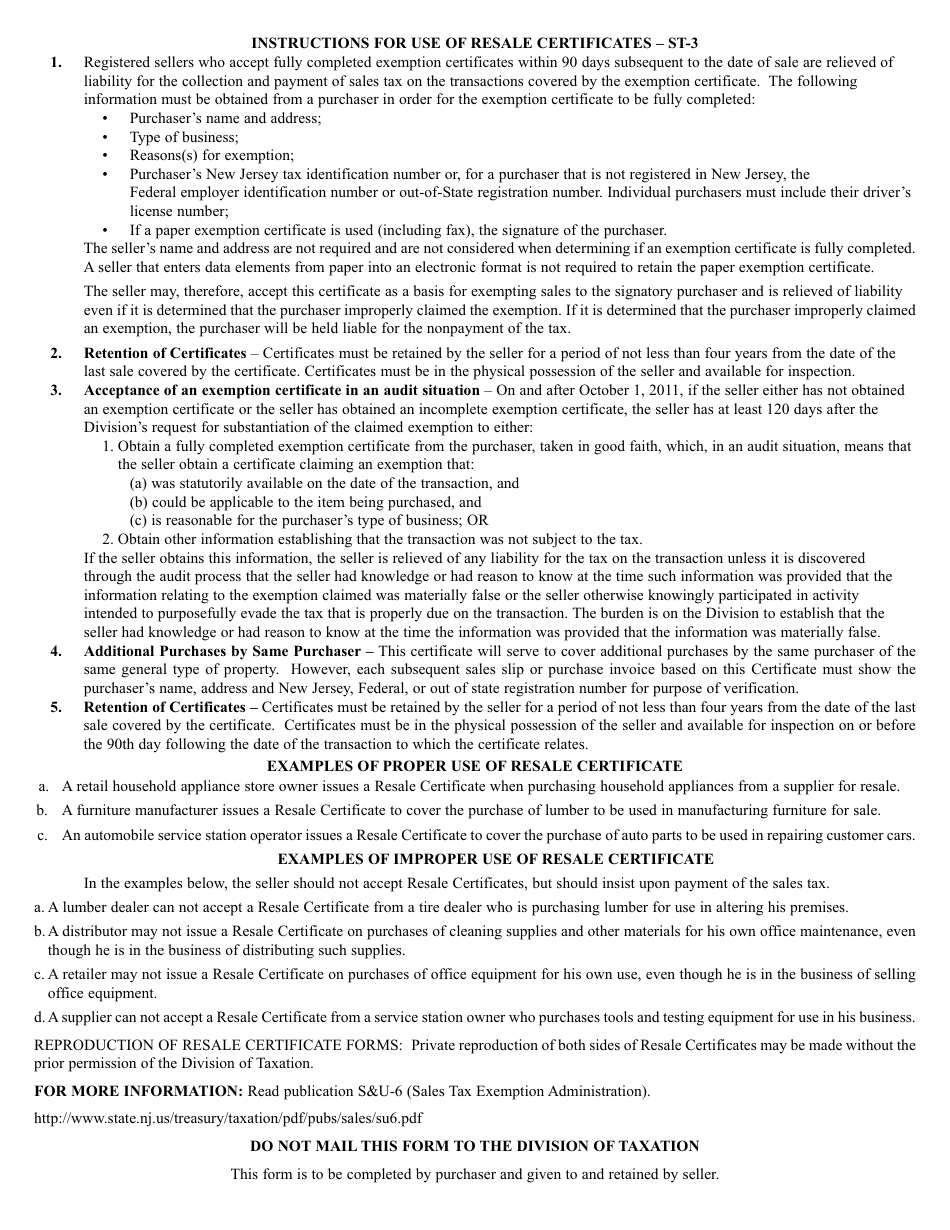

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-3

for the current year.

