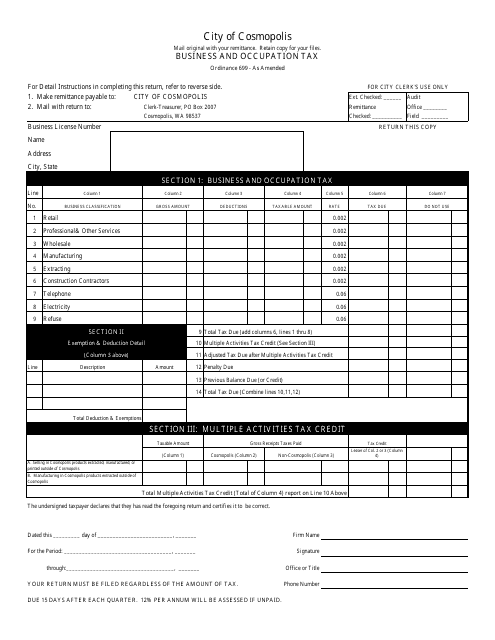

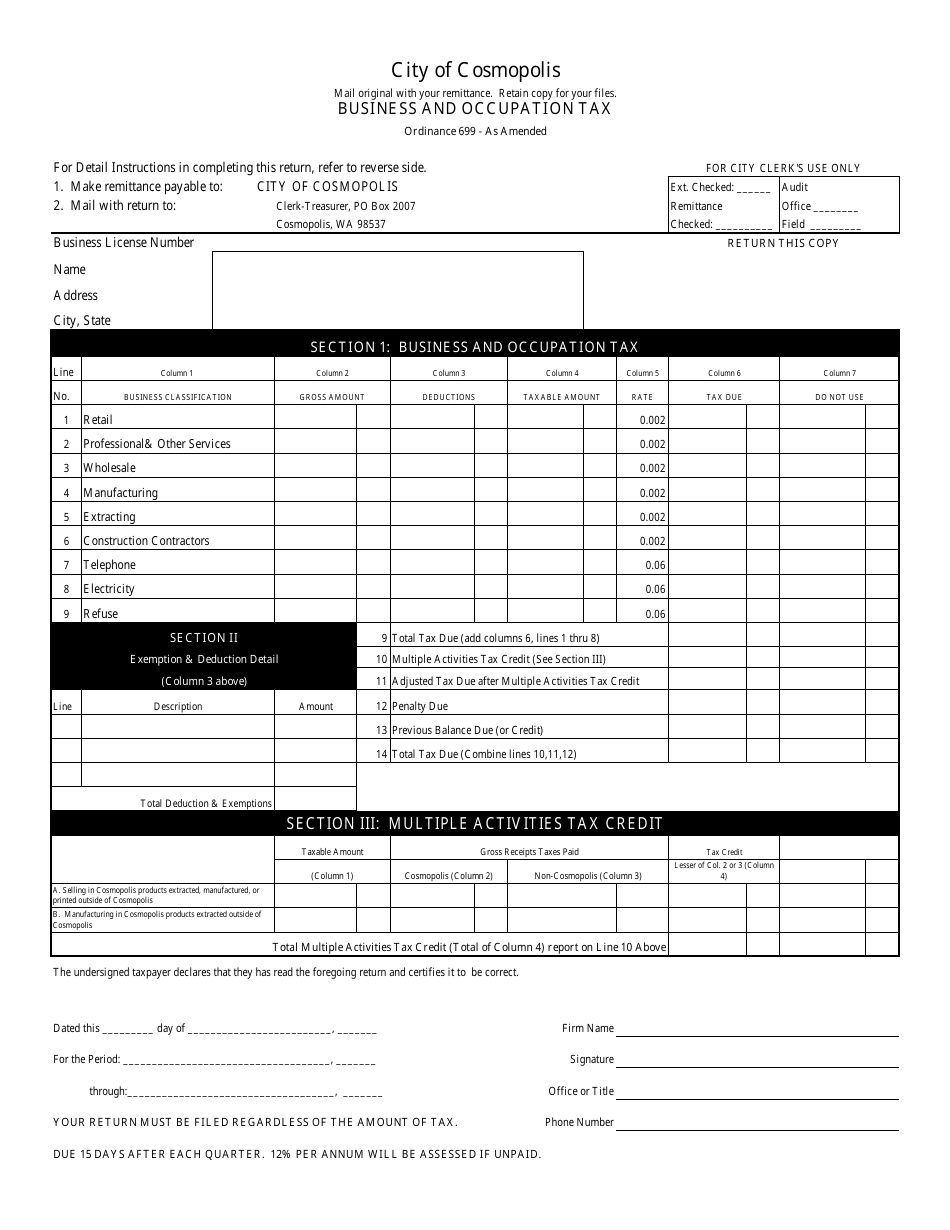

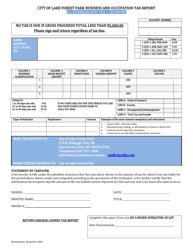

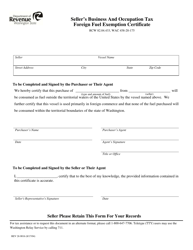

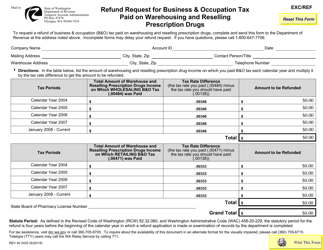

Business and Occupation Tax Form - City of Cosmopolis, Washington

Business and Occupation Tax Form is a legal document that was released by the Washington State Department of Revenue - a government authority operating within Washington. The form may be used strictly within City of Cosmopolis.

FAQ

Q: What is the Business and Occupation Tax Form?

A: The Business and Occupation Tax Form is a document used by businesses operating in the City of Cosmopolis, Washington to report their gross receipts and calculate the tax owed.

Q: Who needs to file the Business and Occupation Tax Form?

A: Any business operating within the City of Cosmopolis, Washington is required to file the Business and Occupation Tax Form.

Q: How often do I need to file the Business and Occupation Tax Form?

A: The Business and Occupation Tax Form must be filed annually or quarterly, depending on the business's gross receipts.

Q: What is the purpose of the Business and Occupation Tax?

A: The Business and Occupation Tax is used to generate revenue for the City of Cosmopolis to fund various municipal services and projects.

Q: How do I calculate the Business and Occupation Tax?

A: The tax rate for the Business and Occupation Tax varies based on the business's classification. The tax is calculated by multiplying the tax rate by the business's gross receipts.

Form Details:

- The latest edition currently provided by the Washington State Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.