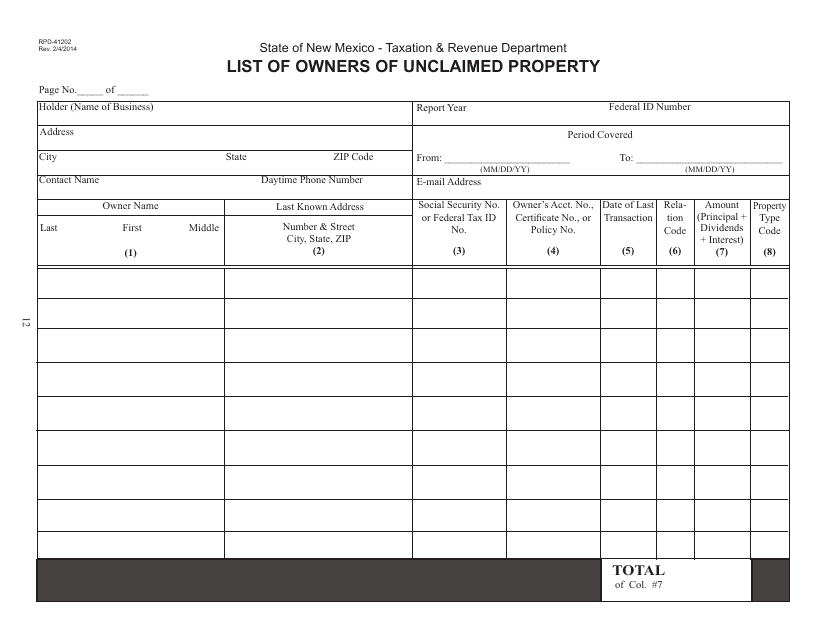

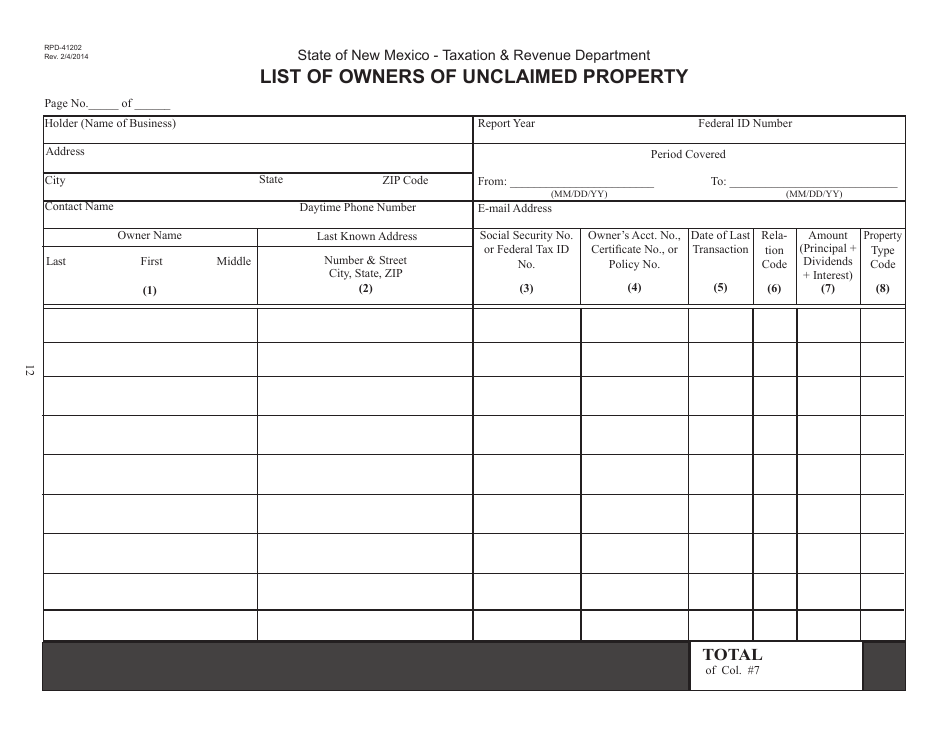

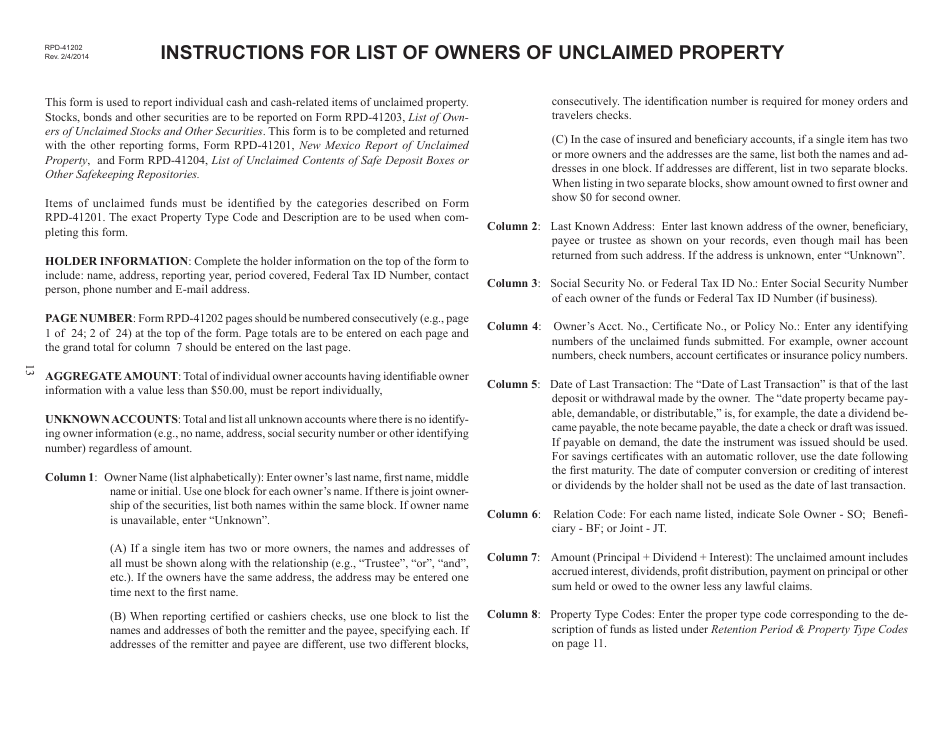

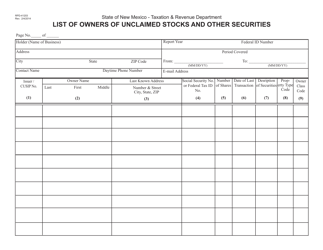

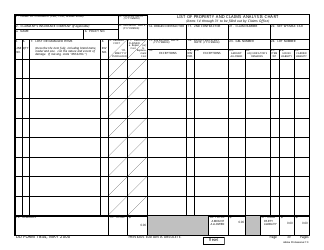

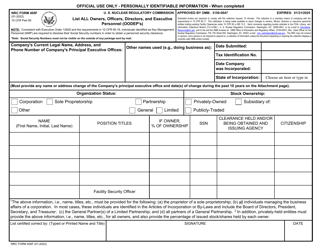

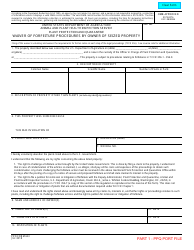

Form RPD-41202 List of Owners of Unclaimed Property - New Mexico

What Is Form RPD-41202?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RPD-41202?

A: RPD-41202 is a form used to list the owners of unclaimed property in New Mexico.

Q: What is unclaimed property?

A: Unclaimed property refers to assets or funds that have been abandoned or forgotten by their owners.

Q: Who needs to complete the RPD-41202 form?

A: The holders of unclaimed property in New Mexico are required to complete the RPD-41202 form.

Q: What information is required in the RPD-41202 form?

A: The form requires information such as the owner's name, contact information, and details about the unclaimed property.

Q: Is there a deadline for submitting the RPD-41202 form?

A: Yes, the form must be submitted by November 1st of each year.

Q: What happens to unclaimed property in New Mexico?

A: Unclaimed property in New Mexico is held by the state until the rightful owner claims it.

Form Details:

- Released on February 4, 2014;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41202 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.