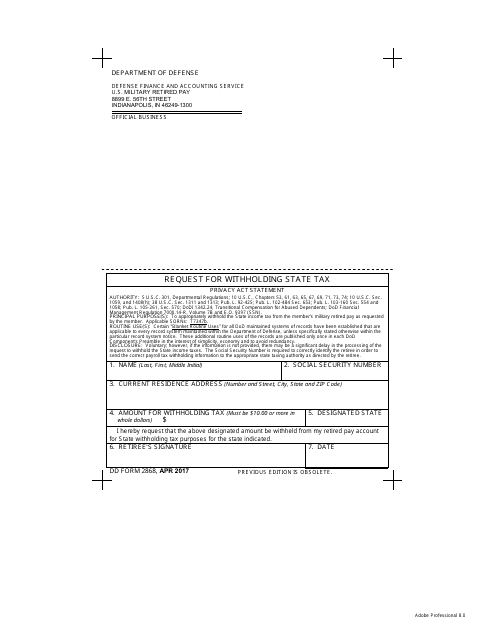

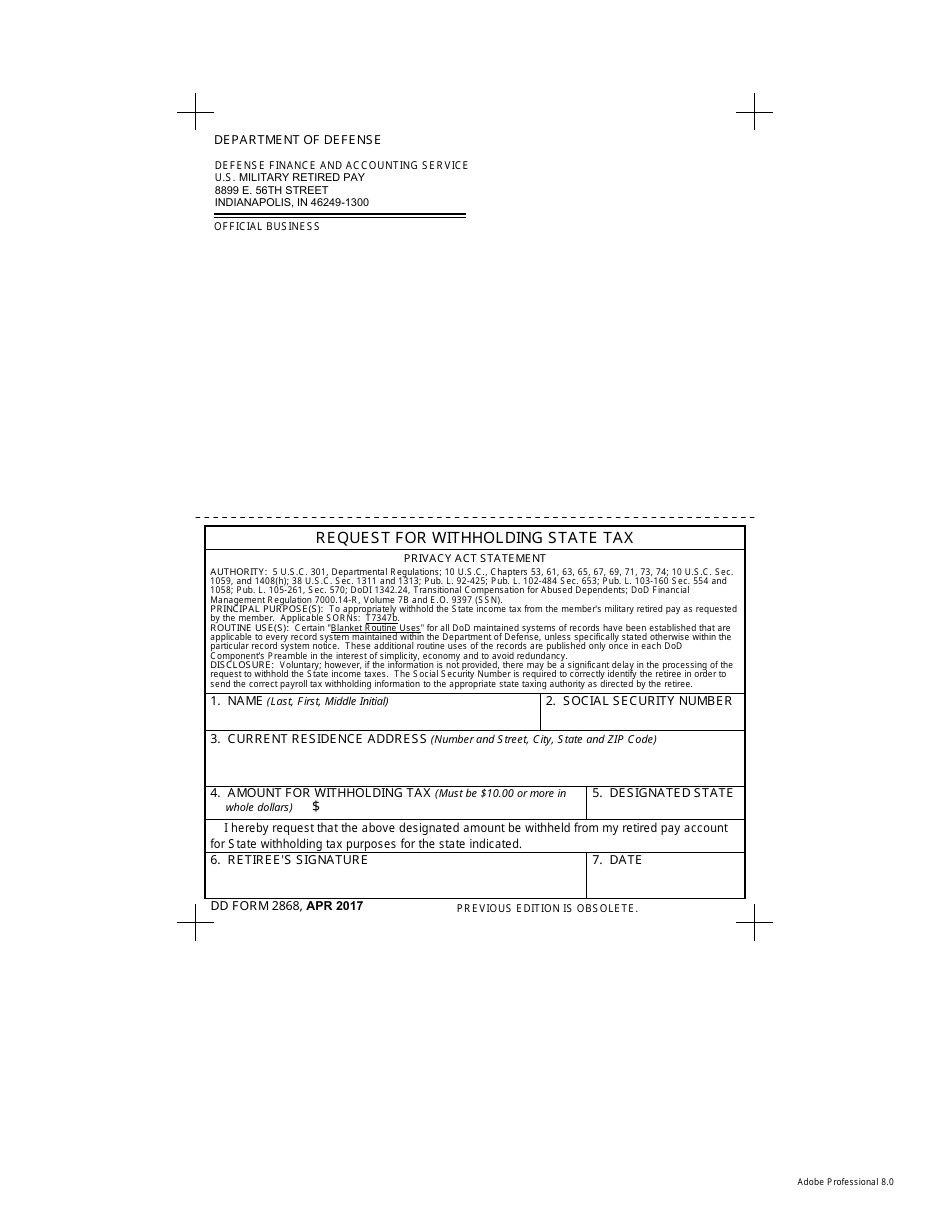

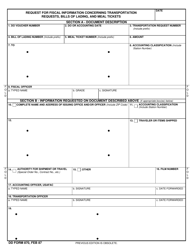

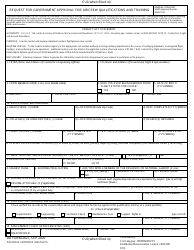

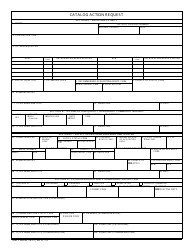

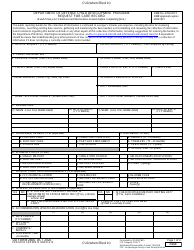

DD Form 2868 Request for Withholding State Tax

What Is DD Form 2868?

This is a form that was released by the U.S. Department of Defense (DoD) on April 1, 2017. The form, often mistakenly referred to as the DA Form 2868 , is a military form used by and within the U.S. Army. As of today, no separate instructions for the form are provided by the DoD.

FAQ

Q: What is DD Form 2868?

A: DD Form 2868 is the Request for Withholding State Tax form.

Q: What is the purpose of DD Form 2868?

A: The purpose of DD Form 2868 is to request the withholding of state taxes from military pay.

Q: Who is required to use DD Form 2868?

A: Military personnel who want to have state taxes withheld from their pay must use DD Form 2868.

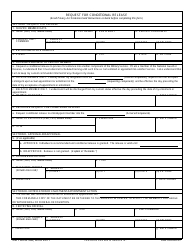

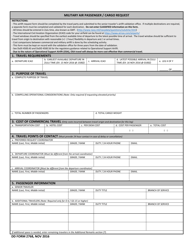

Q: How do I fill out DD Form 2868?

A: You will need to provide your personal information, including your name, Social Security number, and state of legal residence. You will also need to indicate the amount you want withheld from your pay for state taxes.

Q: Why would someone want to withhold state taxes from their military pay?

A: Some military personnel may want to withhold state taxes from their pay to ensure that they have enough funds to meet their state tax obligations.

Q: Can I change the amount of state taxes withheld after submitting DD Form 2868?

A: Yes, you can change the amount of state taxes withheld by submitting a new DD Form 2868 to your unit's personnel office.

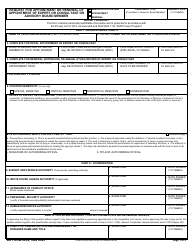

Q: Is DD Form 2868 applicable to both active duty and reserve military personnel?

A: Yes, DD Form 2868 is applicable to both active duty and reserve military personnel.

Q: Are there any penalties for not using DD Form 2868 to withhold state taxes?

A: There may not be any penalties for not using DD Form 2868, but you may be responsible for paying your state taxes independently.

Q: Can I use DD Form 2868 to withhold federal taxes?

A: No, DD Form 2868 is specifically for withholding state taxes. Federal taxes are withheld using the W-4 form.

