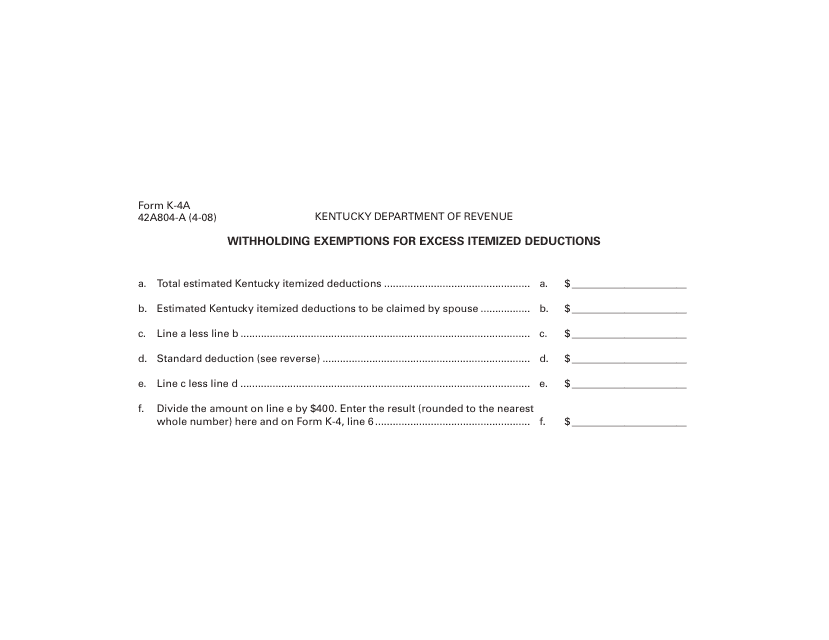

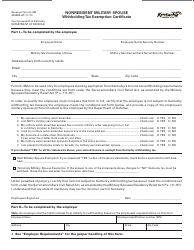

Form K-4A (42A804-A) Withholding Exemptions for Excess Itemized Deductions - Kentucky

What Is Form K-4A (42A804-A)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-4A?

A: Form K-4A is a tax form used to claim withholding exemptions for excess itemized deductions in the state of Kentucky.

Q: Who needs to file Form K-4A?

A: Residents of Kentucky who want to claim withholding exemptions for excess itemized deductions need to file Form K-4A.

Q: What are withholding exemptions for excess itemized deductions?

A: Withholding exemptions for excess itemized deductions allow taxpayers to reduce the amount of income tax withheld from their wages in Kentucky.

Q: Is Form K-4A only for residents of Kentucky?

A: Yes, Form K-4A is specifically for residents of Kentucky.

Q: When should I file Form K-4A?

A: Form K-4A should be filed whenever you want to claim withholding exemptions for excess itemized deductions in Kentucky.

Q: Are there any specific instructions for filling out Form K-4A?

A: Yes, there are specific instructions provided on the form itself. Make sure to read and follow them carefully.

Q: Can I claim withholding exemptions for excess itemized deductions on my federal tax return?

A: No, Form K-4A is specific to the state of Kentucky and cannot be used for federal tax purposes.

Q: What happens if I don't file Form K-4A?

A: If you don't file Form K-4A, you will not be able to claim withholding exemptions for excess itemized deductions in Kentucky.

Q: Can I make changes to my withholding exemptions during the year?

A: Yes, you can make changes to your withholding exemptions by filing a new Form K-4A with the Kentucky Department of Revenue.

Form Details:

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form K-4A (42A804-A) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.