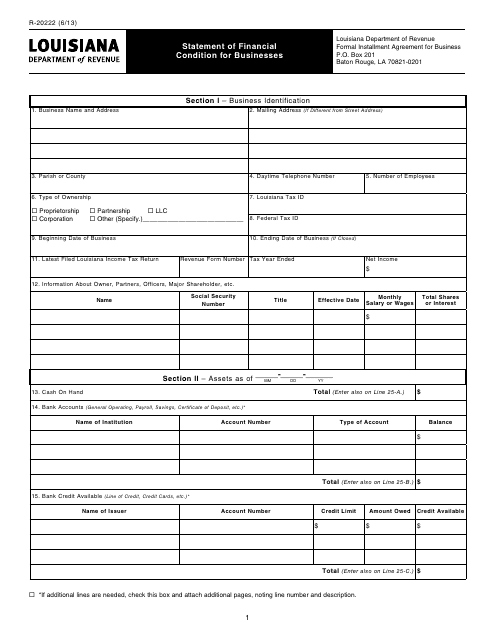

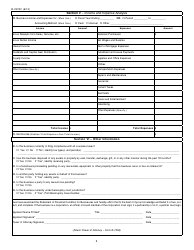

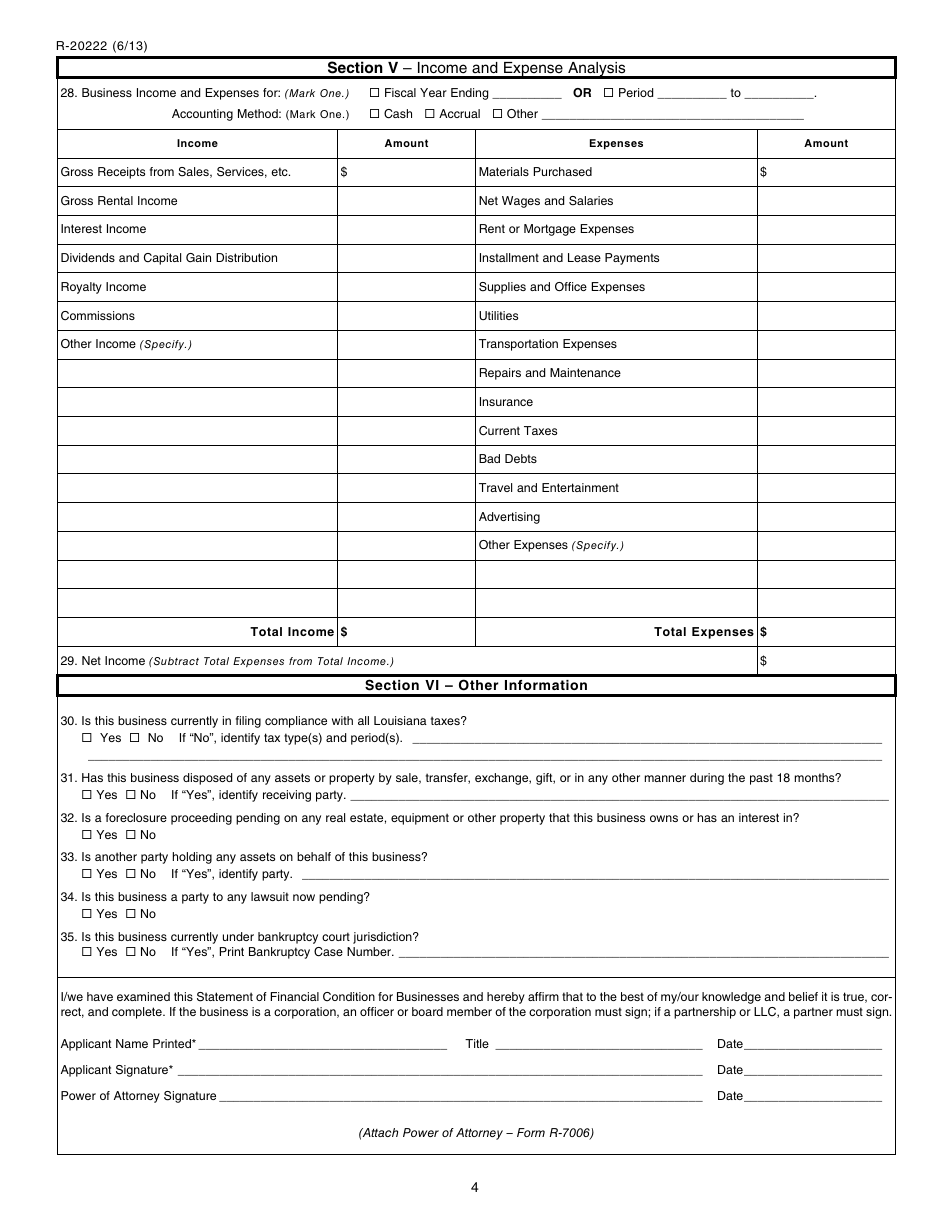

Form R-20222 Statement of Financial Condition for Businesses - Louisiana

What Is Form R-20222?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-20222?

