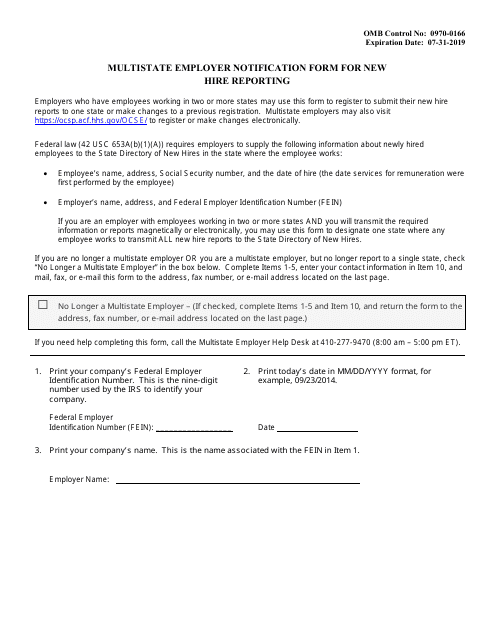

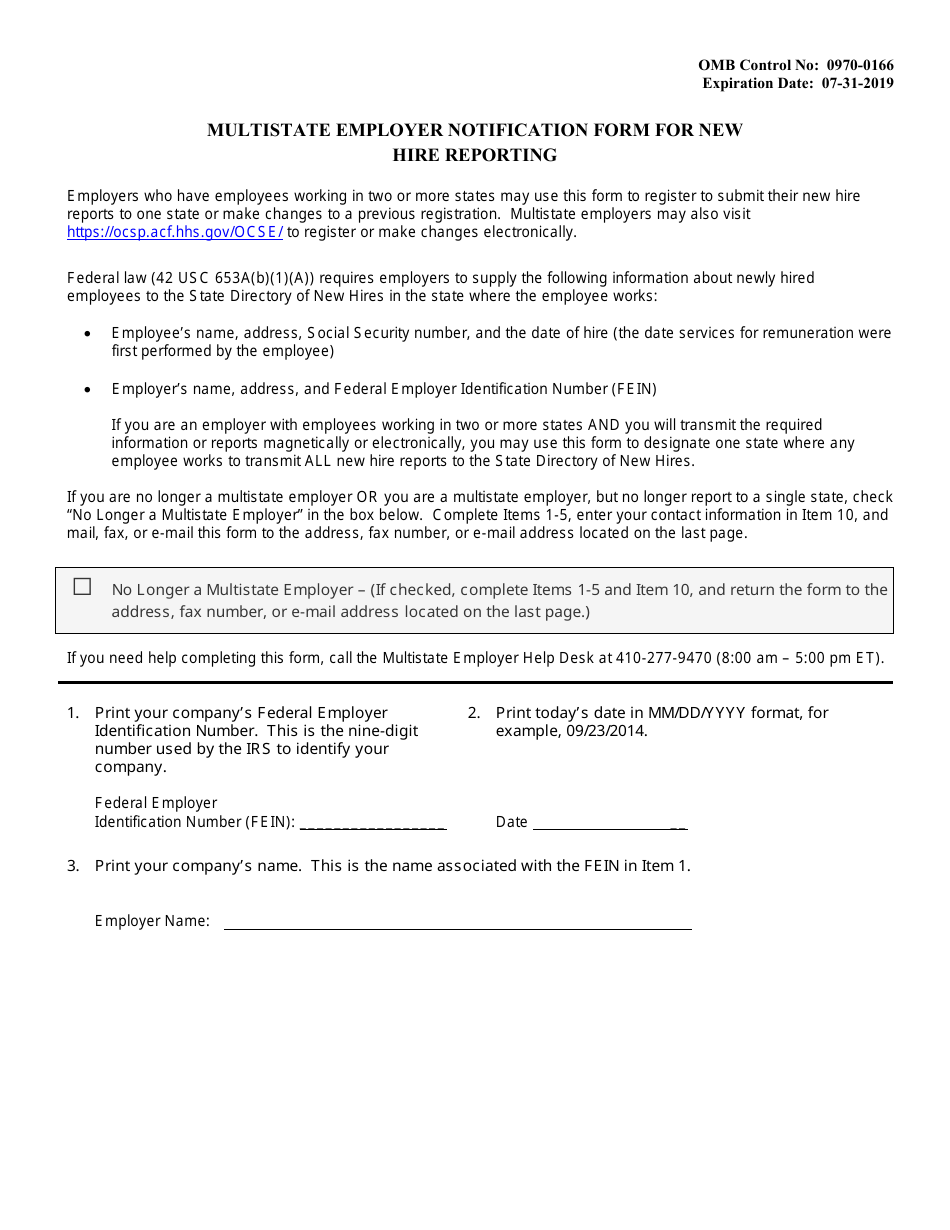

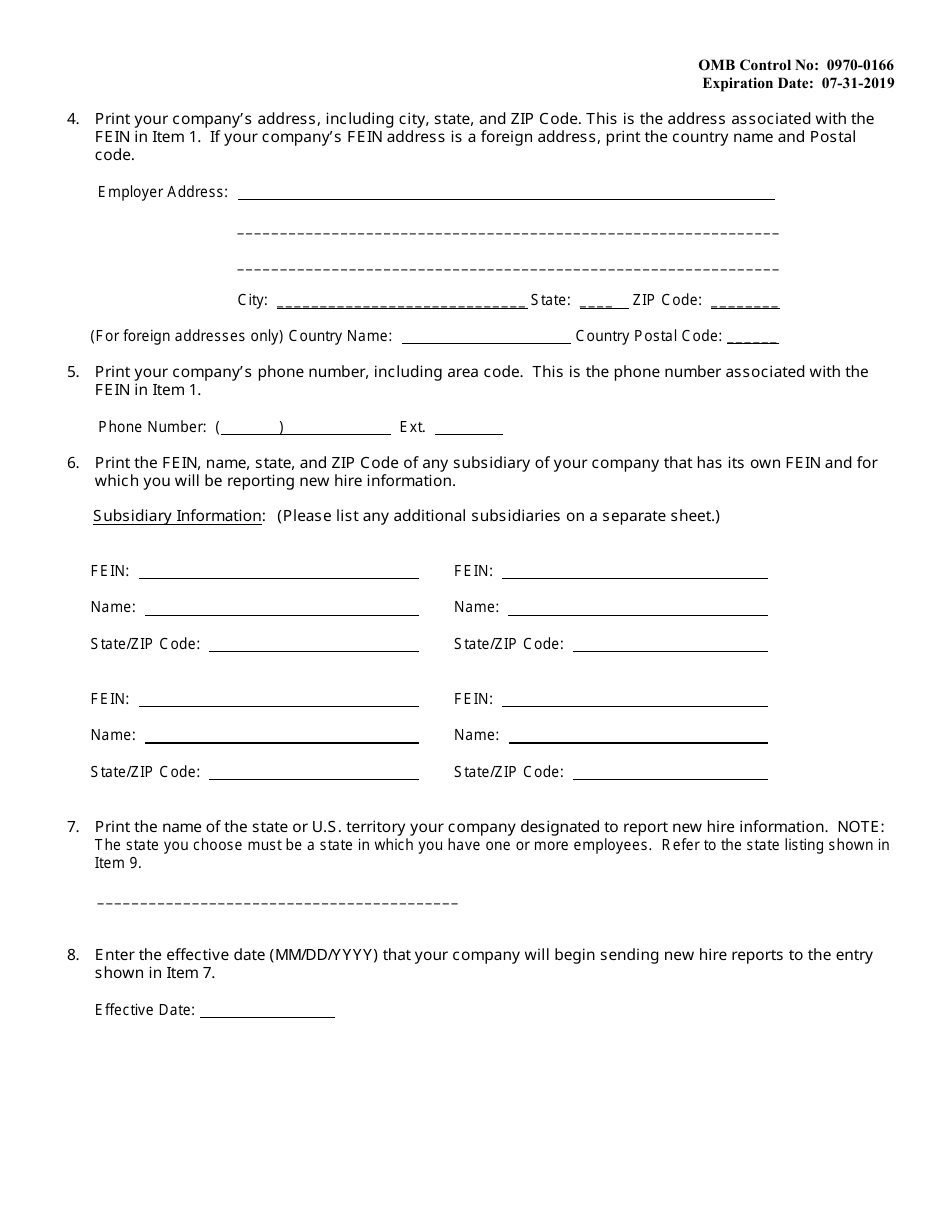

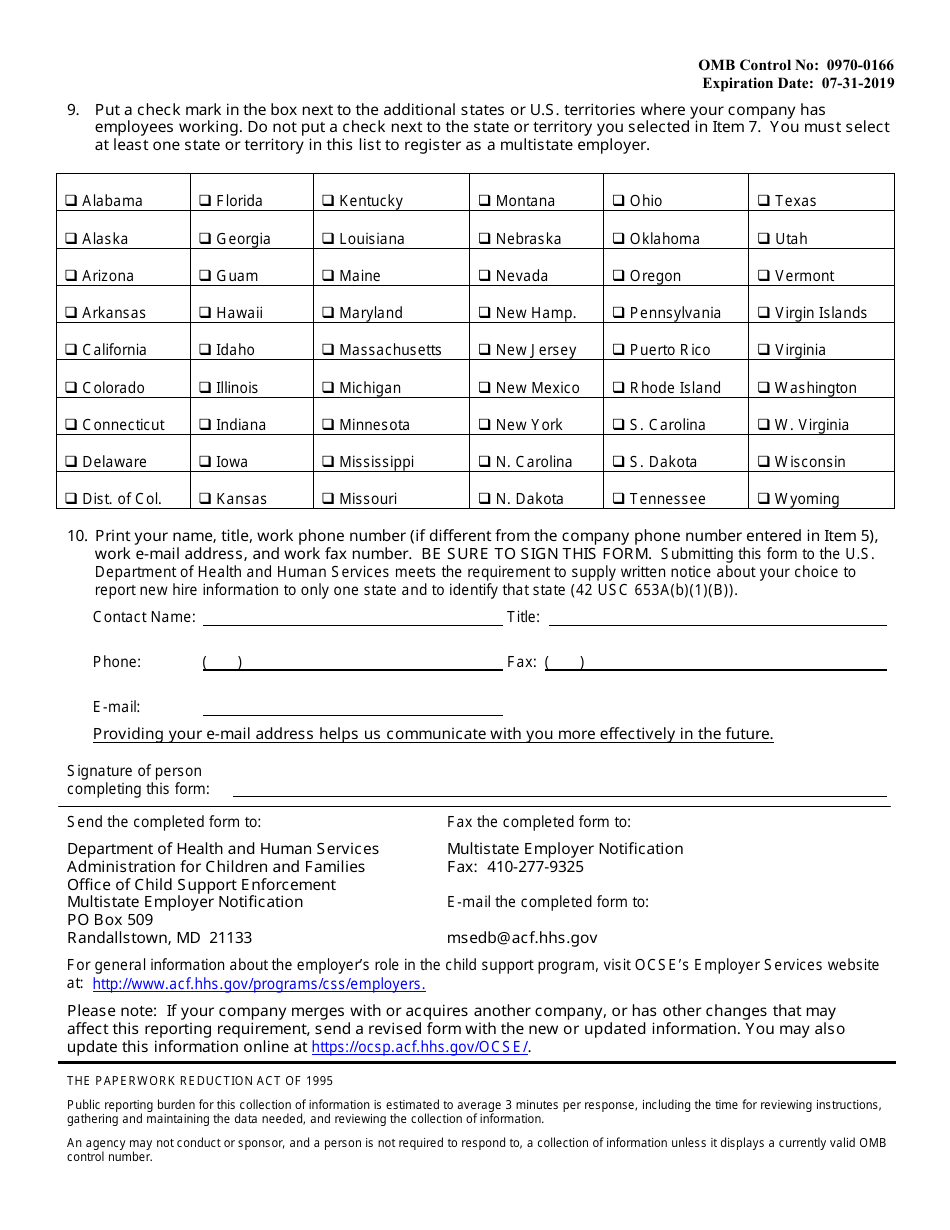

Multistate Employer Notification Form for New Hire Reporting

Multistate Employer Notification Form for New Hire Reporting is a 3-page legal document that was released by the U.S. Department of Health and Human Services - Administration for Children & Families and used nation-wide.

FAQ

Q: What is the Multistate Employer Notification Form?

A: The Multistate Employer Notification Form is a form used for reporting new hires to multiple states.

Q: Who should use the Multistate Employer Notification Form?

