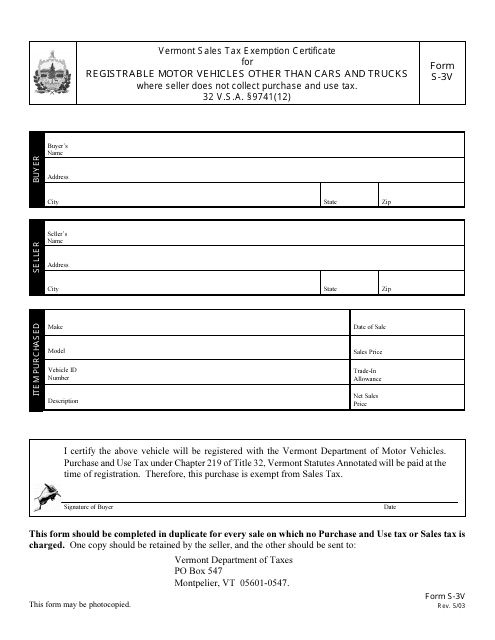

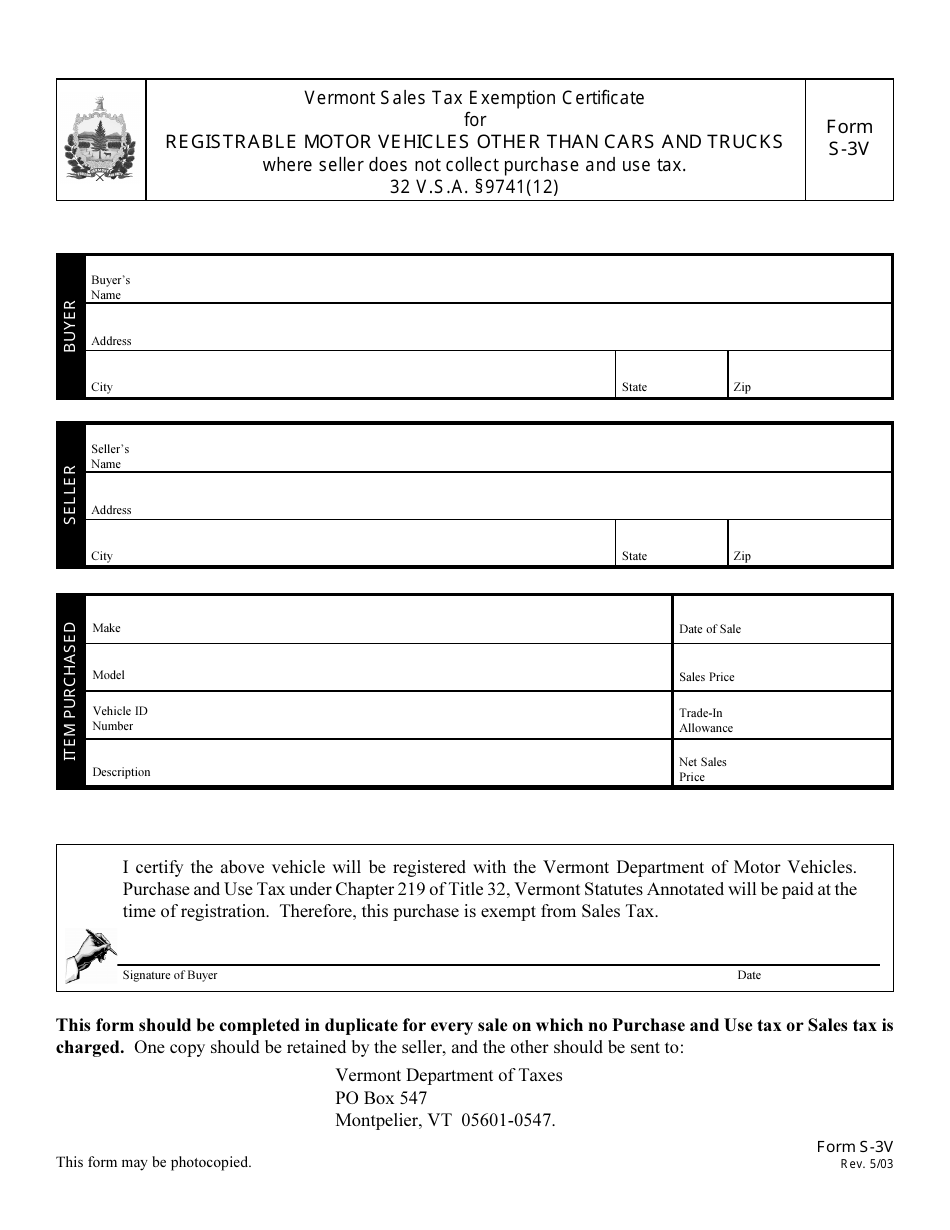

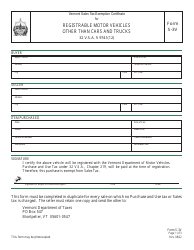

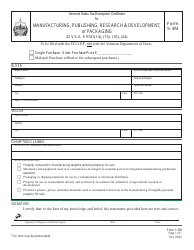

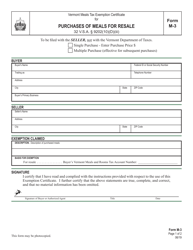

Form S-3V Vermont Sales Tax Exemption Certificate for Registrable Motor Vehicles Other Than Cars and Trucks - Vermont

What Is Form S-3V?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-3V?

A: Form S-3V is the Sales Tax Exemption Certificate for Registrable Motor Vehicles Other Than Cars and Trucks in Vermont.

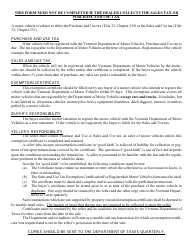

Q: Who is eligible for using Form S-3V?

A: Individuals who are purchasing registrable motor vehicles other than cars and trucks in Vermont are eligible to use Form S-3V.

Q: What is the purpose of Form S-3V?

A: The purpose of Form S-3V is to claim an exemption from paying sales tax on registrable motor vehicles other than cars and trucks in Vermont.

Q: What information is required on Form S-3V?

A: Form S-3V requires information such as the purchaser's name, address, vehicle details, and certification of eligibility.

Q: When should I submit Form S-3V?

A: Form S-3V should be completed and submitted at the time of purchasing a registrable motor vehicle other than a car or truck in Vermont.

Q: Does using Form S-3V guarantee exemption from sales tax?

A: Using Form S-3V does not guarantee exemption from sales tax. The Vermont Department of Taxes will review the form and determine eligibility for exemption.

Q: Are there any conditions for claiming exemption using Form S-3V?

A: Yes, there are certain conditions for claiming exemption using Form S-3V. The vehicle must be registered in Vermont, used primarily in Vermont, and meet specific requirements outlined in the form.

Q: Can I use Form S-3V for cars and trucks?

A: No, Form S-3V is only for registrable motor vehicles other than cars and trucks. For cars and trucks, a different form should be used.

Q: What should I do if my exemption claim using Form S-3V is denied?

A: If your exemption claim using Form S-3V is denied, you may be required to pay the sales tax on the vehicle. You can contact the Vermont Department of Taxes for further assistance.

Form Details:

- Released on May 1, 2003;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S-3V by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.