A: Form R-20222 is the Statement of Financial Condition for Businesses in Louisiana.

Q: Who needs to file Form R-20222?

A: Businesses in Louisiana are required to file Form R-20222.

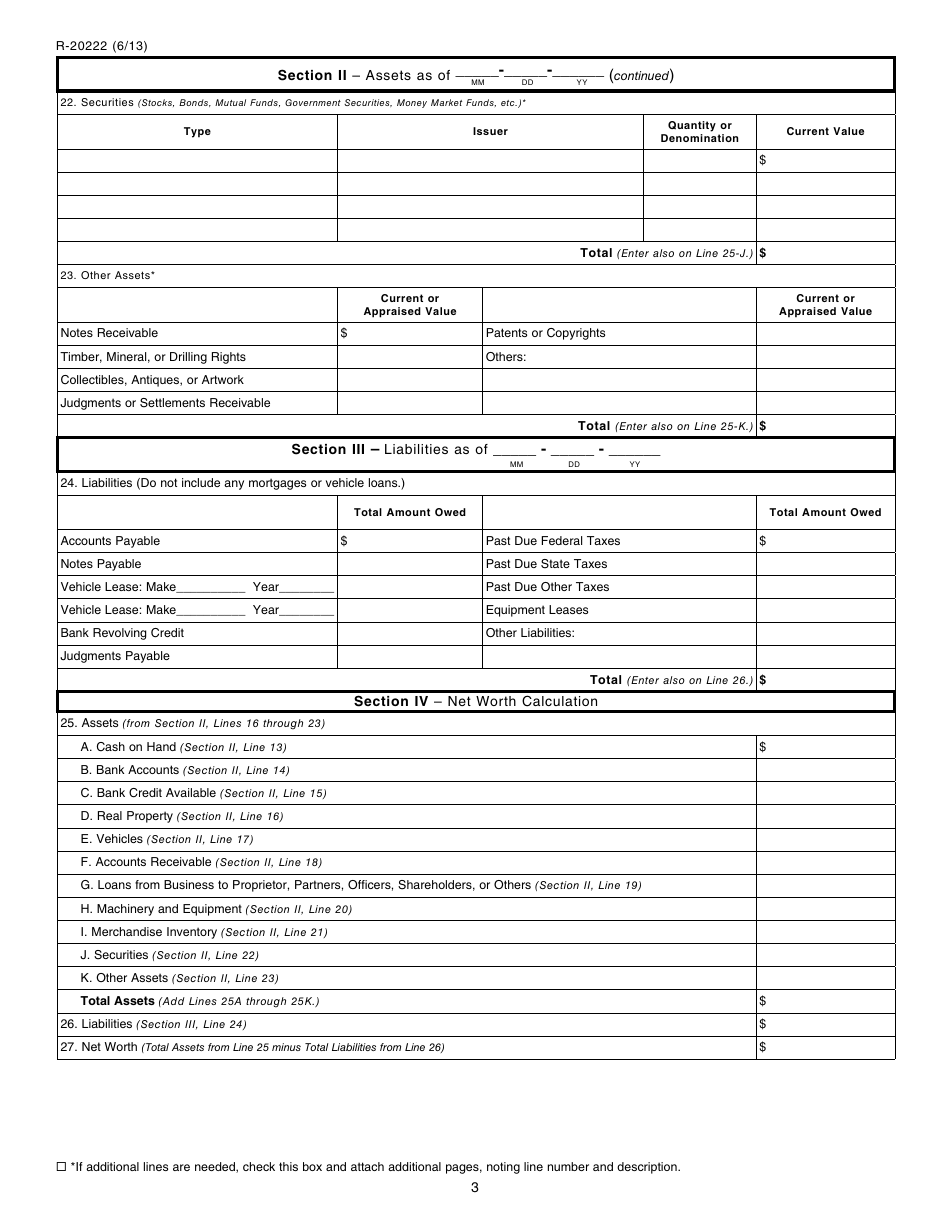

Q: What is the purpose of Form R-20222?

