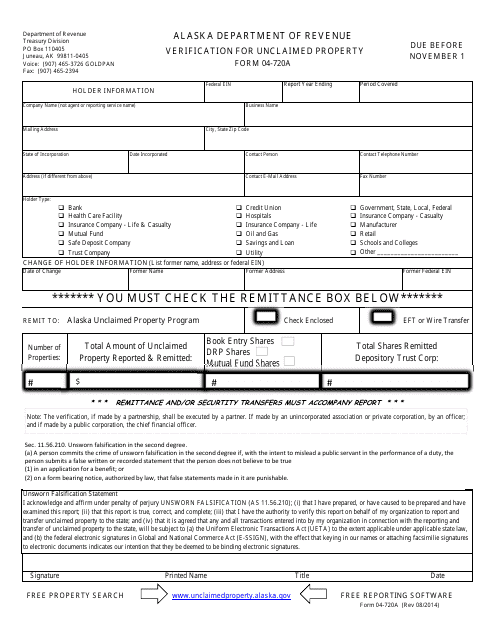

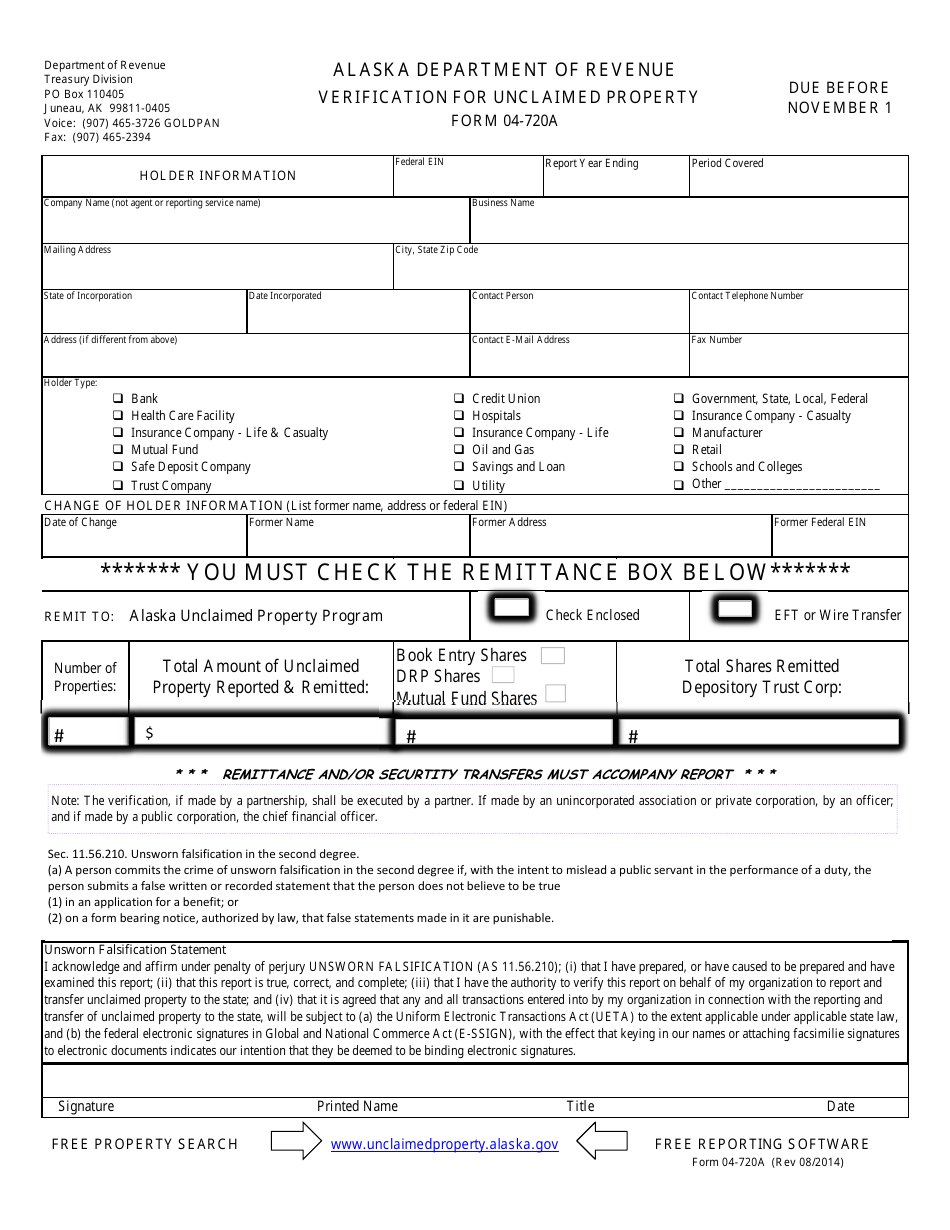

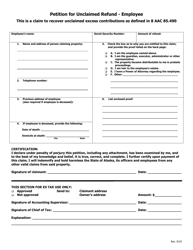

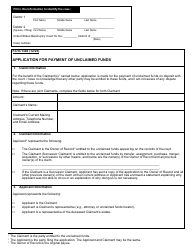

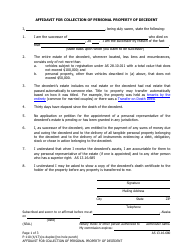

Form 04-720A Verification for Unclaimed Property - Alaska

What Is Form 04-720A?

This is a legal form that was released by the Alaska Department of Revenue - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

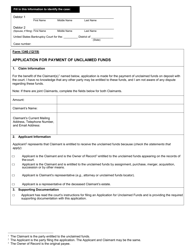

Q: What is Form 04-720A?

A: It is a verification form for unclaimed property in Alaska.

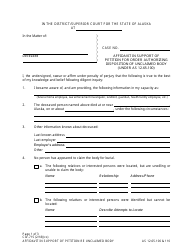

Q: Who needs to fill out Form 04-720A?

A: Anyone who is in possession of unclaimed property in Alaska.

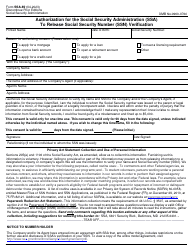

Q: What is unclaimed property?

A: Unclaimed property refers to assets or funds that have been abandoned or forgotten by their rightful owners.

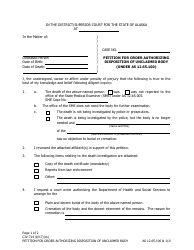

Q: What is the purpose of Form 04-720A?

A: The purpose of the form is to verify the existence and ownership of unclaimed property in Alaska.

Q: Is there a deadline for filing Form 04-720A?

A: Yes, the form must be filed by November 1st of each year.

Q: What information is required on Form 04-720A?

A: The form requires details about the unclaimed property, including the owner's name, contact information, and a description of the property.

Q: What happens after submitting Form 04-720A?

A: After submitting the form, the Alaska Unclaimed Property Division will review the information and may contact you for further verification.

Q: What happens to unclaimed property in Alaska?

A: Unclaimed property in Alaska is held by the state until the rightful owners or their heirs come forward to claim it.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Alaska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 04-720A by clicking the link below or browse more documents and templates provided by the Alaska Department of Revenue.