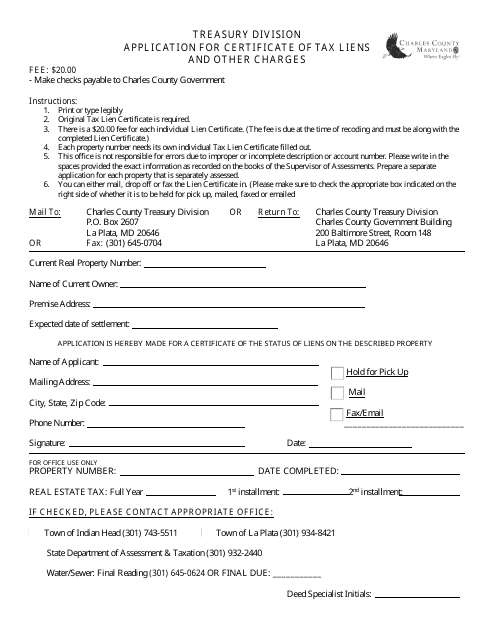

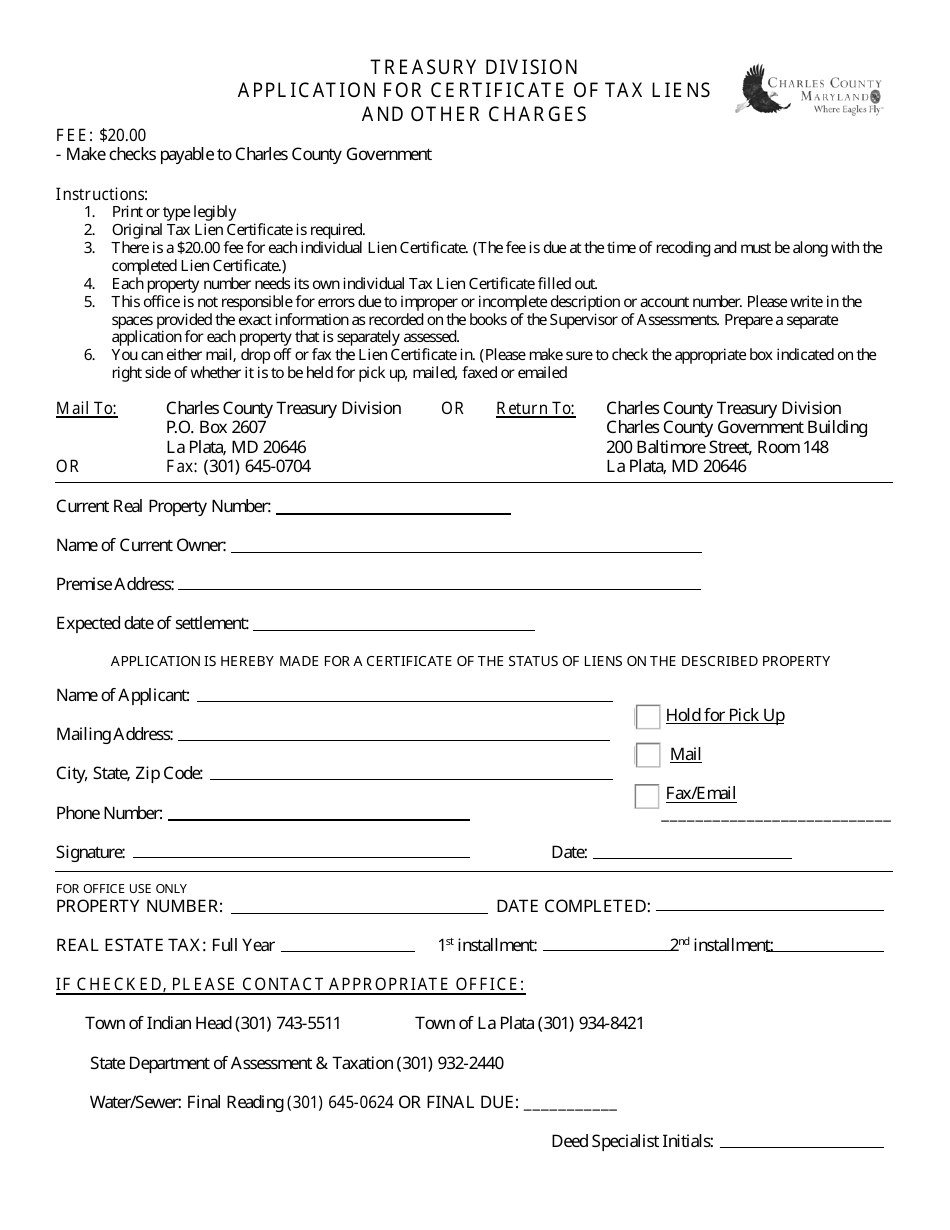

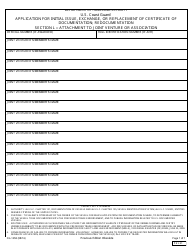

Application for Certificate of Tax Liens and Other Charges - Charles County, Maryland

Application for Certificate of Tax Liens and Other Charges is a legal document that was released by the Comptroller of Maryland - a government authority operating within Maryland. The form may be used strictly within Charles County.

FAQ

Q: What is a Certificate of Tax Liens and Other Charges?

A: A Certificate of Tax Liens and Other Charges is a document that lists any outstanding tax liens and other charges against a property in Charles County, Maryland.

Q: Why would I need a Certificate of Tax Liens and Other Charges?

A: You may need a Certificate of Tax Liens and Other Charges when buying or refinancing a property to ensure that there are no outstanding debts or liens that could affect the title.

Q: How can I apply for a Certificate of Tax Liens and Other Charges in Charles County, Maryland?

A: You can apply for a Certificate of Tax Liens and Other Charges by contacting the Charles County Treasurer's Office and submitting the required documents and fees.

Q: What documents and fees are required to apply for a Certificate of Tax Liens and Other Charges?

A: The exact documents and fees required may vary, so it is best to contact the Charles County Treasurer's Office for specific information.

Q: How long does it take to get a Certificate of Tax Liens and Other Charges?

A: The processing time for a Certificate of Tax Liens and Other Charges can vary, but it is typically several business days to weeks.

Q: What should I do if there are outstanding tax liens or other charges on a property?

A: If there are outstanding tax liens or other charges on a property, you should consult with a legal professional to understand your options and determine the best course of action.

Form Details:

- The latest edition currently provided by the Comptroller of Maryland;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.