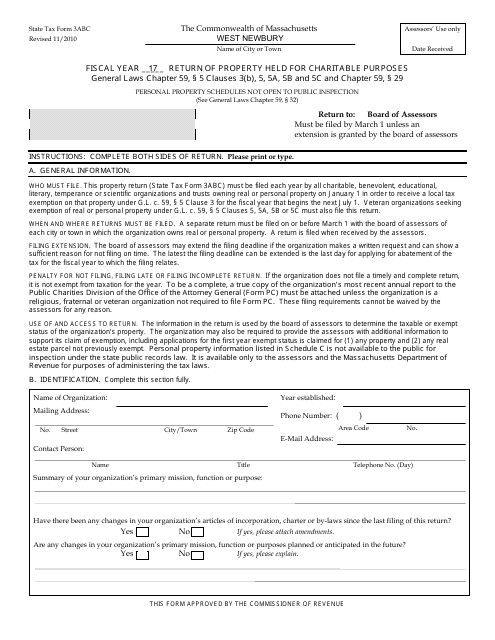

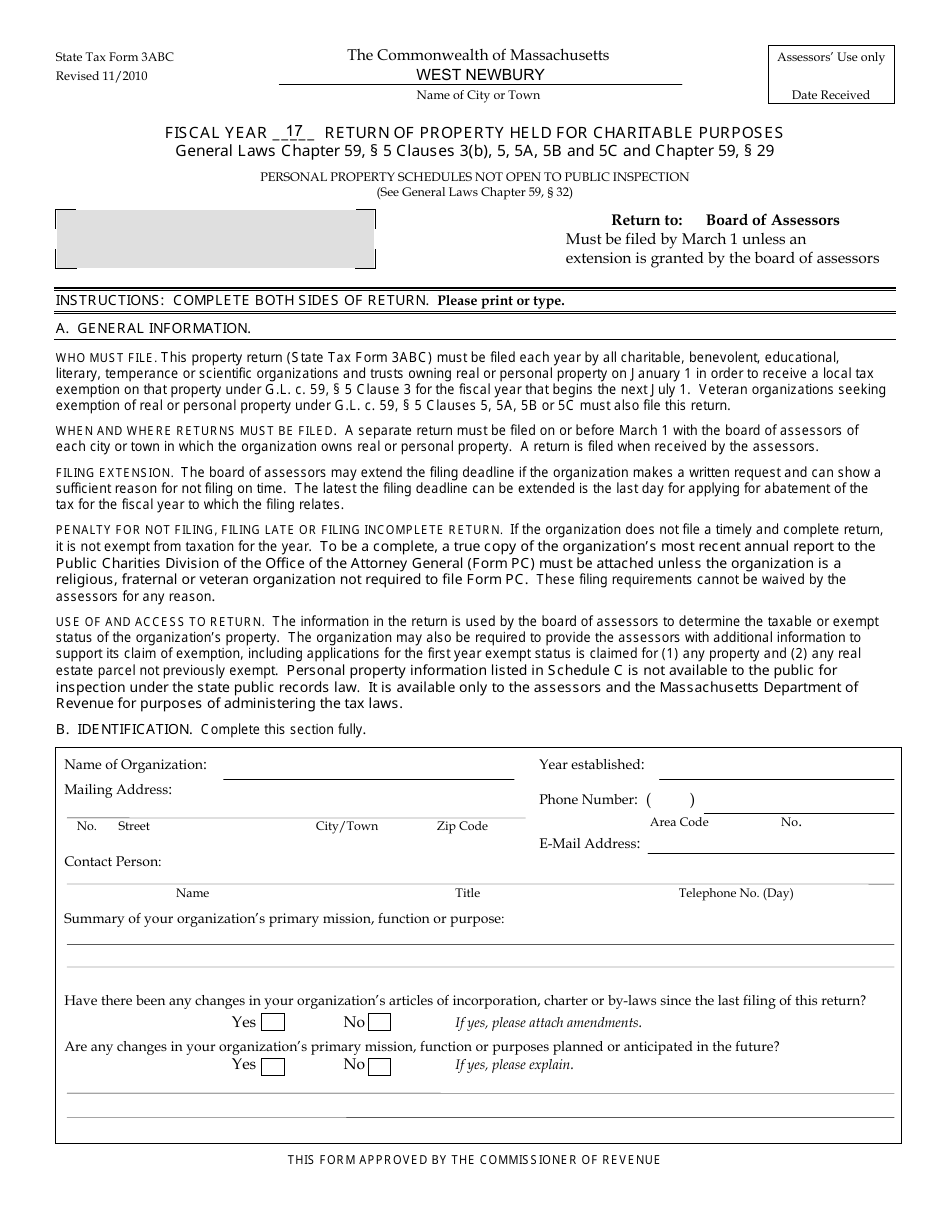

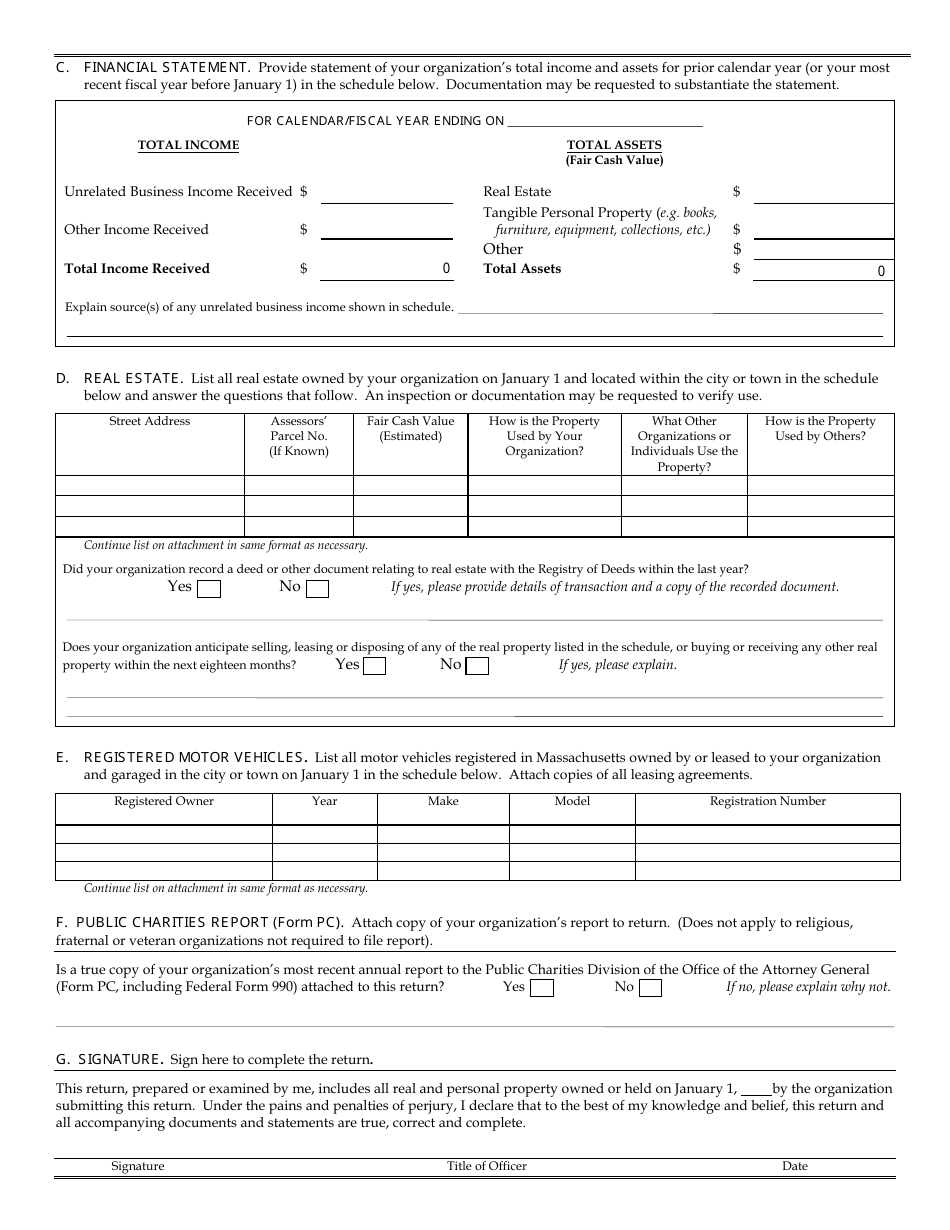

Form 3ABC Return of Property Held for Charitable Purposes - Massachusetts

What Is Form 3ABC?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3ABC?

A: Form 3ABC is a return form used in Massachusetts for reporting property held for charitable purposes.

Q: Who needs to file Form 3ABC?

A: Non-profit organizations that hold property for charitable purposes in Massachusetts need to file Form 3ABC.

Q: What is the purpose of filing Form 3ABC?

A: The purpose of filing Form 3ABC is to report and provide information about property held for charitable purposes.

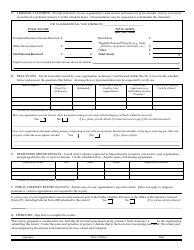

Q: What information is required on Form 3ABC?

A: Form 3ABC requires information such as the organization's name, address, assets held for charitable purposes, and financial details.

Q: When is Form 3ABC due?

A: Form 3ABC is due by the 15th day of the fifth month after the end of the organization's fiscal year.

Q: Is there a filing fee for Form 3ABC?

A: No, there is no filing fee for Form 3ABC.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3ABC by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.