This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 941-X

for the current year.

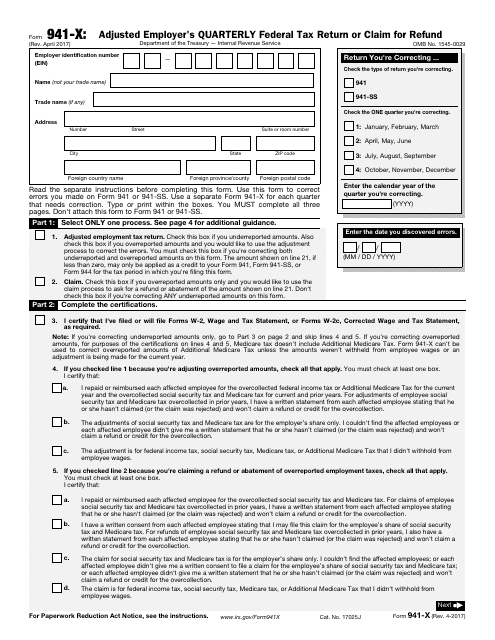

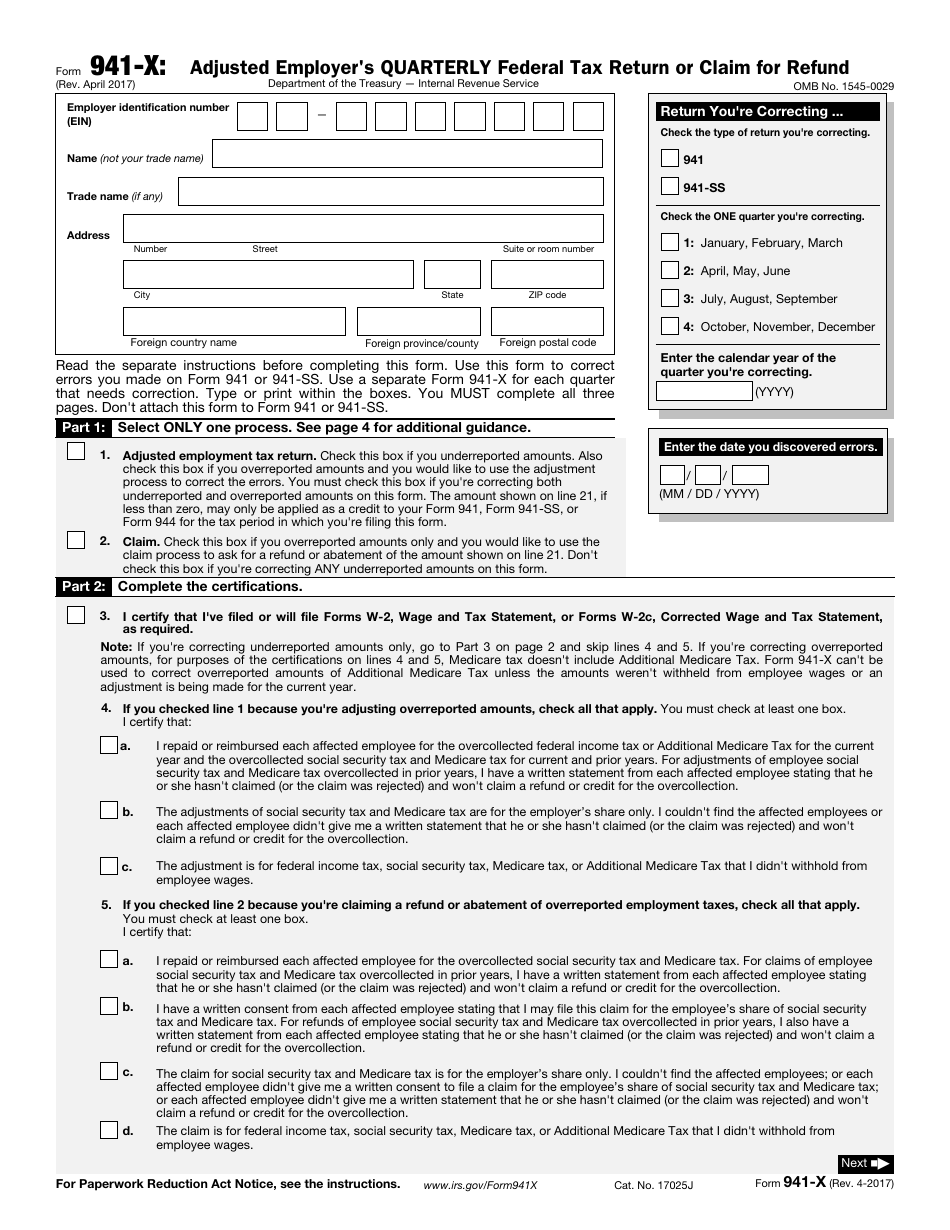

IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

What Is Form 941-X?

