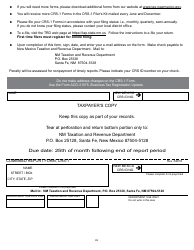

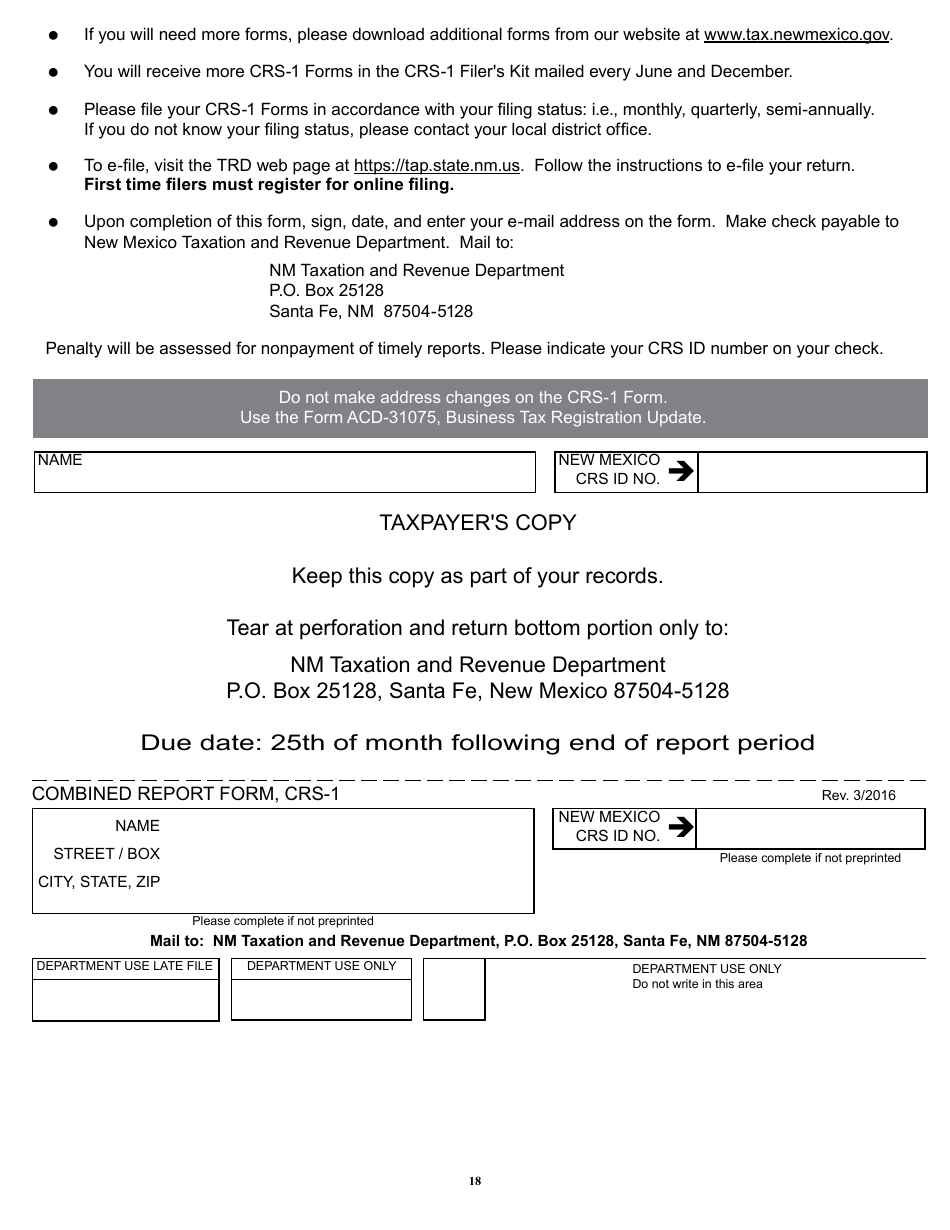

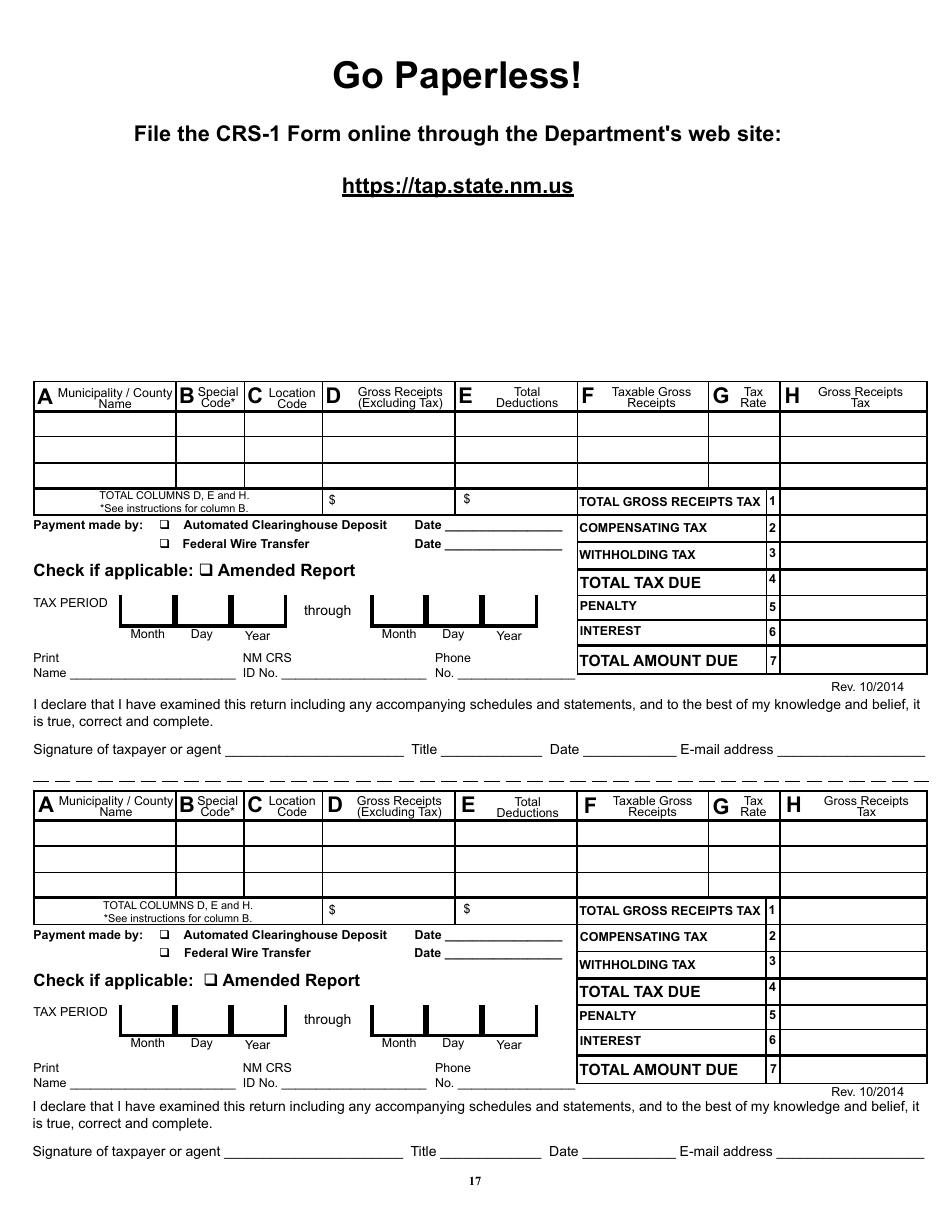

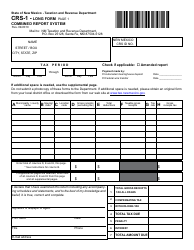

Form CRS-1 Combined Report - New Mexico

What Is Form CRS-1?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CRS-1 Combined Report?

A: Form CRS-1 Combined Report is a reporting form for businesses in New Mexico.

Q: Who is required to file Form CRS-1 Combined Report?

A: Businesses operating in New Mexico are required to file Form CRS-1 Combined Report.

Q: What information is required in Form CRS-1 Combined Report?

A: Form CRS-1 Combined Report requires businesses to provide information about their operations, income, and expenses.

Q: When is the deadline to file Form CRS-1 Combined Report?

A: The deadline to file Form CRS-1 Combined Report is typically March 15th of each year.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRS-1 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.