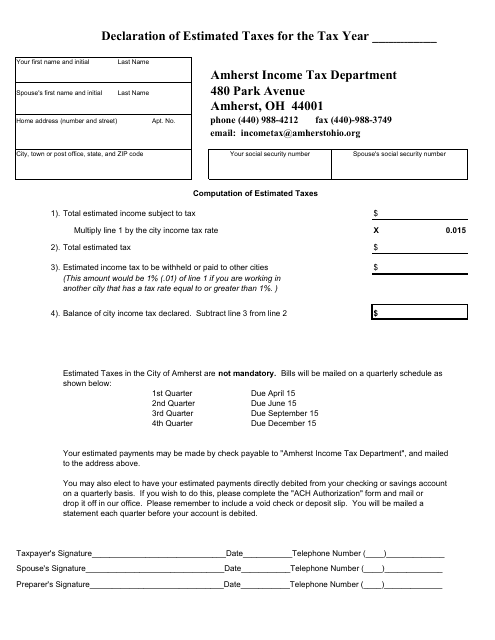

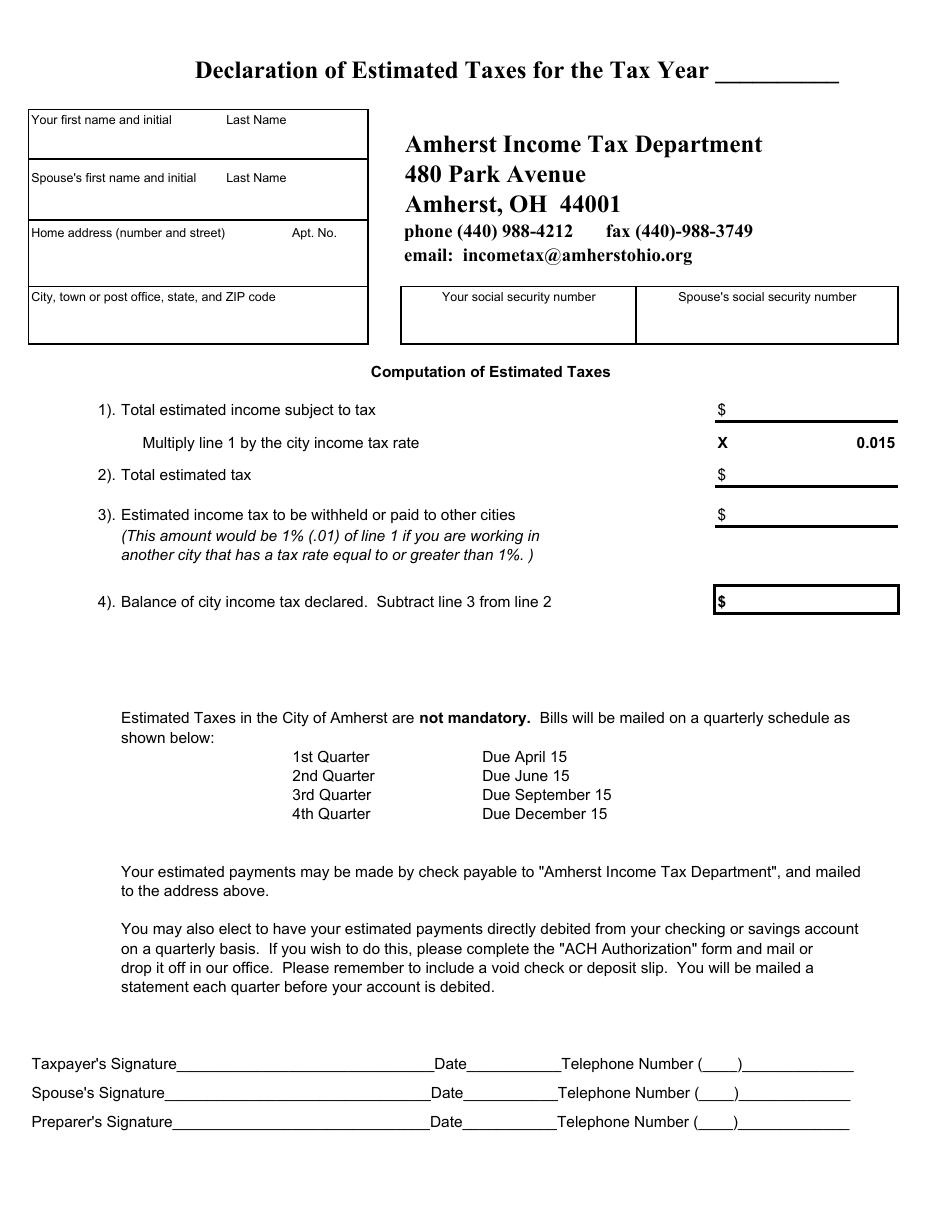

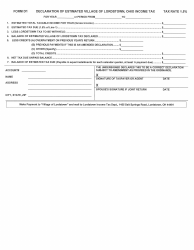

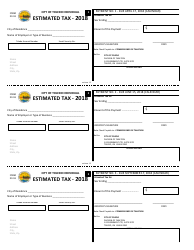

Declaration of Estimated Taxes - City of Amherst, Ohio

Declaration of Estimated Taxes is a legal document that was released by the Income Tax Department - City of Amherst, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Amherst.

FAQ

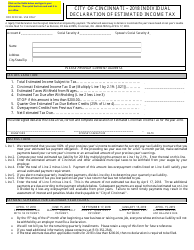

Q: What is the Declaration of Estimated Taxes?

A: The Declaration of Estimated Taxes is a form used by residents of City of Amherst, Ohio to estimate and pay their taxes throughout the year.

Q: Who needs to file a Declaration of Estimated Taxes in City of Amherst, Ohio?

A: Residents of City of Amherst, Ohio who have taxable income and expect to owe $200 or more in taxes for the year need to file a Declaration of Estimated Taxes.

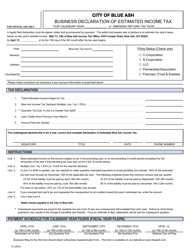

Q: When is the deadline to file a Declaration of Estimated Taxes in City of Amherst, Ohio?

A: The deadline to file a Declaration of Estimated Taxes in City of Amherst, Ohio is April 15th of each year.

Q: What happens if I don't file a Declaration of Estimated Taxes in City of Amherst, Ohio?

A: If you are required to file a Declaration of Estimated Taxes in City of Amherst, Ohio and fail to do so, you may be subject to penalties and interest on the unpaid tax amount.

Q: Can I make changes to my Declaration of Estimated Taxes in City of Amherst, Ohio?

A: Yes, you can make changes to your Declaration of Estimated Taxes in City of Amherst, Ohio by submitting an amended form.

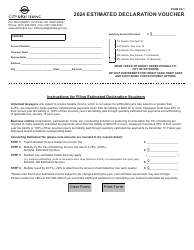

Form Details:

- The latest edition currently provided by the Income Tax Department - City of Amherst, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Amherst, Ohio.