IRS Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund is a form used to correct mistakes on previously filed IRS Forms 941 or 941-SS. This form can be used to make Form 941 corrections for under-reported or over-reported amounts.

IRS Form 941-X is used to correct the following: wages, tips, and other compensation; income tax withheld from wages, tips, and other compensation; taxable social security wages; taxable social security tips; taxable Medicare wages and tips; taxable wages and tips subject to additional Medicare tax withholding, qualified small businesspayroll tax credit for increasing research activities; and credits for COBRA premium assistance payments.

The most recent version of the document was issued by the Internal Revenue Service (IRS) on April 1, 2017 . A fillable version of the form is available for download below.

When Is 941-X Due?

Over-reported taxes can be corrected within 2 years from the date when the over-reported taxes were paid or within 3 years from filing the form. Under-reported taxes should be corrected before the form due date for that quarter and the tax must be paid by the time the form is filed.

If the document is filed on time, under-reported taxes are paid by the time of filing, the grounds for corrections are explained in details and the date of error discovery is provided, the employer will not be subject to failure-to-pay penalties.

Where to File 941-X?

The mailing address for the form depends on the location of the person filing this form. The complete list of mailing addresses can be found in the IRS-issued instructions for IRS Form 941-X.

Form 941-X Instructions

-

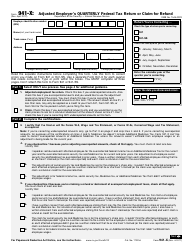

Part 1. The desired process.

-

Part 2. Certifications.

