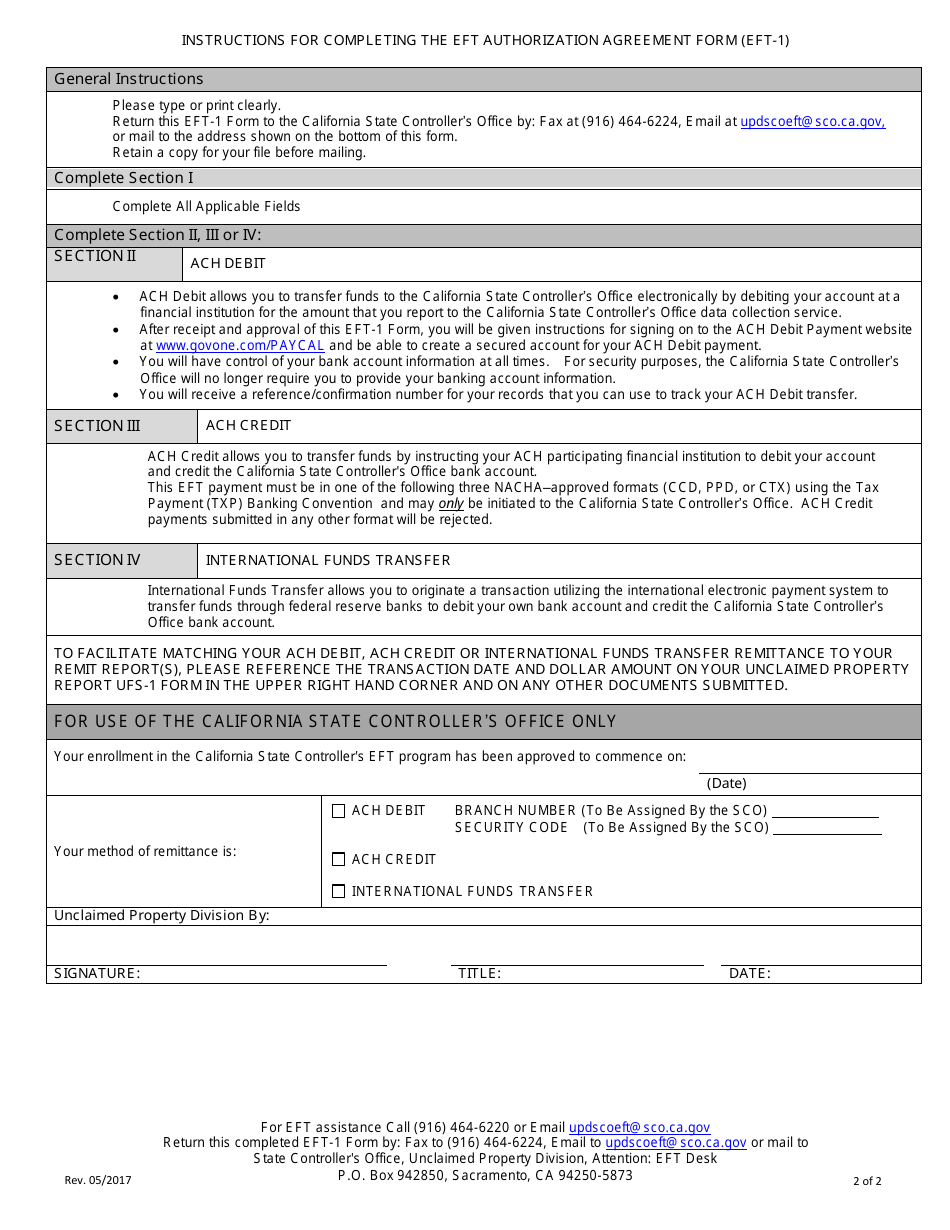

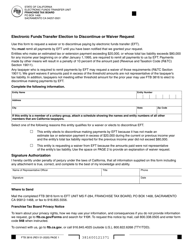

This version of the form is not currently in use and is provided for reference only. Download this version of

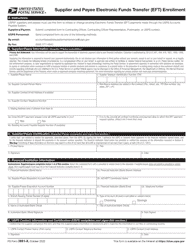

Form EFT-1

for the current year.

