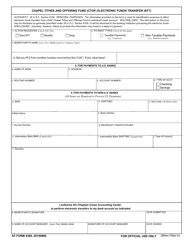

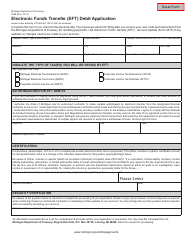

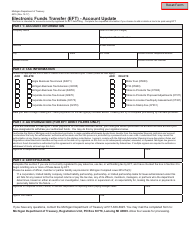

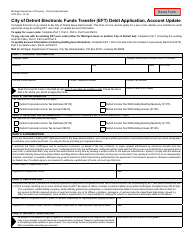

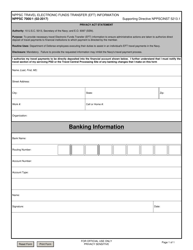

Form 2329 Instructions for Payments of Michigan Sales, Use, Withholding, and Other Michigan Business Taxes Using Electronic Funds Transfer (Eft) Credit - Michigan

What Is Form 2329?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

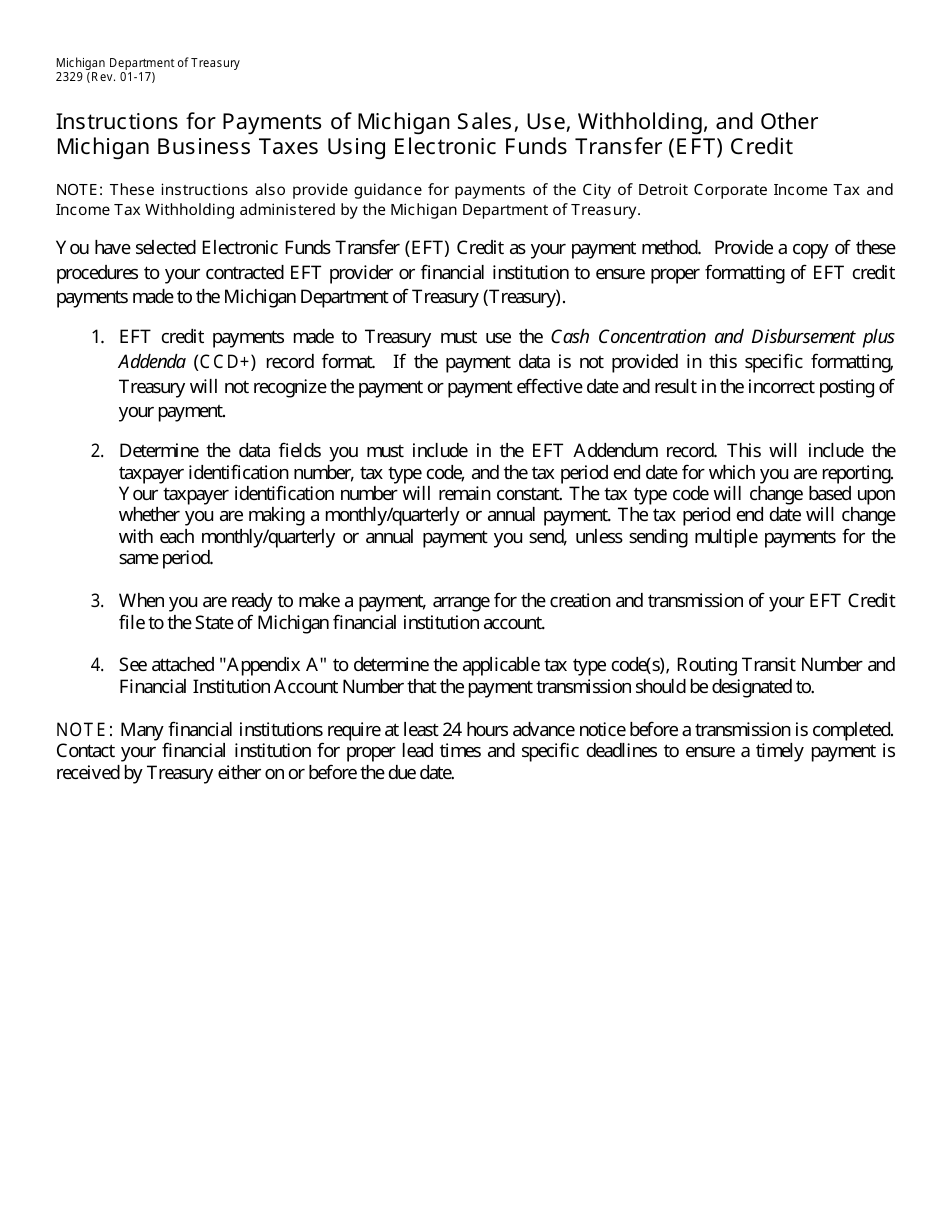

Q: What is Form 2329?

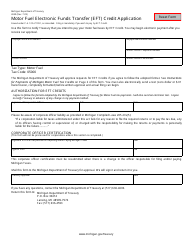

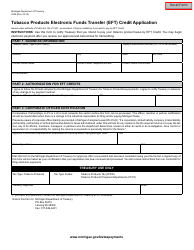

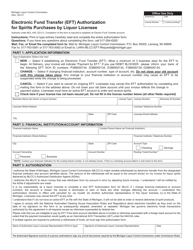

A: Form 2329 is a form used for making payments of various Michigan business taxes using electronic funds transfer (EFT) credit.