-

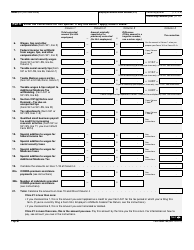

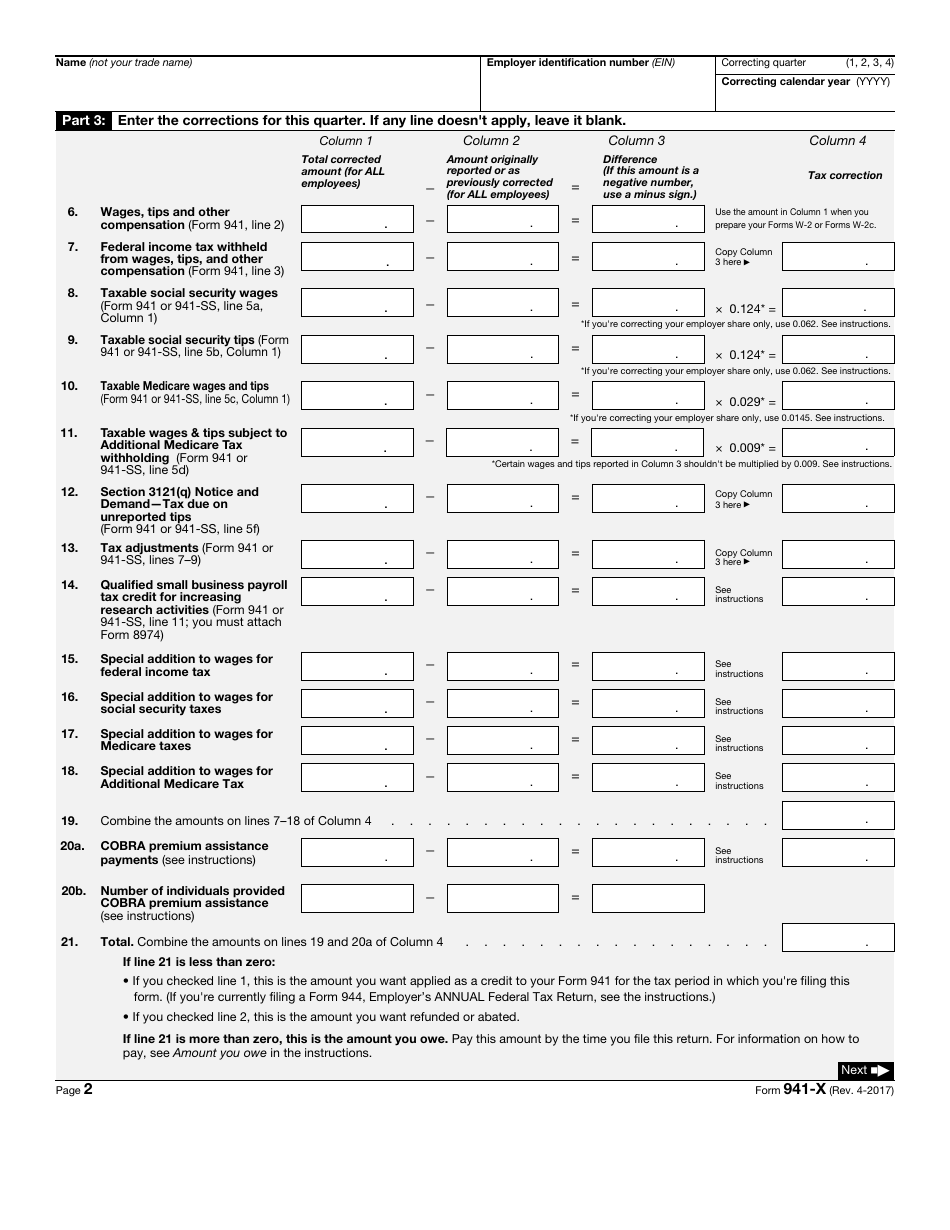

Part 3. Corrections for the quarter.

- Lines 6-14 are self-explanatory;

- Lines 15-18 apply only if you reclassified any workers to independent contractors or nonemployees. Enter additions to wages only for reclassified workers, not all employees. Enter the correct amount of additions to wages in Column 1 and the originally reported amounts in Column 2. Enter the difference between the amounts in Column 3. Use Section 3509 for rates and calculation the number for Column 4;

- Line 19. Add amounts provided in Column 4 of Lines 7-18 and enter the resulting number;

- Line 20a, COBRA premium assistance payments. Enter 65% if the total COBRA premium assistance payments for all eligible individuals. For tax periods ending before January 2014, enter any COBRA payments in Column 2. For tax periods beginning after December 2013, enter 0, unless you are correcting a previously filed IRS Form 941-X. Enter the difference between Columns 1 and 2 in Columns 3 and 4;

- Line 20b, Number of individuals provided COBRA premium assistance. Enter the number of eligible individuals, who paid the reduces premium in the reported quarter in Column 1. If you are making a correction for a tax period beginning December 2013, enter 0 in Column 2. For tax periods ending before January 1, 2014, enter the number of assistance-eligible individuals provided COBRA premium assistance previously reported on Form 941 or 941-SS;

- Line 21, Total. Add amounts entered in Column 4 in Lines 19 and 20a.