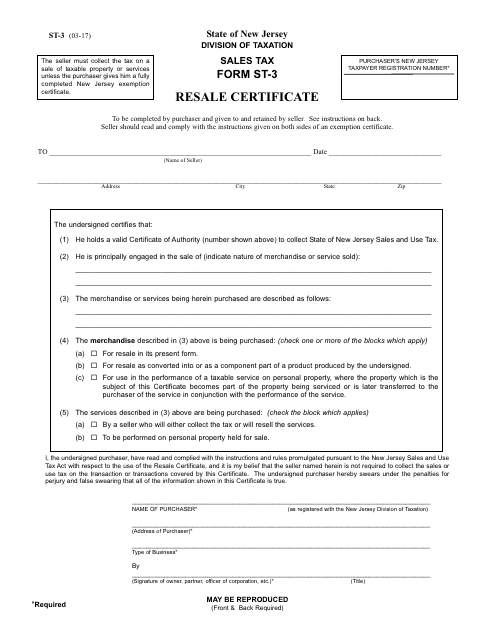

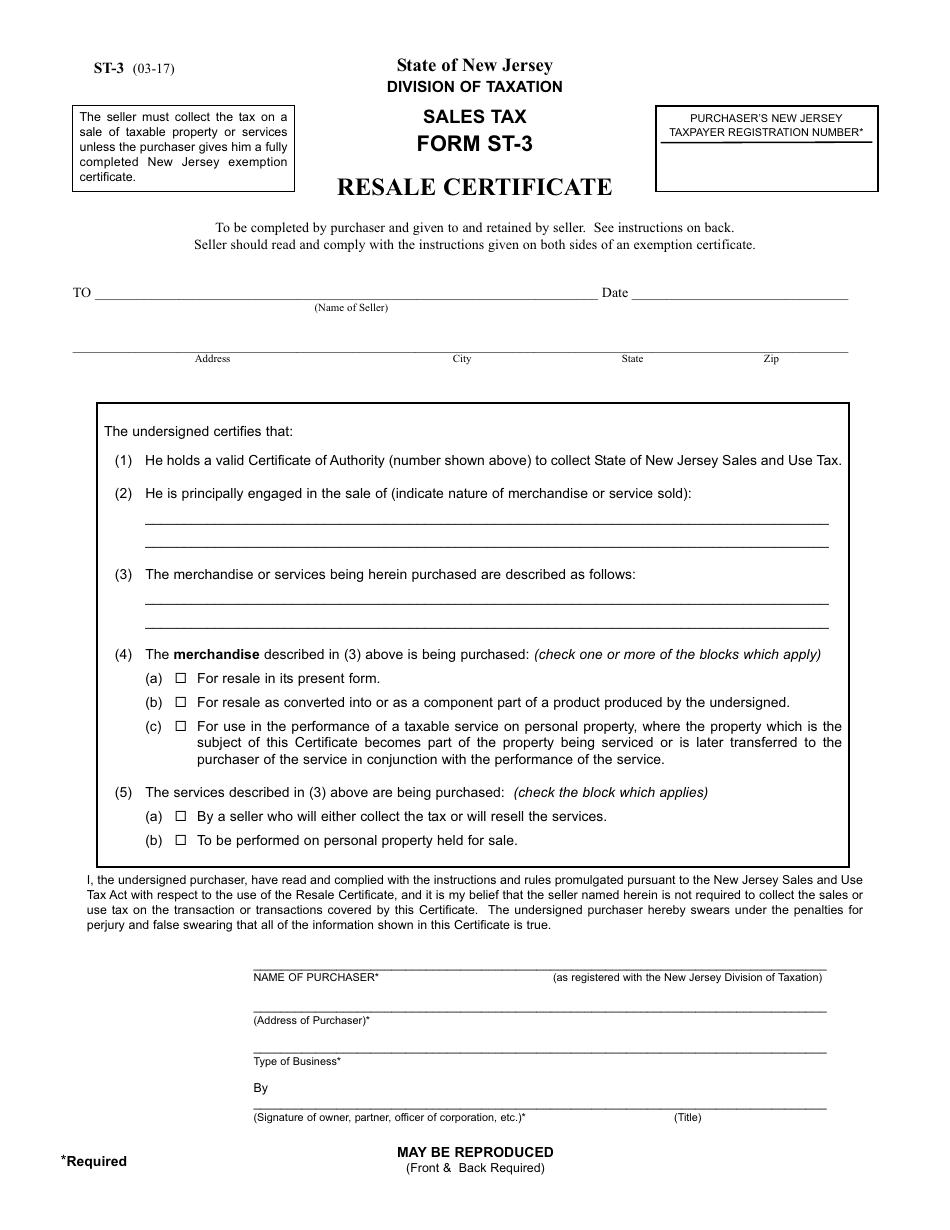

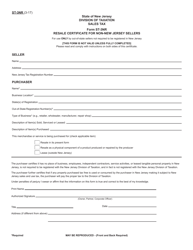

Form ST-3 Resale Certificate - New Jersey

What Is Form ST-3?

Form ST-3, Resale Certificate , is a legal document you need to fill out to gain tax exemption for the goods you plan to resell in the State of New Jersey. The retailer who wishes to buy products to resell them later in an ordinary course of business may use this document to avoid paying sales tax twice. Instead, the retailer will charge sales tax to their customers on the final value of the goods that are resold. The resale certificate does not expire and will serve as evidence why sales tax was not collected on a particular transaction.

This form was released by the New Jersey Division of Taxation , a component of the state's Department of the Treasury . The latest version of the form was issued on March 1, 2017 , with all previous editions obsolete.

How to Get a Resale Certificate in NJ?

Resale Certificates (or "Reseller Permits") are issued by the New Jersey Division of Taxation. Download a Form ST-3 fillable version from the link below.

A Resale Certificate is completed by a purchaser and handed in to the seller when buying items or supplies intended for resale (or for manufacturing goods that will later be sold). These kinds of purchases - accompanied by a completed Form ST-3 - can be legally made without paying sales.

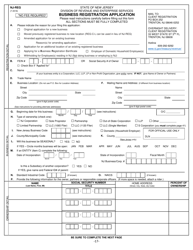

Before filing the form, the purchaser must first apply for a New Jersey Business Tax Identification Number. The New Jersey Business Tax Identification Number is applied for via Form NJ-REG, Business Registration Application.

How to Fill Out NJ Sales Tax Exempt Form ST-3?

The purchaser of the goods for resale is required to add the following information to the NJ ST-3 Form:

- Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction.

