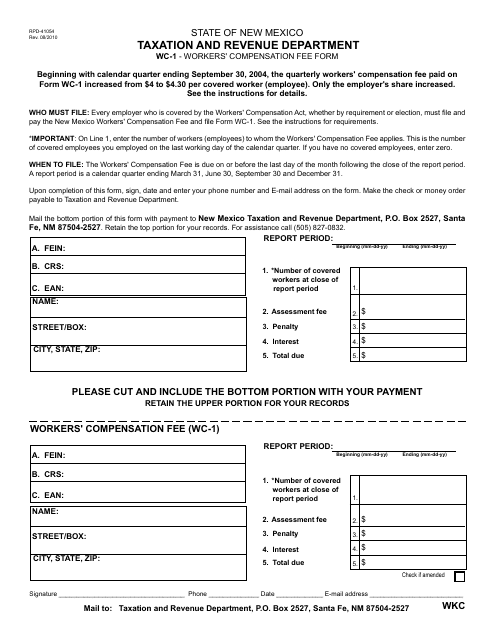

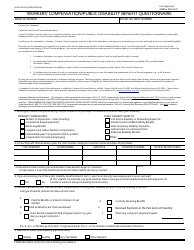

Form WC-1 (RPD-41054) Workers' Compensation Fee Form - New Mexico

What Is Form WC-1 (RPD-41054)?

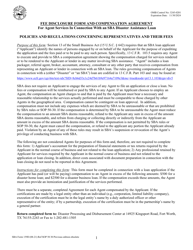

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form WC-1?

A: Form WC-1 is the Workers' Compensation Fee Form in New Mexico.

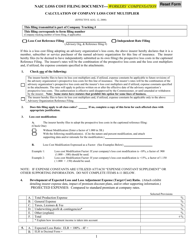

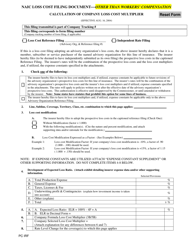

Q: What is the purpose of Form WC-1?

A: The purpose of Form WC-1 is to calculate and report workers' compensation fees in New Mexico.

Q: Who needs to fill out Form WC-1?

A: Employers in New Mexico who are subject to the workers' compensation law need to fill out Form WC-1.

Q: When should Form WC-1 be filed?

A: Form WC-1 should be filed annually no later than April 30th of each year.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WC-1 (RPD-41054) by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.