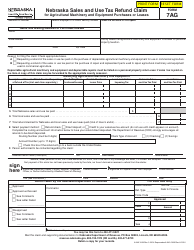

This version of the form is not currently in use and is provided for reference only. Download this version of

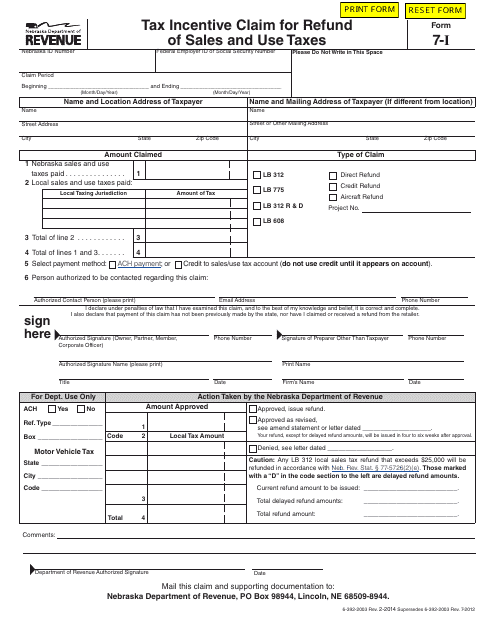

Form 7-I

for the current year.

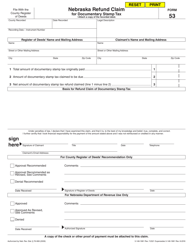

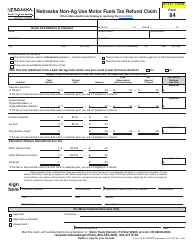

Form 7-I Tax Incentive Claim for Refund of Sales and Use Taxes - Nebraska

What Is Form 7-I?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 7-I?

A: Form 7-I is a tax form used in Nebraska to claim a refund of sales and use taxes.

Q: What is the purpose of Form 7-I?

A: The purpose of Form 7-I is to request a refund of sales and use taxes paid on qualifying purchases.

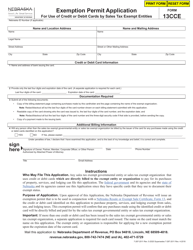

Q: Who can use Form 7-I?

A: Form 7-I can be used by businesses and individuals who have paid sales and use taxes in Nebraska.

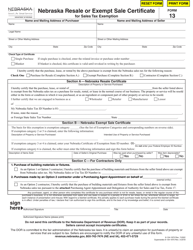

Q: What are the qualifying purchases for a refund?

A: Qualifying purchases for a refund include materials, machinery, equipment, and other tangible property used in the production of goods or services.

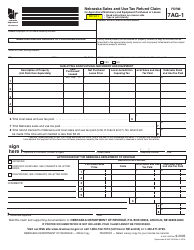

Q: How do I complete Form 7-I?

A: To complete Form 7-I, include your contact information, details about the qualifying purchases, and the amount of sales and use taxes paid.

Q: When will I receive my refund?

A: Refunds are typically processed within 45 days of receipt of a complete and accurate Form 7-I.

Q: Is there a deadline for submitting Form 7-I?

A: Yes, Form 7-I must be submitted within three years from the date the taxes were due or paid, whichever is later.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 7-I by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.