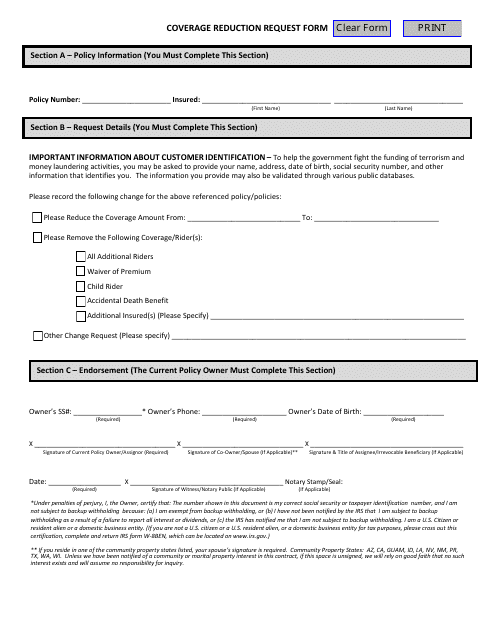

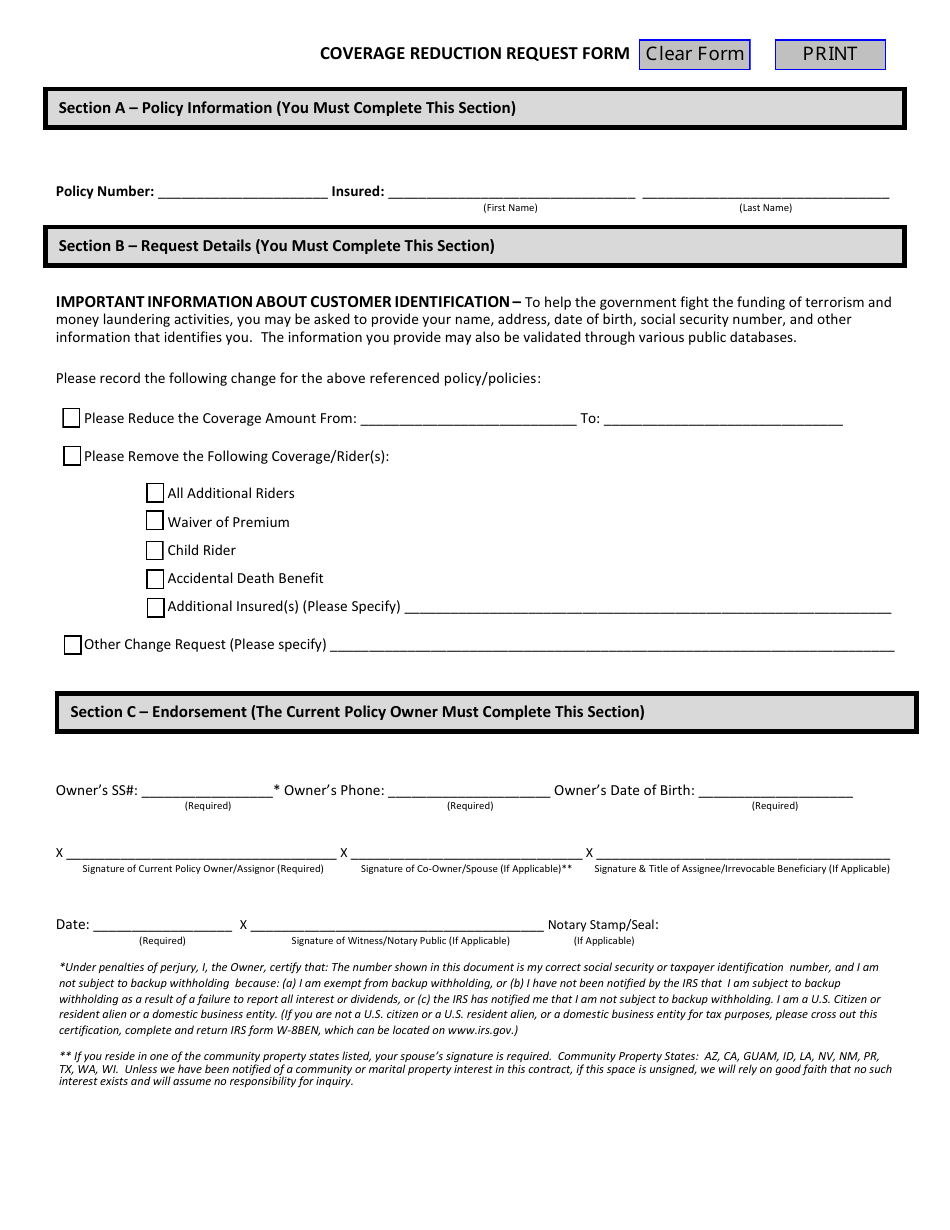

Coverage Reduction Request Form - Unified Life

The Coverage Reduction Request Form - Unified Life is used to request a reduction in coverage for a life insurance policy offered by Unified Life.

FAQ

Q: What is the Coverage Reduction Request Form?

A: The Coverage Reduction Request Form is a document used to request a decrease in insurance coverage with Unified Life.

Q: Why would someone want to request a coverage reduction?

A: There are various reasons why someone may want to request a coverage reduction, such as changes in financial situations or a desire for lower premiums.

Q: What information is required on the form?

A: The form typically requires personal information, policy details, and the requested coverage reduction amount.

Q: Are there any fees associated with submitting the form?

A: There may be administrative fees associated with processing the request, but these fees can vary depending on the insurance policy and company.

Q: How long does it take to process a coverage reduction request?

A: The processing time can vary depending on the insurer, but it is typically within a few weeks.

Q: Will my premium change immediately after the coverage reduction?

A: Your premium may change after the coverage reduction is approved and processed, but the specific timing can depend on the policy and insurer.

Q: Can I request a coverage increase in the future?

A: Yes, you can typically request a coverage increase in the future if needed, but it may involve a separate process and underwriting requirements.