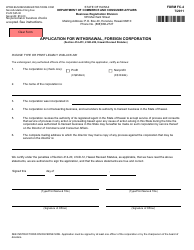

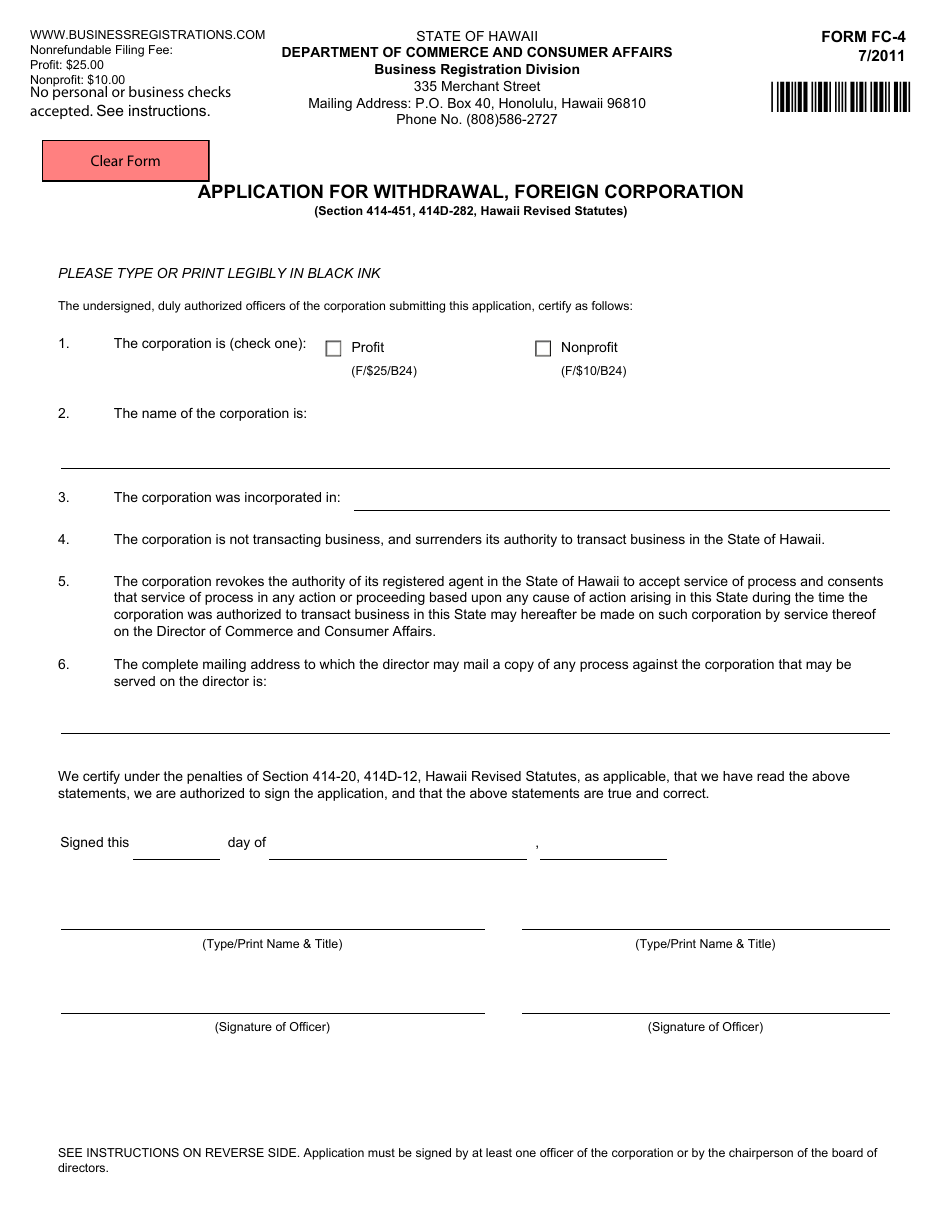

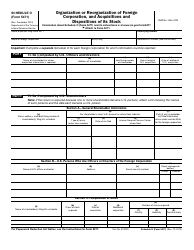

Form FC-4 Application for Withdrawal, Foreign Corporation - Hawaii

What Is Form FC-4?

This is a legal form that was released by the Hawaii Department of Commerce & Consumer Affairs - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FC-4?

A: Form FC-4 is an application for withdrawal for a foreign corporation in Hawaii.

Q: Who can file Form FC-4?

A: Form FC-4 can be filed by a foreign corporation that wishes to withdraw from doing business in Hawaii.

Q: What is the purpose of Form FC-4?

A: The purpose of Form FC-4 is to officially notify the state of Hawaii that a foreign corporation is ceasing its business activities in the state.

