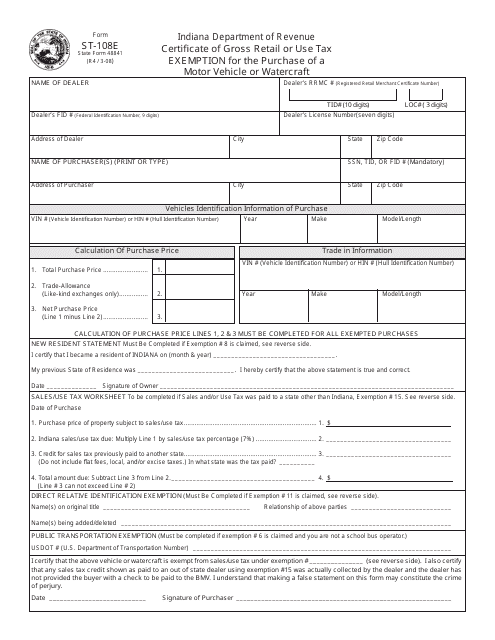

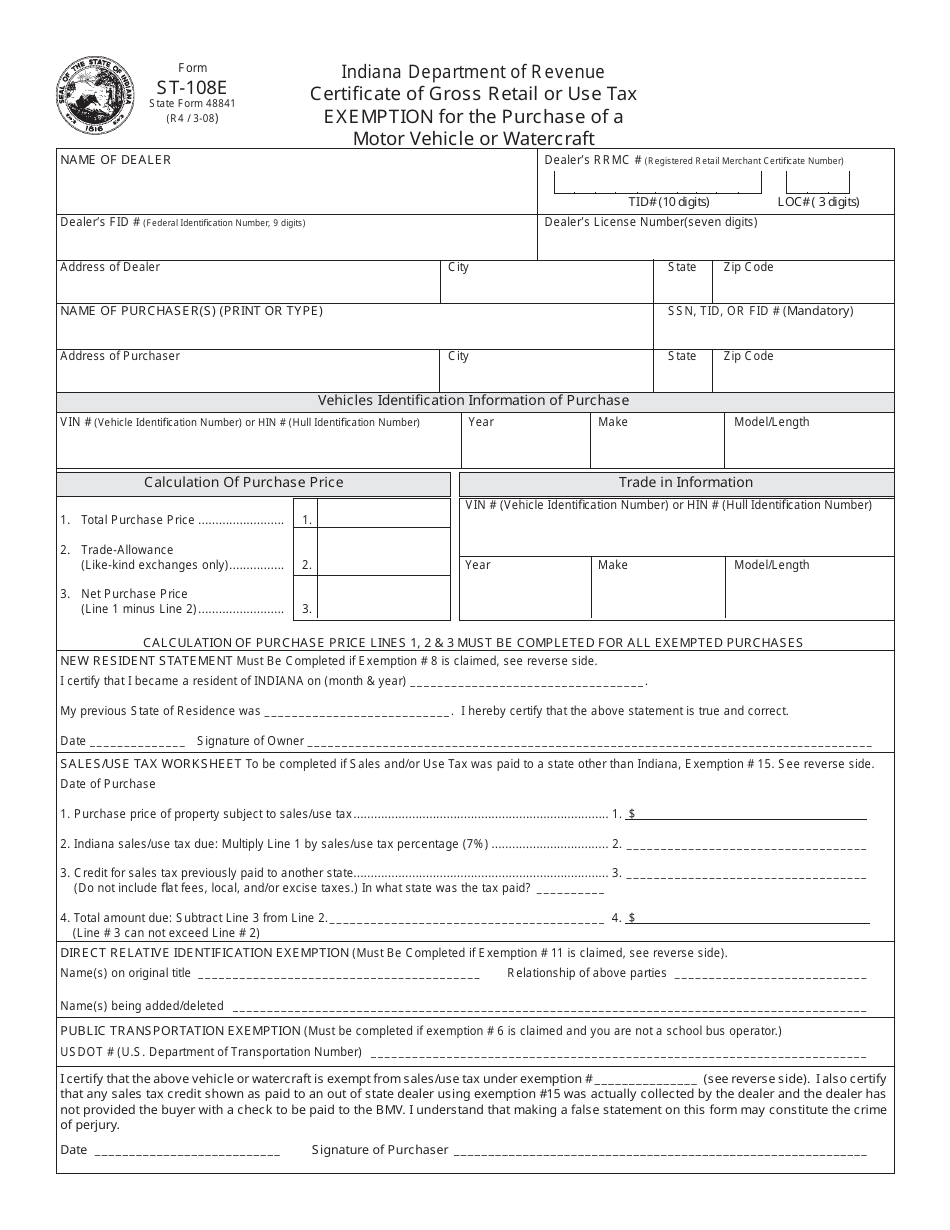

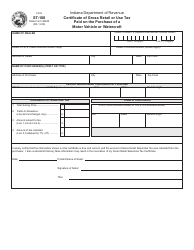

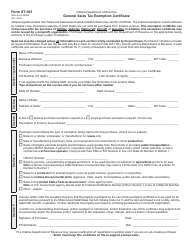

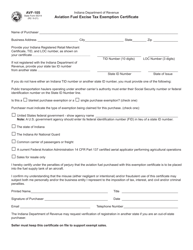

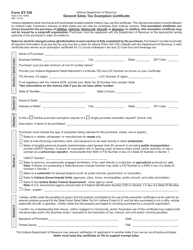

Form ST-108E Certificate of Gross Retail or Use Tax Exemption for the Purchase of a Motor Vehicle or Watercraft - Indiana

What Is Form ST-108E?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-108E?