A: The purpose of Form R-20222 is to report the financial condition of businesses in Louisiana.

Q: When is the deadline to file Form R-20222?

A: The filing deadline for Form R-20222 varies and is specified by the Louisiana Department of Revenue.

Q: Are there any penalties for not filing Form R-20222?

A: Yes, businesses may face penalties for failing to file Form R-20222.

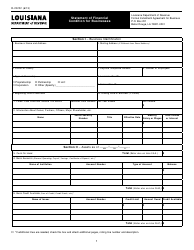

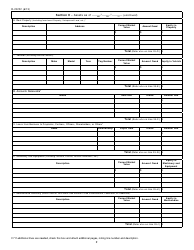

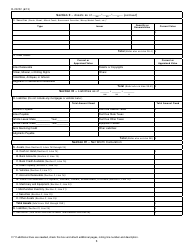

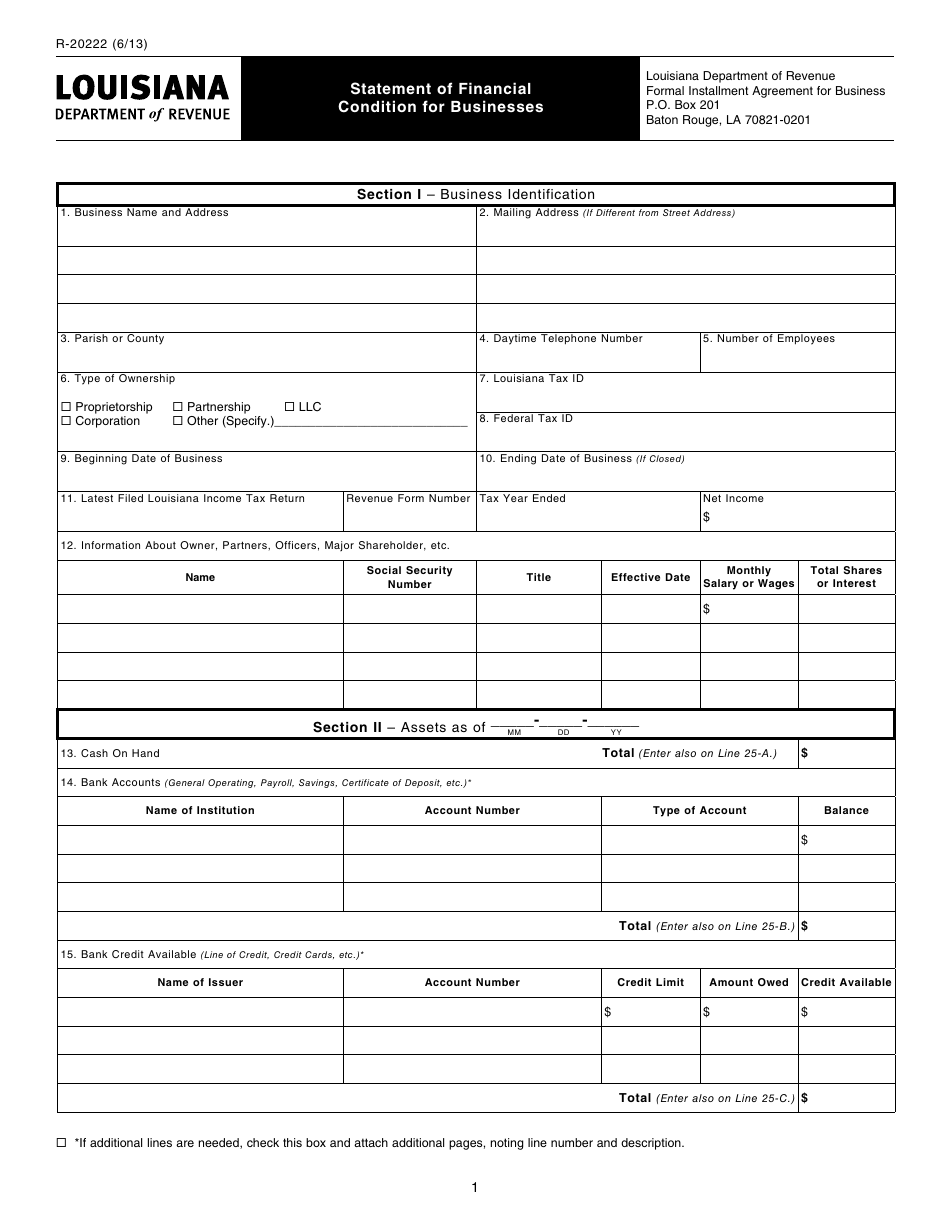

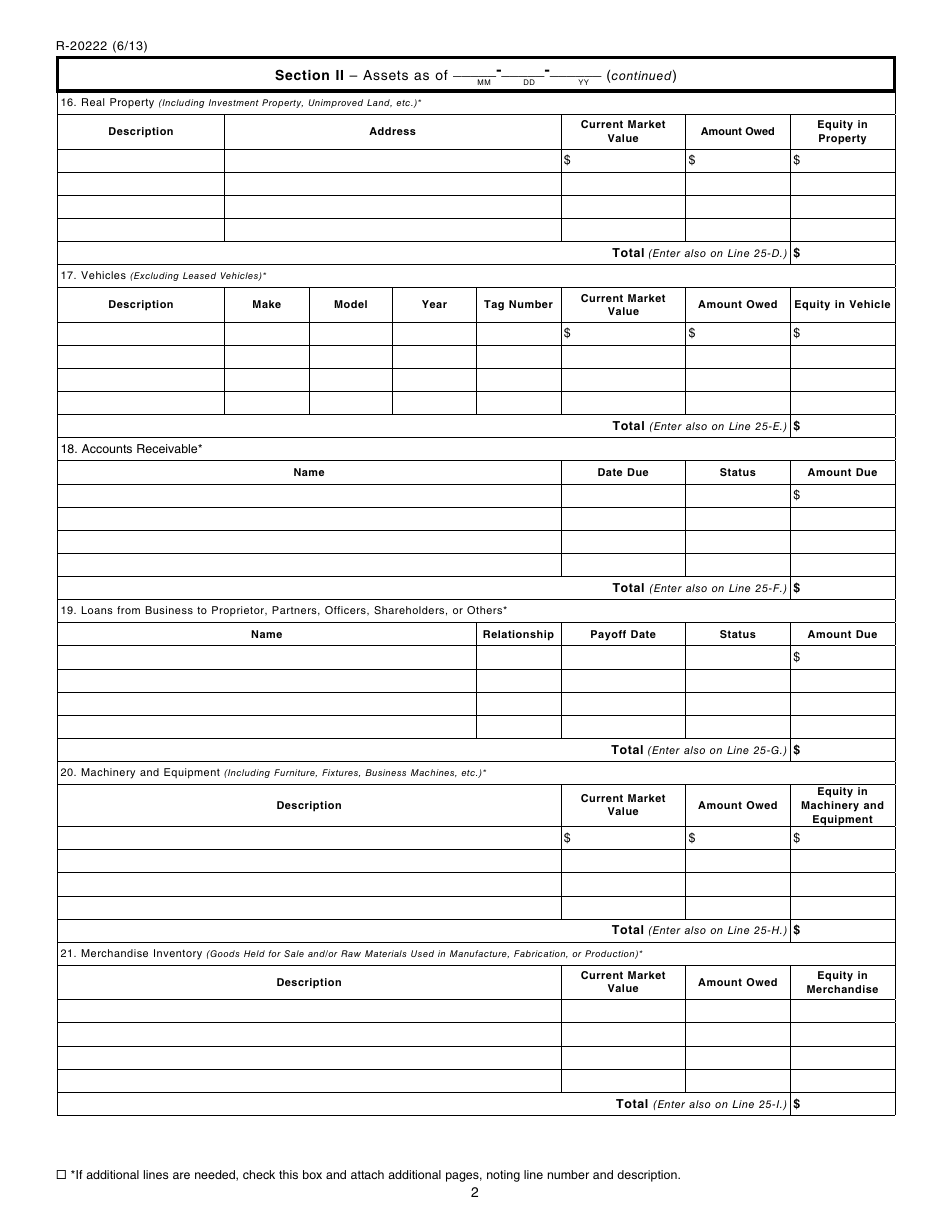

Q: What information is required on Form R-20222?

A: Form R-20222 requires businesses to provide detailed financial information, including income, expenses, assets, and liabilities.

Q: Can I request an extension to file Form R-20222?

A: Yes, businesses can request an extension to file Form R-20222, but it must be done before the original filing deadline.

Q: Is Form R-20222 only for businesses in Louisiana?

A: Yes, Form R-20222 is specifically for businesses operating in Louisiana.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-20222 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.