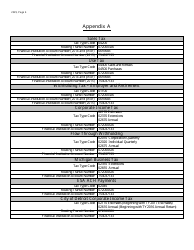

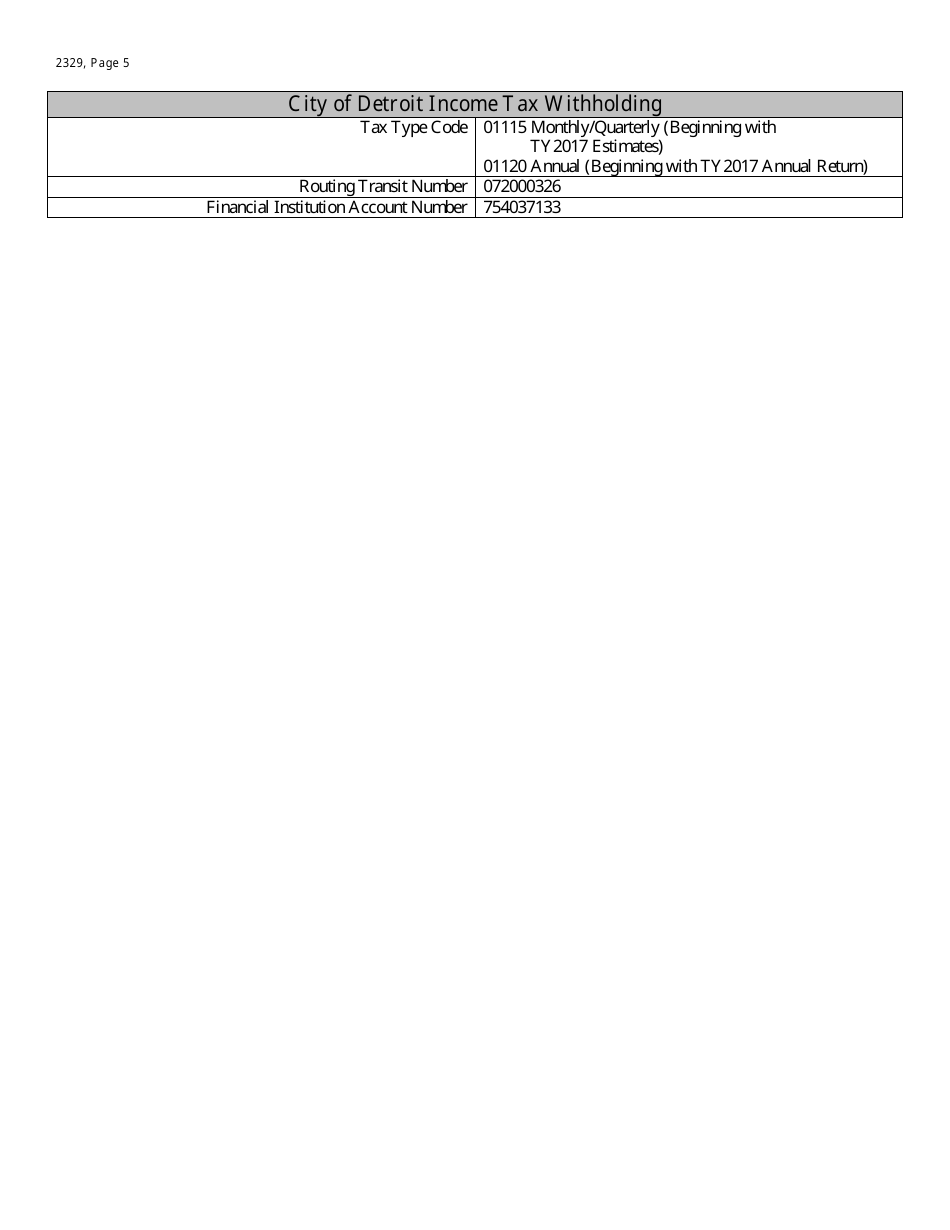

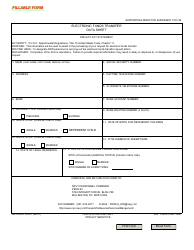

Q: What types of taxes can be paid using Form 2329?

A: Form 2329 can be used to pay Michigan sales, use, withholding, and other Michigan business taxes.

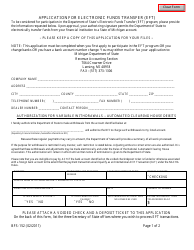

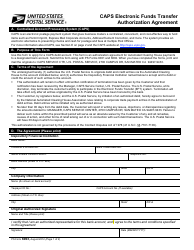

Q: What is Electronic Funds Transfer (EFT) credit?

A: Electronic Funds Transfer (EFT) credit is a method of making electronic payments from your bank account to the Michigan Department of Treasury.

Q: Are all businesses required to use EFT credit for tax payments?

A: No, only some businesses are required to use EFT credit for tax payments. The requirements depend on the amount of tax liability and the type of business.

Q: Can Form 2329 be used for federal tax payments?

A: No, Form 2329 is specifically for payments of Michigan business taxes. It cannot be used for federal tax payments.

Q: What is the purpose of making electronic payments using EFT credit?

A: The purpose of making electronic payments using EFT credit is to streamline the tax payment process, eliminate paper checks, and ensure secure and timely transfers of funds.

Q: Is there a penalty for not using EFT credit for tax payments when required?

A: Yes, there may be penalties for businesses that are required to use EFT credit for tax payments but do not comply with the requirement.

Q: How can I determine if my business is required to use EFT credit for tax payments?

A: You can refer to the Michigan Department of Treasury's guidelines or consult with a tax professional to determine if your business is required to use EFT credit for tax payments.

Q: Can I combine multiple tax payments on one Form 2329?

A: No, you should use a separate Form 2329 for each tax payment. Combining multiple tax payments on one form may result in processing errors.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2329 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.