Form Details:

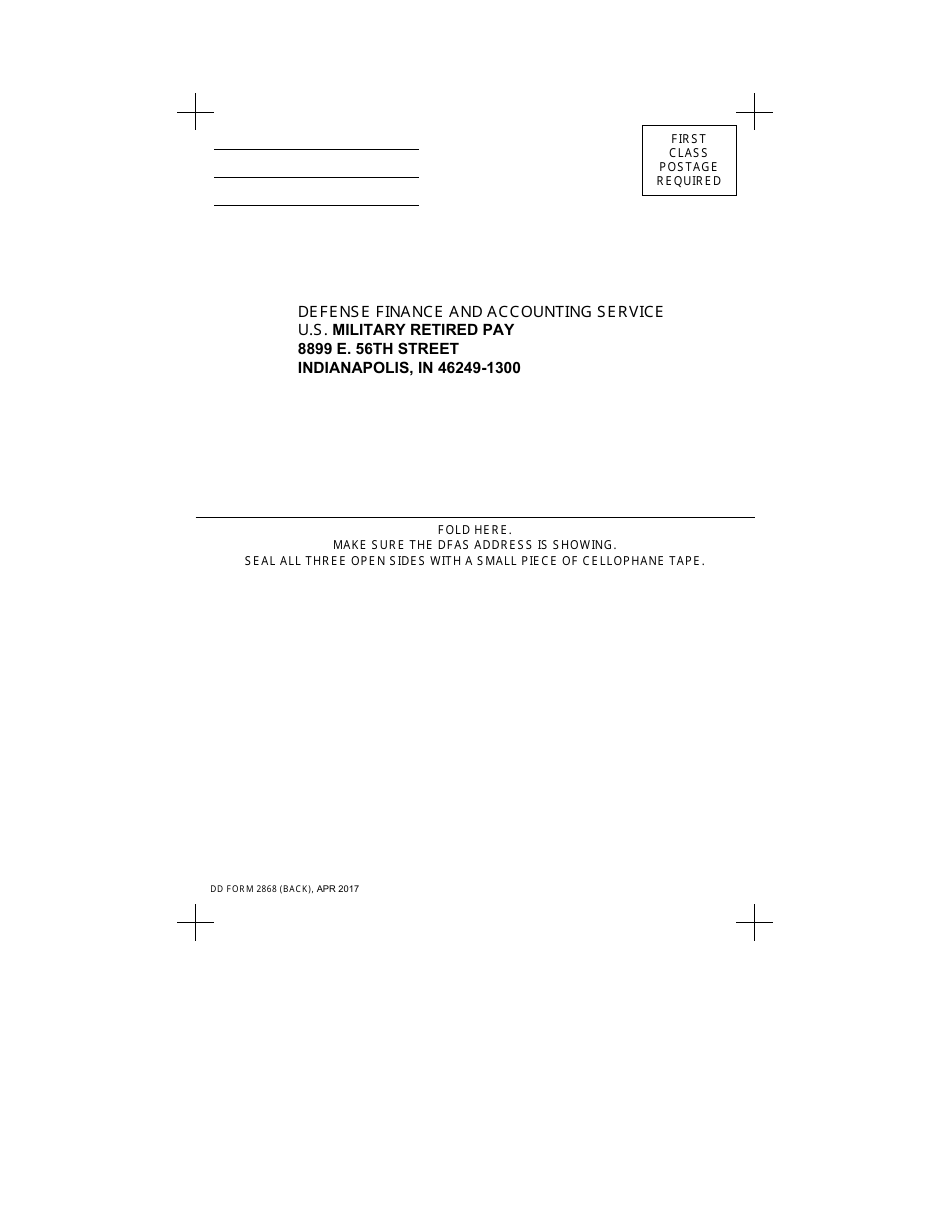

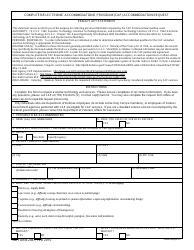

- A 2-page document available for download in PDF;

- The latest version available from the Executive Services Directorate;

- Editable, printable, and free to use;

- Fill out the form in our online filing application.

Download an up-to-date fillable DD Form 2868 down below in PDF format or browse hundreds of other DoD Forms compiled in our online library.