A: Employers who have employees working in multiple states should use the form to report new hires.

Q: What is new hire reporting?

A: New hire reporting is a requirement for employers to report information about newly hired employees to the appropriate state agencies.

Q: Why is new hire reporting necessary?

A: New hire reporting is necessary for various reasons, including ensuring that child support obligations are met and preventing fraud.

Q: How often should the Multistate Employer Notification Form be submitted?

A: The frequency of submission may vary by state, but typically the form should be submitted within 20 days of the employee's start date.

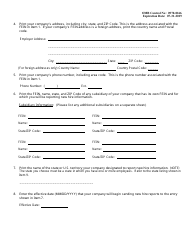

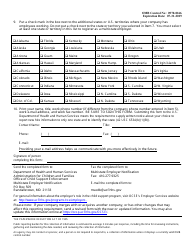

Q: What information is required on the Multistate Employer Notification Form?

A: The form typically requires information such as the employer's name, address, federal employer identification number (FEIN), and the employee's name, address, and social security number.

Q: Are there any penalties for not submitting the Multistate Employer Notification Form?

A: Penalties for non-compliance with new hire reporting requirements vary by state, but can include fines and other legal consequences.

Form Details:

- The latest edition currently provided by the U.S. Department of Health and Human Services - Administration for Children & Families;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.