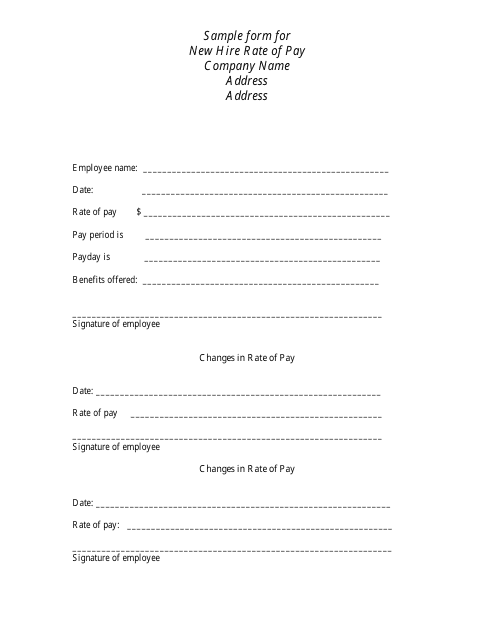

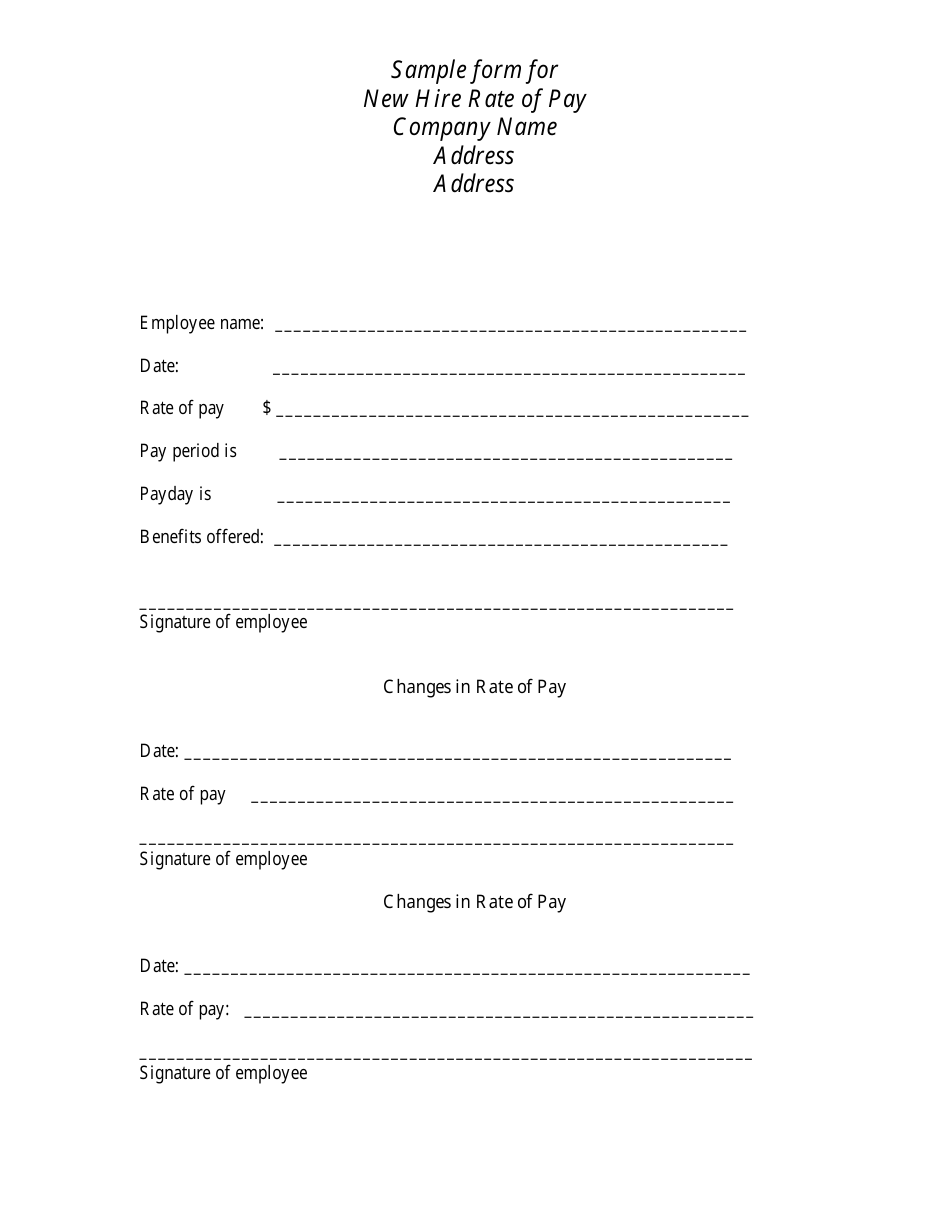

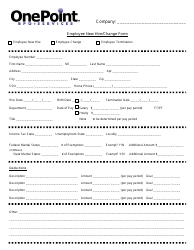

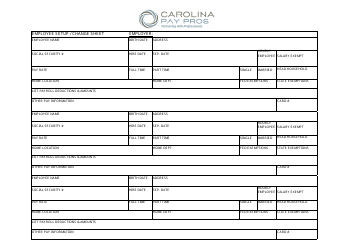

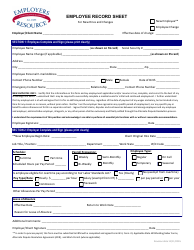

New Hire Rate of Pay Form

The New Hire Rate of Pay Form is typically used by employers to document and establish the rate of pay for new employees. It helps to ensure transparency and clarity regarding the wage or salary that will be paid to a new hire.

The employer or company typically files the New Hire Rate of Pay Form.

FAQ

Q: What is the New Hire Rate of Pay Form?

A: The New Hire Rate of Pay Form is a document used to determine the initial wage or salary for a newly hired employee.

Q: Why is the New Hire Rate of Pay Form important?

A: The New Hire Rate of Pay Form is important because it ensures that the newly hired employee is paid a fair and consistent wage or salary.

Q: Who is responsible for completing the New Hire Rate of Pay Form?

A: The employer or human resources department is responsible for completing the New Hire Rate of Pay Form.

Q: What information is typically included in the New Hire Rate of Pay Form?

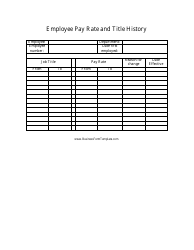

A: The New Hire Rate of Pay Form typically includes the employee's name, position, start date, and proposed rate of pay.

Q: Can the employee negotiate their rate of pay on the New Hire Rate of Pay Form?

A: Yes, the employee can negotiate their rate of pay on the New Hire Rate of Pay Form. It is recommended to discuss any desired changes with the employer or human resources department.

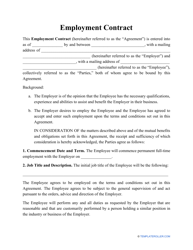

Q: Is the New Hire Rate of Pay Form legally binding?

A: The New Hire Rate of Pay Form is not legally binding, but it serves as an important record of the initial agreed-upon rate of pay for the employee.