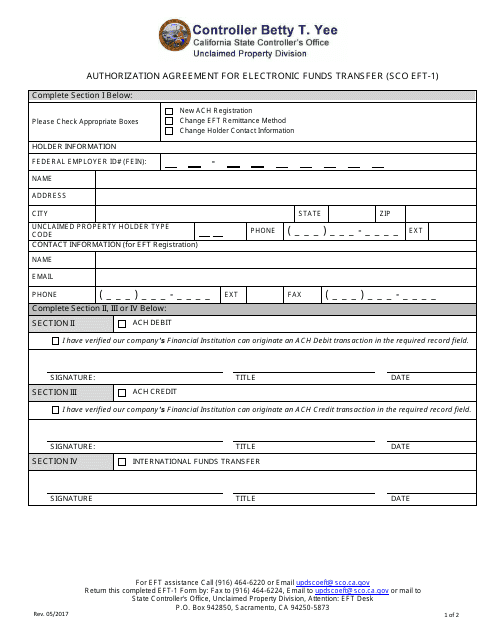

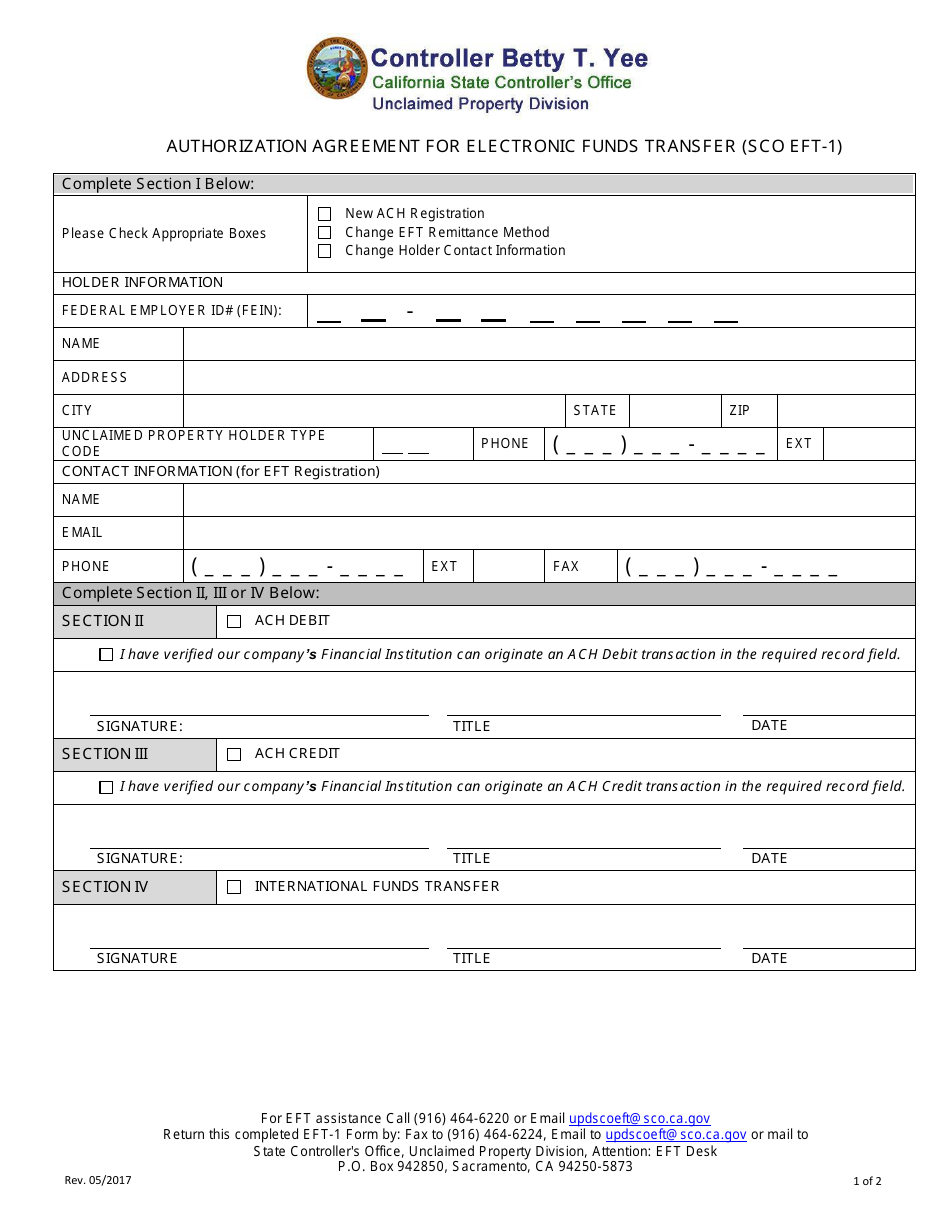

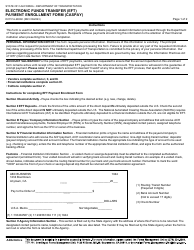

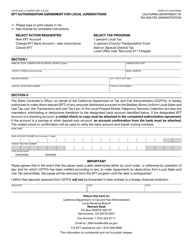

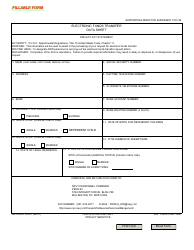

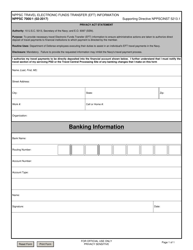

Form EFT-1 Authorization Agreement for Electronic Funds Transfer - California

What Is Form EFT-1?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is EFT-1?

A: EFT-1 stands for Authorization Agreement for Electronic Funds Transfer.

Q: What is the purpose of EFT-1?

A: The purpose of EFT-1 is to authorize electronic funds transfer for certain transactions.

Q: Who uses EFT-1?

A: EFT-1 is used by individuals or businesses in California.

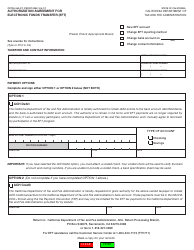

Q: What transactions can be authorized with EFT-1?

A: EFT-1 can be used to authorize electronic funds transfer for various transactions, such as tax payments, refunds, and other government payments.

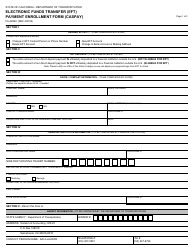

Q: How do I fill out EFT-1?

A: To fill out EFT-1, you will need to provide your personal or business information, banking details, and specify the type of transaction you wish to authorize.

Q: Is there a fee for using EFT-1?

A: There may be fees associated with using EFT-1, depending on the type of transaction and the banking institution.

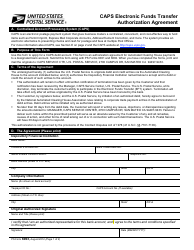

Q: Can I cancel or modify my EFT-1 authorization?

A: Yes, you can cancel or modify your EFT-1 authorization by submitting a written request to the relevant government agency.

Q: Is EFT-1 secure?

A: EFT-1 utilizes secure electronic funds transfer protocols to ensure the confidentiality and integrity of your financial information.

Q: Is EFT-1 only applicable in California?

A: Yes, EFT-1 is specifically designed for use in California and may not be applicable in other states or jurisdictions.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EFT-1 by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.