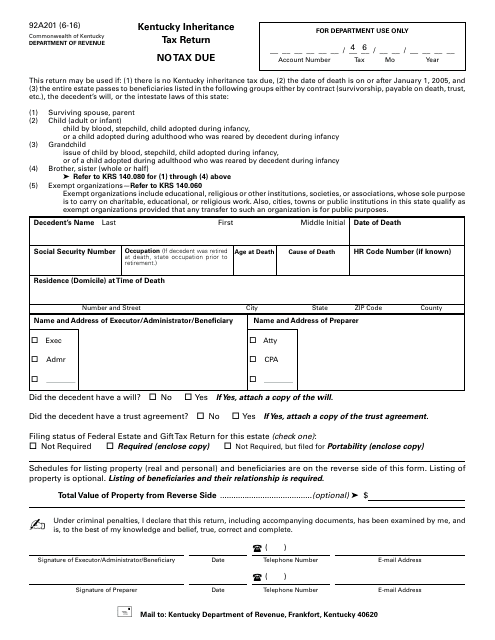

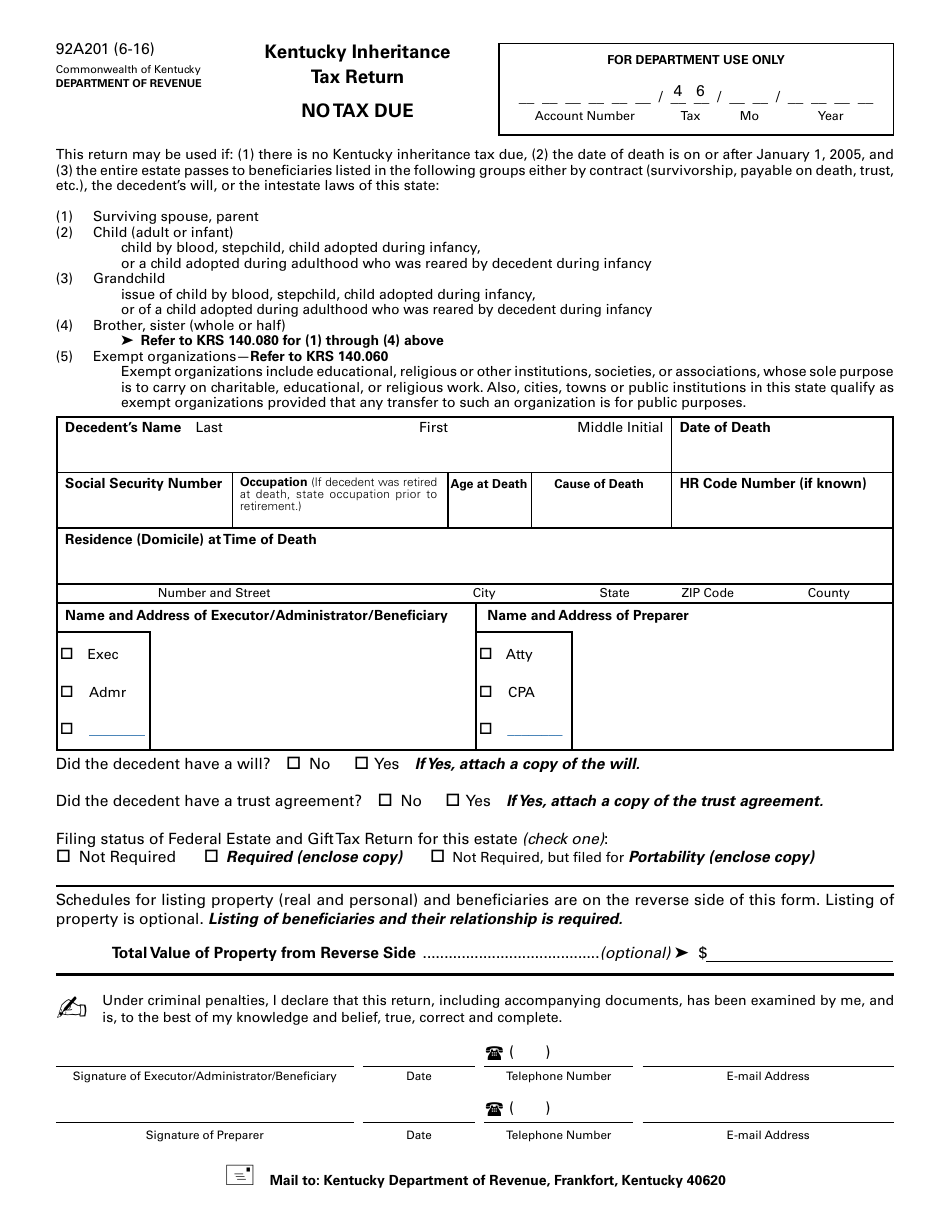

Form 92A201 Kentucky Inheritance Tax Return - No Tax Due - Kentucky

What Is Form 92A201?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 92A201?

A: Form 92A201 is the Kentucky Inheritance Tax Return.

Q: What is the purpose of Form 92A201?

A: Form 92A201 is used to report any potential inheritance tax liabilities in Kentucky.