-

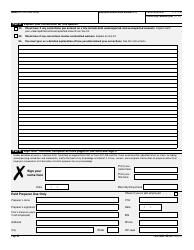

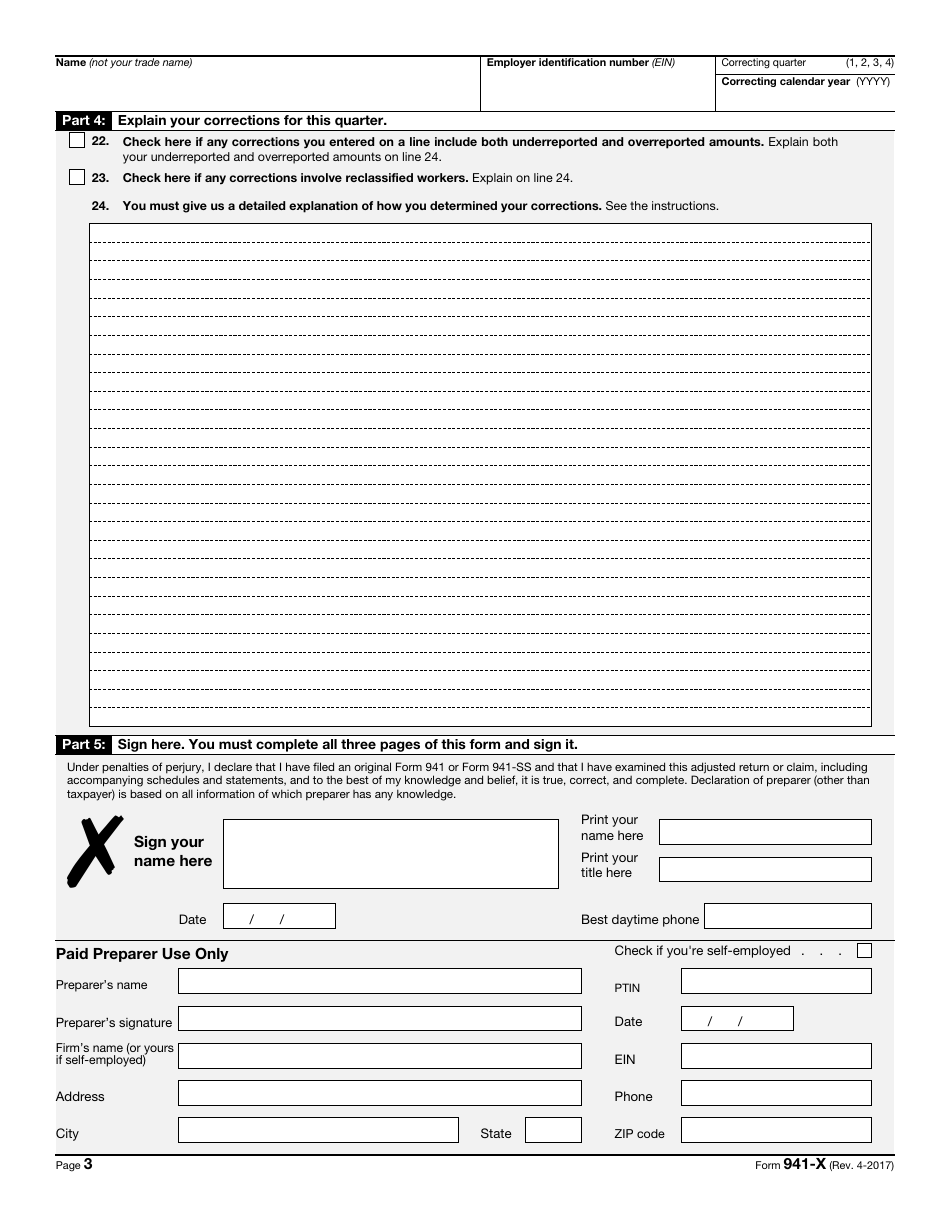

Part 4. Explanations for corrections.

- Line 22. Check the box if any of your corrections contain both under-reported and over-reported amounts;

- Line 23. Check the box, if any of your corrections involve reclassified workers;

- Line 24. Provide a detailed explanation of how you determined your corrections. If you checked the box in the previous item, explain this as well.

-

Part 5. Signature field.

-

Print your name and title, enter your best daytime phone number and sign the form. If you are a paid preparer, fill the Paid Preparer Use Only part. Check the box, if you are self-employed, provide your name, your firm's name, address, Preparer Tax Identification Number (PTIN), EIN and phone number.

The following people have authority to sign IRS Form 941-X: the owner of the business, president, vice president, other authorized principal officer, a responsible and authorized member, partner, or an officer having knowledge of partnership affairs, the owner of a limited liability company (LLC) or an authorized principal officer and fiduciary of a trust.

To request a refund or abatement of arrested interest or penalties, the employer should use IRS Form 843, Claim for Refund and Request for Abatement. IRS Form 941-X cannot be used for these purposes.

How to Correct Form 941-X?

If you discovered a mistake on your form, file another one, correcting the same form and mail it before the due date.

IRS 941-X Related Forms

- IRS Form 941, Employer's Quarterly Federal Tax Return is a form used to report Medicare, social security and income taxes withheld from the employee's paychecks and pay the employer's share of Medicare and social security taxes. This form is filed four times a year.

- IRS Form 941-SS, Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands is a form used for the same purpose as IRS Form 941, but is used by employers, located in the above-mentioned territories.