- Provide your taxpayer registration number . It is either a Certificate of Authority number or, for purchasers not registered in New Jersey, the out-of-state registration number, or Federal employer identification number. Individuals must record their driver's license numbers.

- Describe the nature of goods or services you sell in an ordinary course of business.

- List the goods or services you purchase from the seller.

- Indicate the reason for this purchase - resale in its present form, as a component part of another product, or use in the performance of a taxable service on personal property.

- If you purchase services, check the applicable box - they are bought by the seller who will collect the tax or resell the services, or they are needed to be performed on personal property in preparation for the sale.

- Indicate your legal name or name of the business and provide your address . Write down your type of business and sign the form, adding your title (if the document is signed by the owner, officer of the corporation, partner, etc.) When you sign the form, you confirm the information in the certificate is true and accurate to the best of your knowledge, complying with the rules of the use of the ST-3 Form.

Where to Send My ST-3 Form?

Once the form is completed, you do not send it anywhere - give the ST-3 Form to the seller. The seller will then retain it for a period of not less than four years from the date of the sale. Before accepting the certificate, however, the seller is responsible for its certification. Review the document to make sure it is fully completed and verify the purchaser's business is registered by checking it online via the New Jersey Division of Revenue's Business Registration Certificate Service. Additionally, the seller must evaluate whether the merchandise sold is reasonably consistent with the purchaser's ordinary course of business.

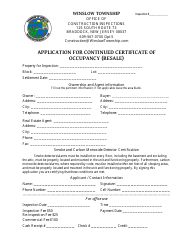

ST-3 Related Forms: