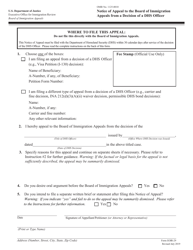

This version of the form is not currently in use and is provided for reference only. Download this version of

Form REV-65

for the current year.

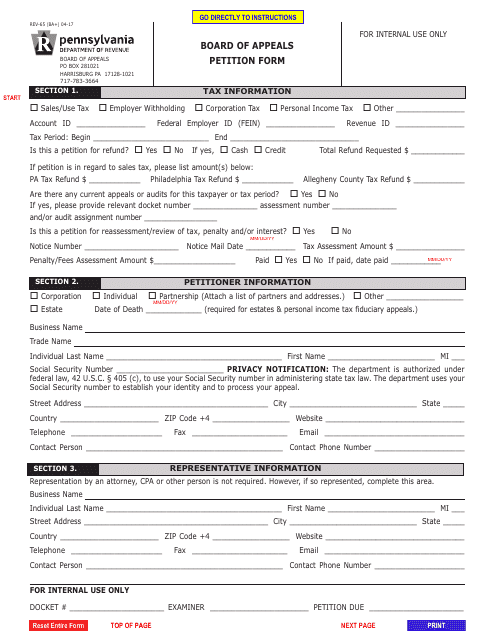

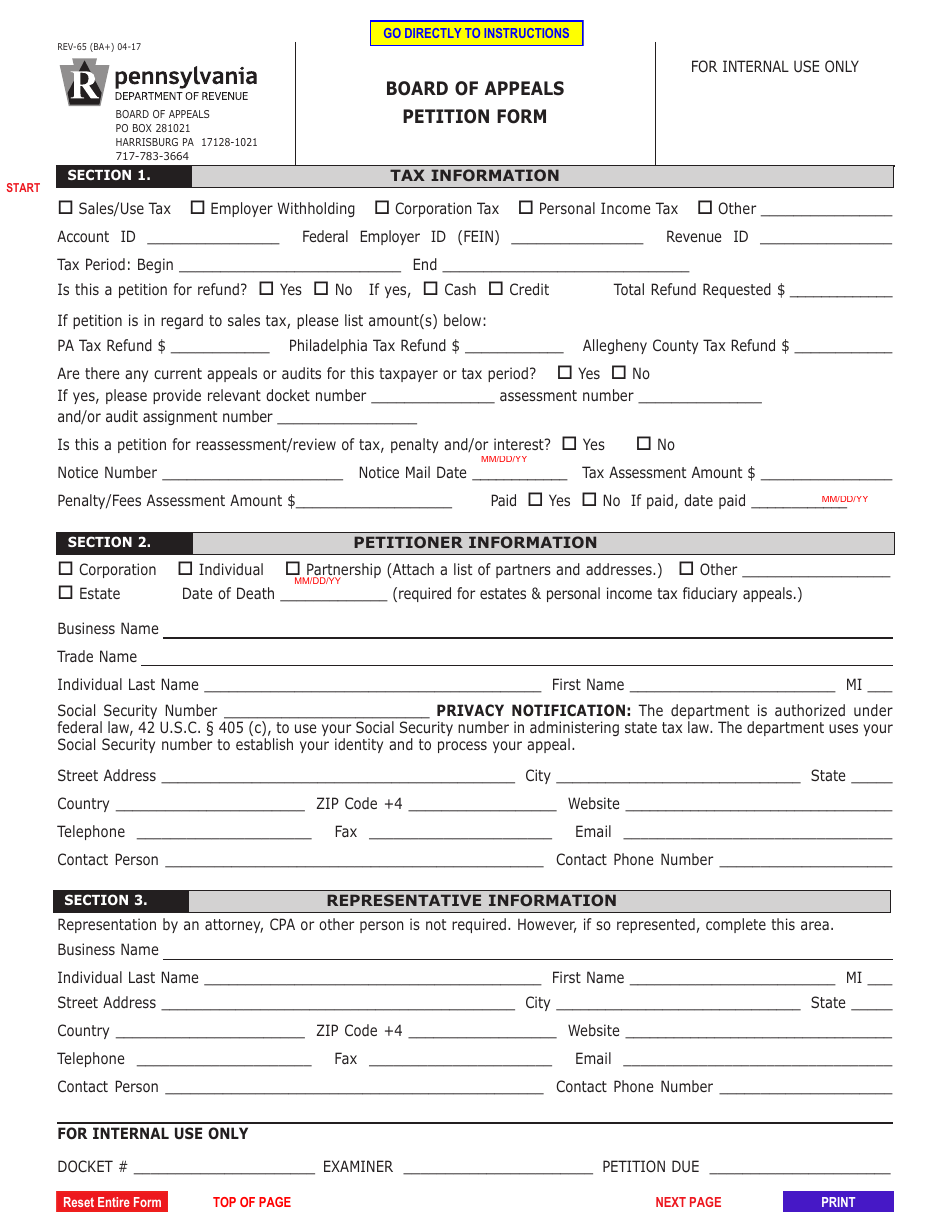

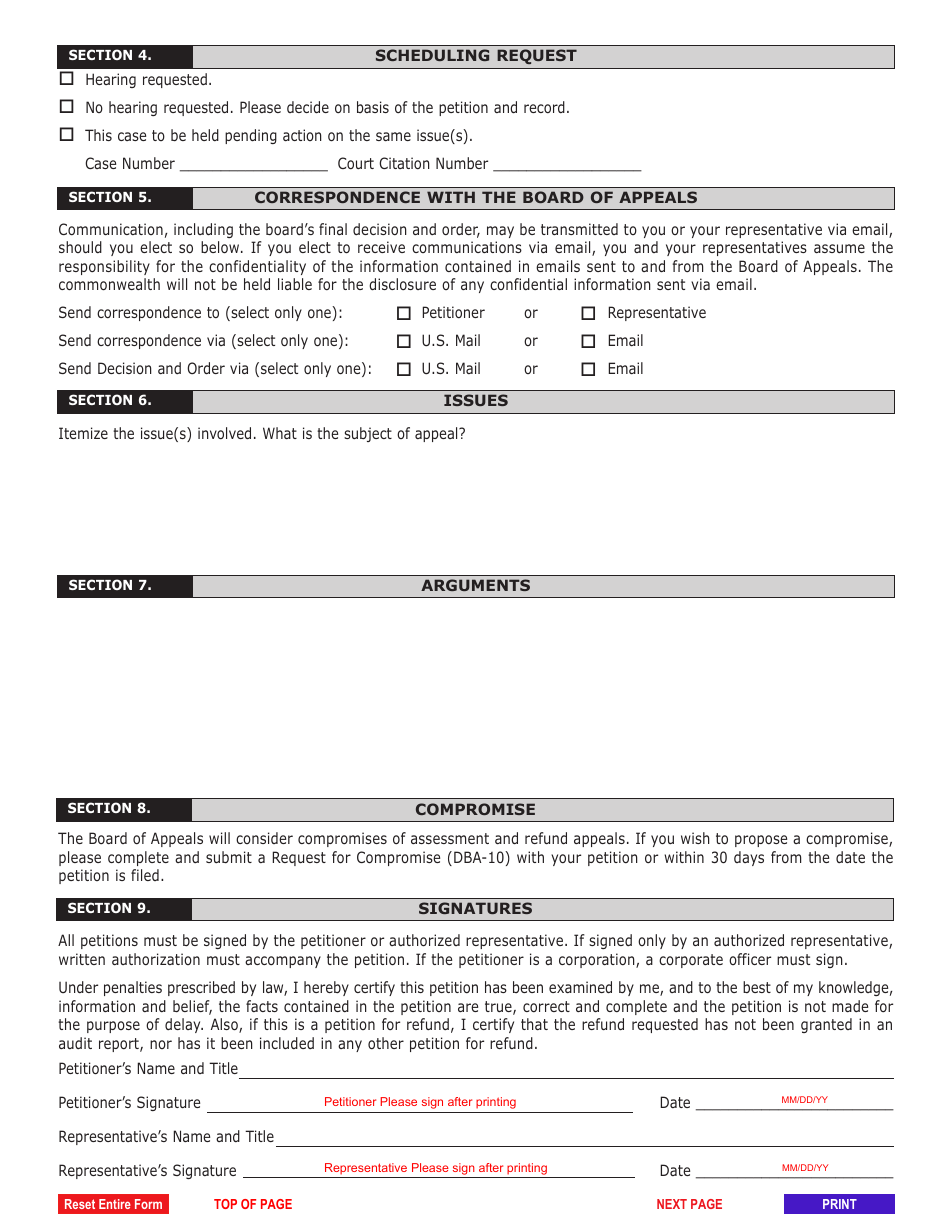

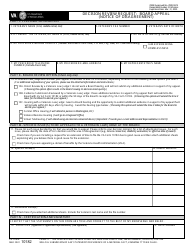

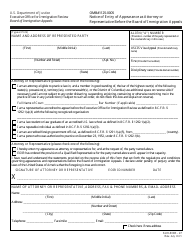

Form REV-65 Board of Appeals Petition Form - Pennsylvania

What Is Form REV-65?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

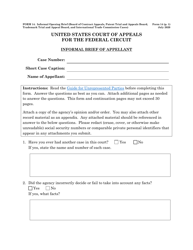

Q: What is the REV-65 Board of Appeals Petition Form?

A: The REV-65 form is a petition form used in Pennsylvania for appealing a tax assessment or other decisions made by a local tax board.

Q: What can I appeal using the REV-65 form?

A: You can appeal various decisions related to taxes, including property tax assessments, tax exemptions, and tax classifications.

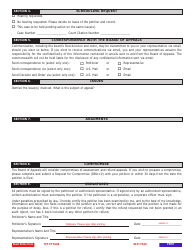

Q: What information do I need to provide on the REV-65 form?

A: You'll need to provide your contact information, the details of the decision you're appealing, supporting evidence, and any additional information required by the form.

Q: What is the deadline for filing the REV-65 form?

A: The deadline for filing the REV-65 form varies depending on the type of decision being appealed. It is typically within 45 days from the date of the notice or decision.

Q: Is there a fee for filing the REV-65 form?

A: There is no fee for filing the REV-65 form.

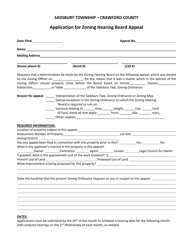

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-65 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.