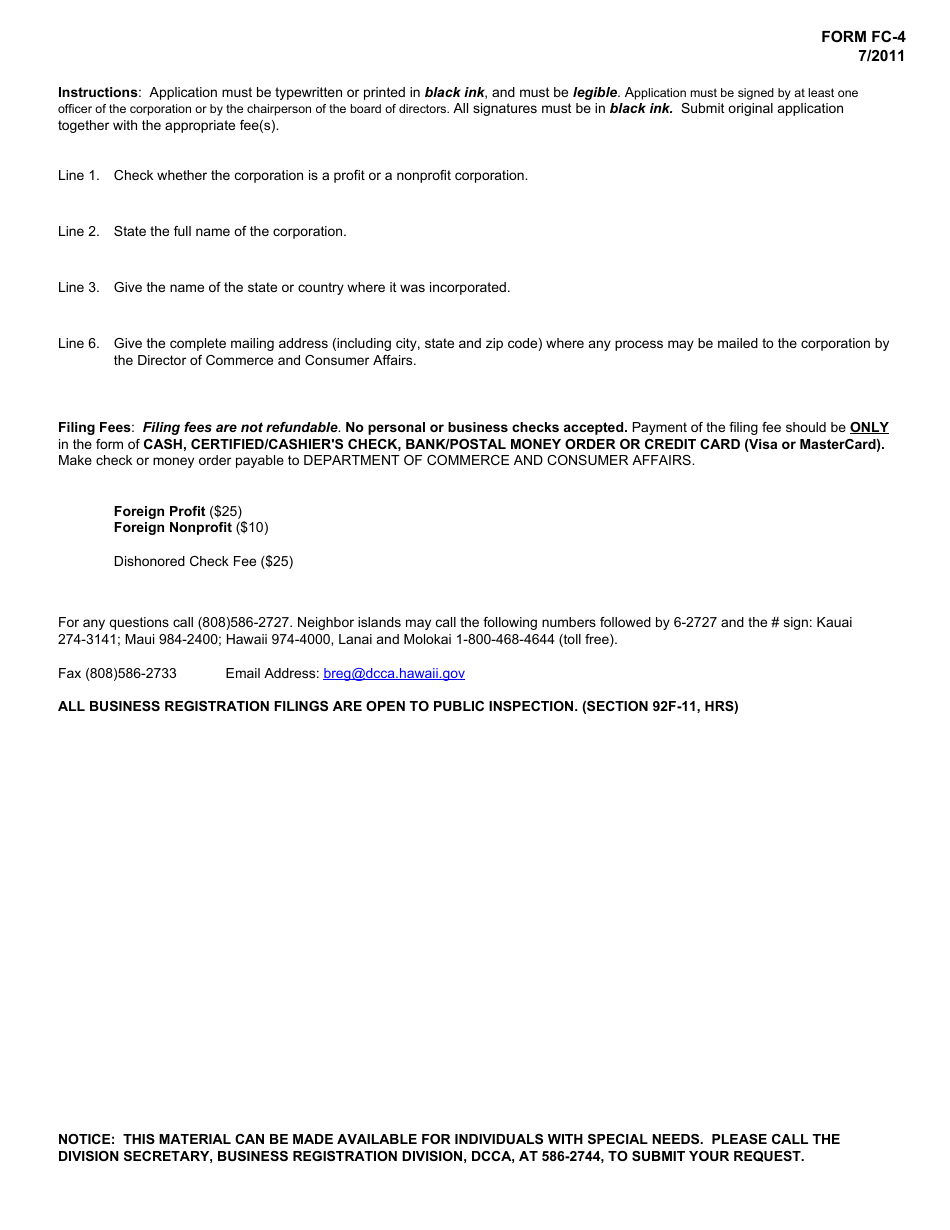

Q: Are there any fees associated with filing Form FC-4?

A: Yes, there is a filing fee that must be paid when submitting Form FC-4.

Q: What information is required on Form FC-4?

A: Form FC-4 requires information such as the name and address of the foreign corporation, the date of withdrawal, and the name and address of the registered agent.

Q: Is there a deadline for filing Form FC-4?

A: Yes, the foreign corporation must file Form FC-4 within thirty days after it has ceased its business activities in Hawaii.

Q: What happens after Form FC-4 is filed?

A: Once Form FC-4 is filed and the necessary fees are paid, the state of Hawaii will process the application and update its records to reflect the withdrawal of the foreign corporation.

Q: Is Form FC-4 specific to Hawaii?

A: Yes, Form FC-4 is specific to Hawaii and is used for the withdrawal of a foreign corporation in the state.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Hawaii Department of Commerce & Consumer Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FC-4 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Commerce & Consumer Affairs.