A: Form ST-108E is a certificate of gross retail or use tax exemption for the purchase of a motor vehicle or watercraft in Indiana.

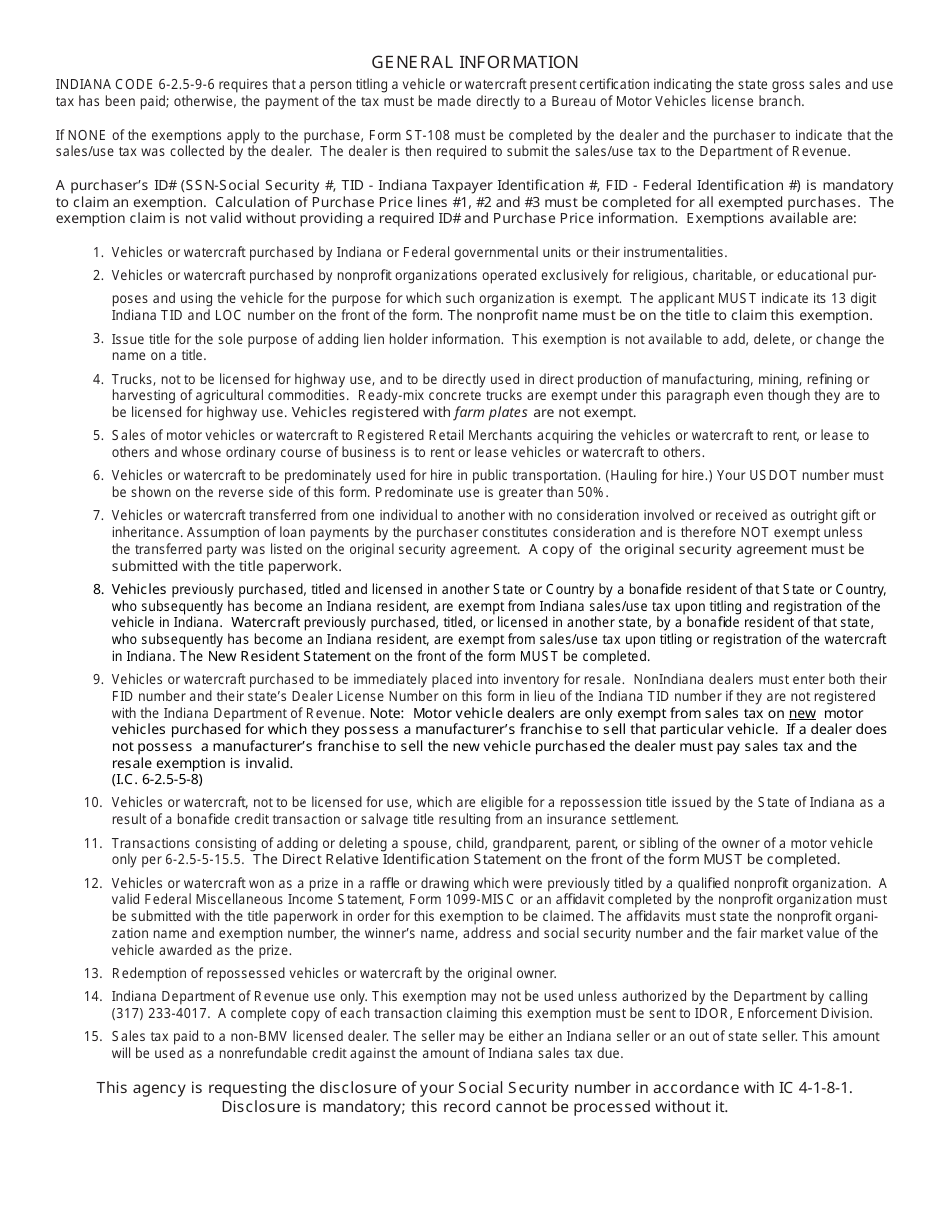

Q: Who needs to fill out Form ST-108E?

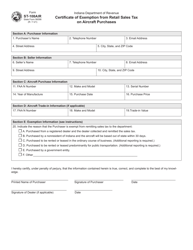

A: Anyone who wants to claim a gross retail or use tax exemption for the purchase of a motor vehicle or watercraft in Indiana needs to fill out Form ST-108E.

Q: What is the purpose of Form ST-108E?

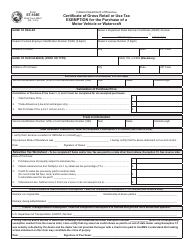

A: The purpose of Form ST-108E is to certify that a motor vehicle or watercraft is being purchased for a tax-exempt purpose.

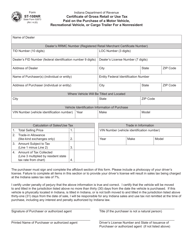

Q: What information is required on Form ST-108E?

A: Form ST-108E requires information such as the buyer's name, address, social security or federal employer identification number, vehicle or watercraft information, and a statement of exemption.

Q: Are there any fees or taxes associated with Form ST-108E?

A: No, there are no fees or taxes associated with Form ST-108E itself. However, regular fees and taxes may still apply to the purchase of a motor vehicle or watercraft.

Q: When should Form ST-108E be filled out?

A: Form ST-108E should be filled out at the time of purchase, before the vehicle or watercraft is titled or registered.

Q: Is Form ST-108E specific to Indiana?

A: Yes, Form ST-108E is specific to the state of Indiana.

Q: Can I use Form ST-108E for other types of purchases?

A: No, Form ST-108E is specifically for the purchase of motor vehicles or watercraft.

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-108E by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.