Q: What does it mean if there is 'No Tax Due' on Form 92A201?

A: If there is 'No Tax Due' on the form, it means that there is no inheritance tax owed to the state of Kentucky.

Q: Who needs to file Form 92A201?

A: Anyone who is the executor or administrator of an estate in Kentucky, or anyone who is required to pay inheritance taxes, needs to file Form 92A201.

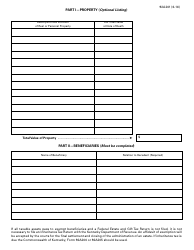

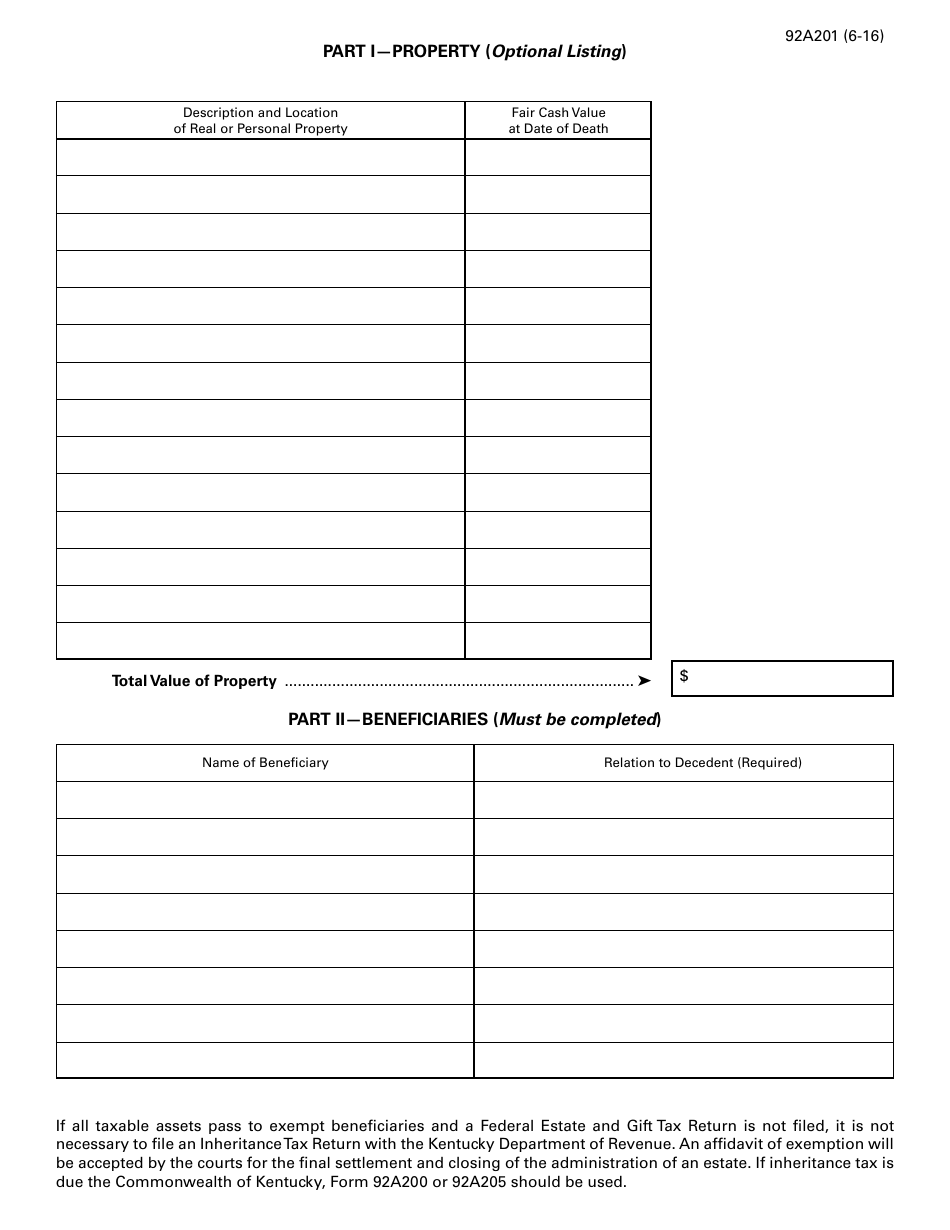

Q: What information is required on Form 92A201?

A: Form 92A201 requires information about the deceased person, the estate, the beneficiaries, and any assets subject to inheritance tax.

Q: When should I file Form 92A201?

A: Form 92A201 should be filed within 18 months after the decedent's death, or within 18 months after the final determination of any federal estate tax liability, whichever is later.

Q: Are there any penalties for late filing of Form 92A201?

A: Yes, there are penalties for late filing of Form 92A201, including interest and potential legal actions.

Q: Is Form 92A201 the only tax form required for estate administration in Kentucky?

A: No, in addition to Form 92A201, there may be other tax forms, such as the federal estate tax return (Form 706), that need to be filed depending on the circumstances of the estate.

Q: Can I get assistance in completing Form 92A201?

A: Yes, you can seek assistance from a tax professional or the Kentucky Department of Revenue to help you complete Form 92A201 accurately.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 92A201 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.