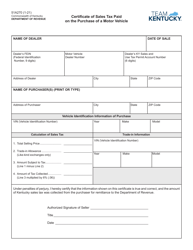

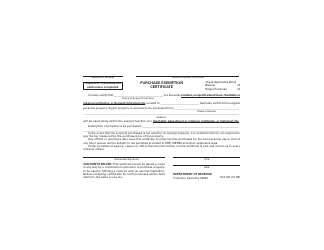

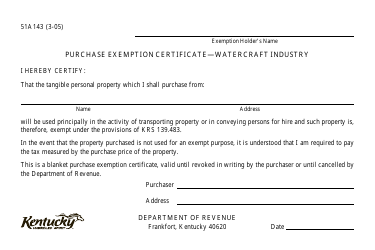

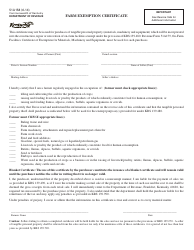

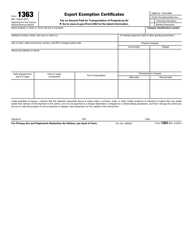

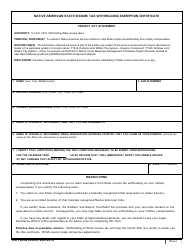

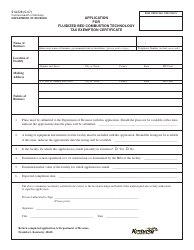

Form 51A127 Out-of-State Purchase Exemption Certificate - Kentucky

What Is Form 51A127?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A127?

A: Form 51A127 is the Out-of-State Purchase Exemption Certificate for Kentucky.

Q: What is the purpose of Form 51A127?

A: The purpose of Form 51A127 is to claim an exemption from Kentucky sales tax on items purchased out-of-state.

Q: Who needs to fill out Form 51A127?

A: Individuals who make qualified purchases out-of-state and want to claim an exemption from Kentucky sales tax need to fill out Form 51A127.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A127 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.