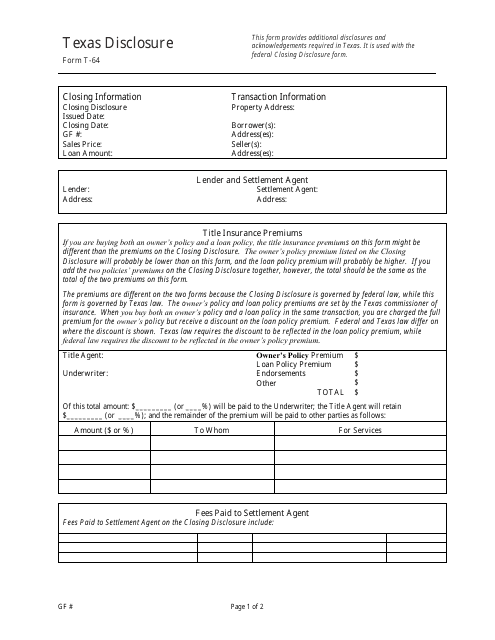

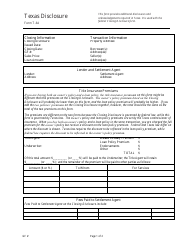

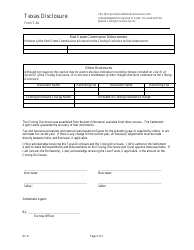

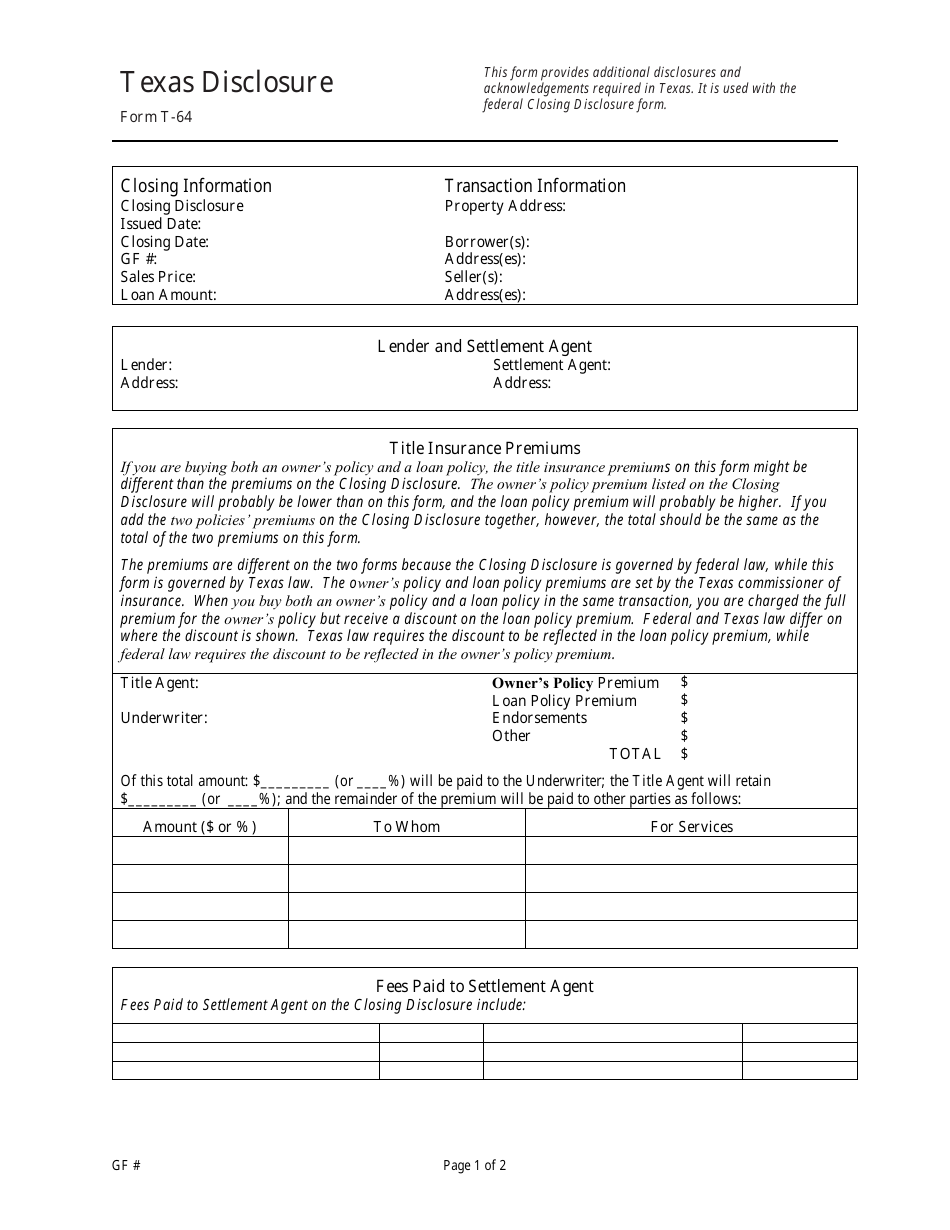

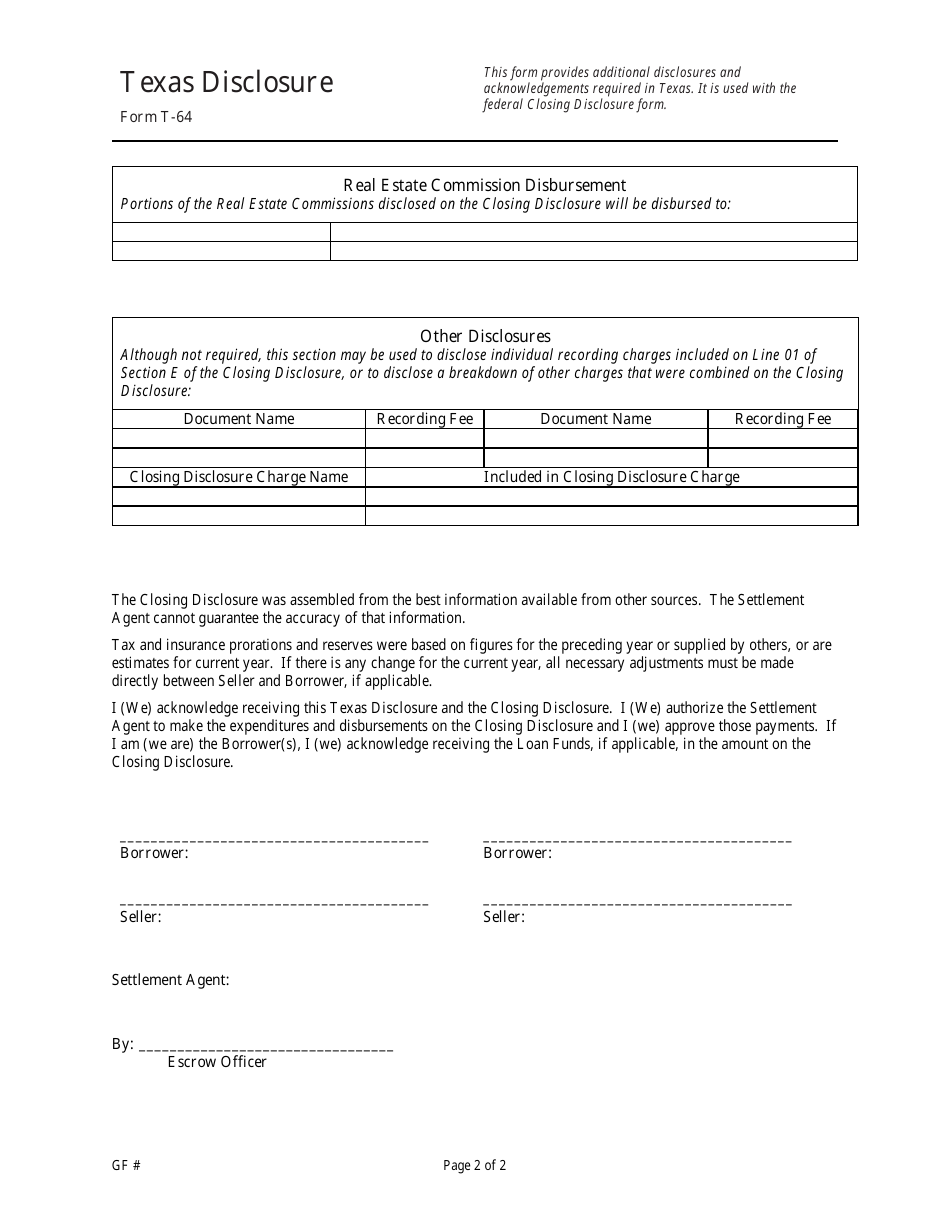

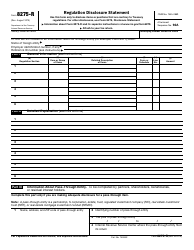

Form T-64 Disclosure - Texas

What Is Form T-64?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

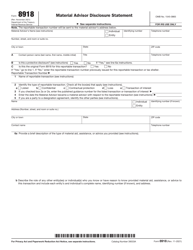

Q: What is Form T-64 Disclosure?

A: Form T-64 Disclosure is a document used in the state of Texas to disclose relevant information about a property during a real estate transaction.

Q: Who completes Form T-64 Disclosure?

A: The seller of the property completes Form T-64 Disclosure and provides it to the buyer.

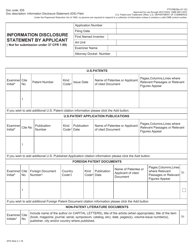

Q: What information does Form T-64 Disclosure include?

A: Form T-64 Disclosure includes information about the property's condition, any known defects, and any environmental hazards.

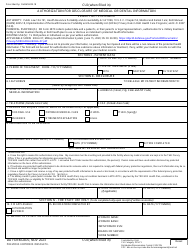

Q: Why is Form T-64 Disclosure important?

A: Form T-64 Disclosure is important because it ensures that the buyer has all the necessary information about the property before making a purchase decision.

Q: When should Form T-64 Disclosure be completed?

A: Form T-64 Disclosure should be completed as early as possible in the real estate transaction process, ideally before an offer is made.

Q: Who is responsible for the accuracy of Form T-64 Disclosure?

A: The seller is responsible for the accuracy of the information provided in Form T-64 Disclosure.

Q: Are there any penalties for providing false information on Form T-64 Disclosure?

A: Yes, providing false information on Form T-64 Disclosure may result in legal consequences.

Q: Is Form T-64 Disclosure required in every real estate transaction in Texas?

A: Yes, Form T-64 Disclosure is typically required in every real estate transaction in Texas to ensure transparency and protect the buyer.

Form Details:

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form T-64 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.