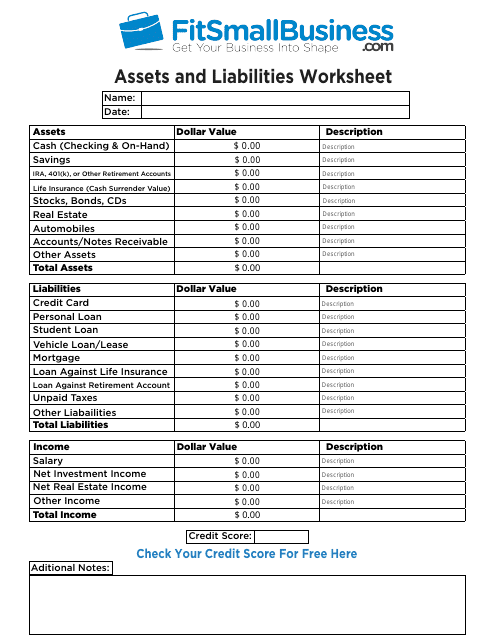

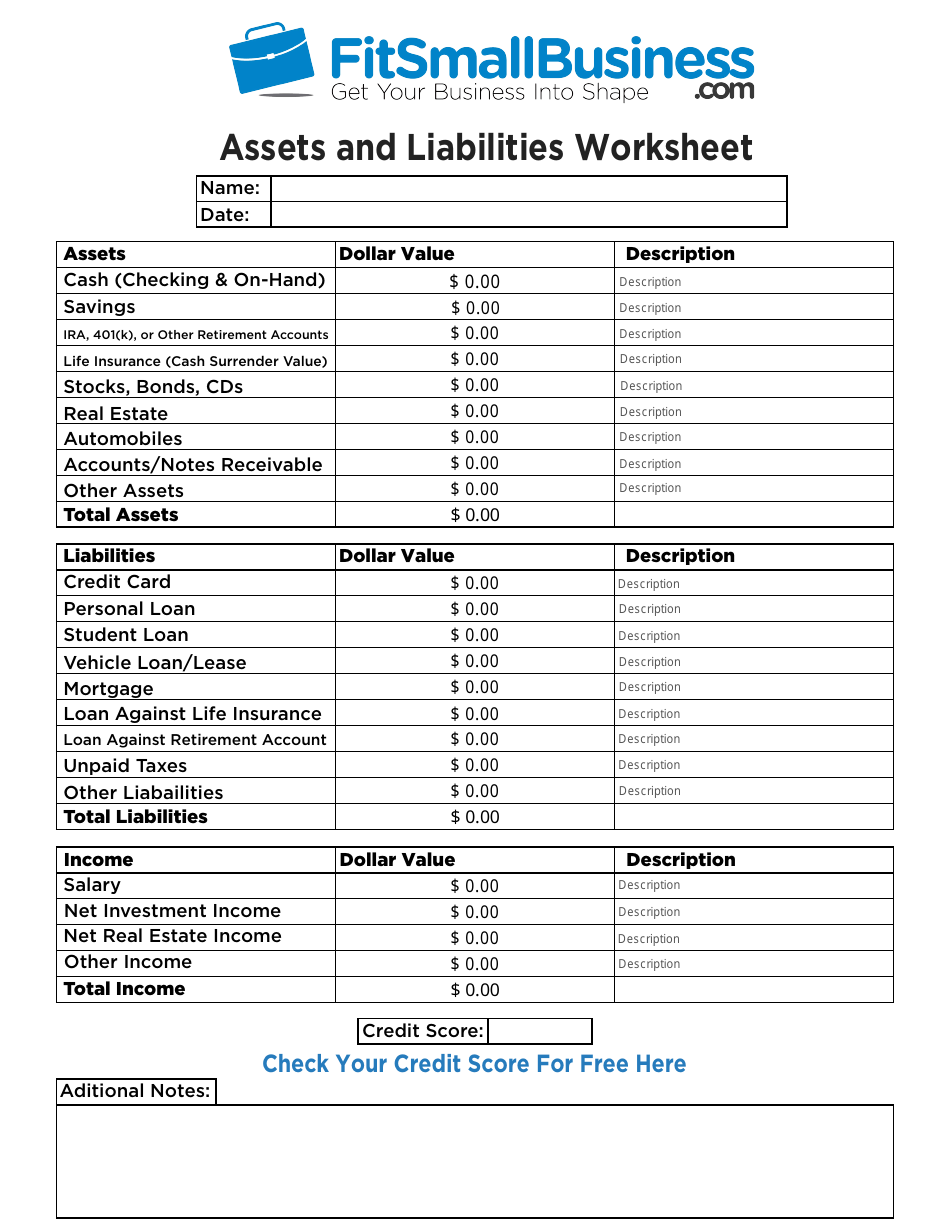

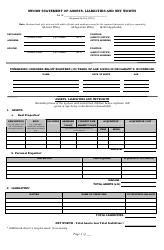

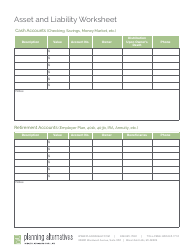

Assets and Liabilities Worksheet Template

An Assets and Liabilities Worksheet Template is used to track and manage your assets (such as cash, investments, property) and liabilities (such as loans, credit card debt, mortgage) in order to have a clear understanding of your financial position.

The Assets and Liabilities Worksheet Template is typically filed by individuals or businesses to track and document their financial assets and liabilities.

FAQ

Q: What is an assets and liabilities worksheet?

A: An assets and liabilities worksheet is a template used to keep track of the items that you own (assets) and what you owe (liabilities).

Q: Why do I need an assets and liabilities worksheet?

A: An assets and liabilities worksheet helps you organize and manage your financial information, providing a clear picture of your net worth.

Q: What should I include in an assets and liabilities worksheet?

A: Include all of your assets such as cash, investments, real estate, vehicles, and personal belongings; and your liabilities including mortgages, loans, credit card balances, and other debts.

Q: How do I use an assets and liabilities worksheet?

A: Fill in the values of each asset and liability, and then calculate the difference between your total assets and total liabilities to determine your net worth.

Q: Is it necessary to update my assets and liabilities worksheet regularly?

A: Yes, it is important to update your assets and liabilities worksheet regularly as your financial situation changes over time. This will ensure that you have an accurate understanding of your net worth.