This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8975

for the current year.

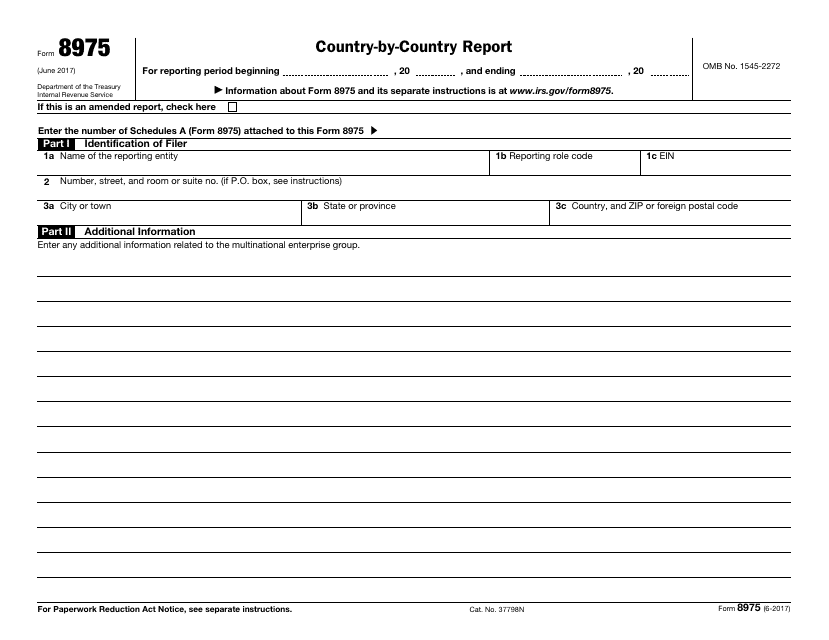

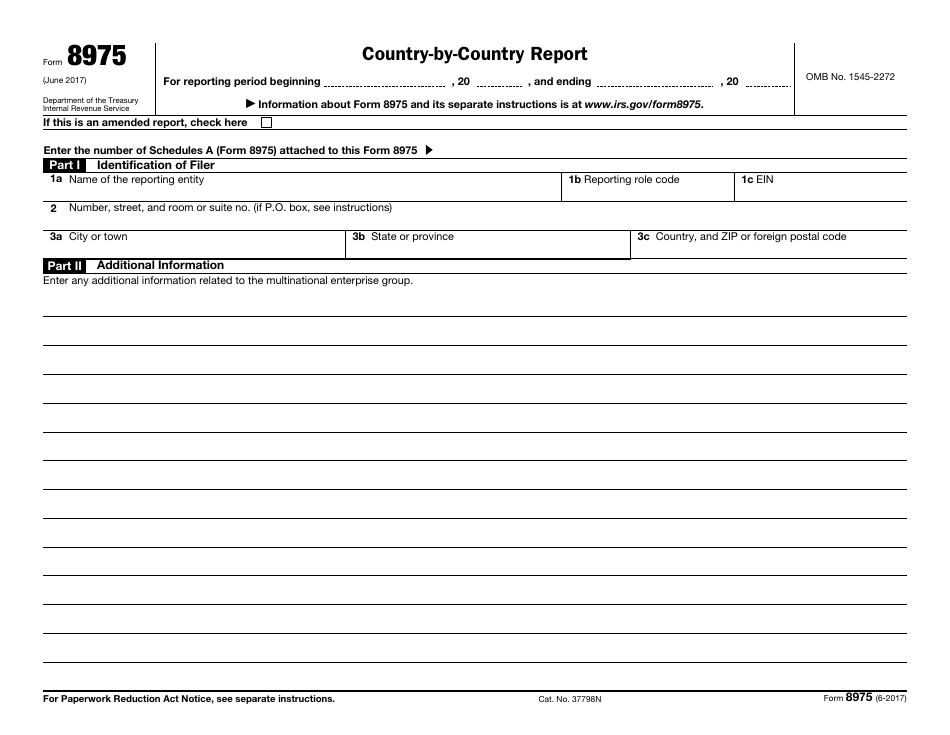

IRS Form 8975 Country-By-Country Report

What Is IRS Form 8975?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8975?

A: IRS Form 8975 is a Country-By-Country Report that certain multinational enterprises (MNEs) must file with the Internal Revenue Service (IRS).

Q: Which entities are required to file Form 8975?

A: Only ultimate parent entities of multinational enterprise (MNE) groups with annual revenue of $850 million or more in the preceding fiscal year are required to file Form 8975.

Q: What information is included in the Country-By-Country Report?

A: The Country-By-Country Report includes information on the MNE group's allocation of income, taxes paid, and other indicators of economic activity in each tax jurisdiction where the group operates.

Q: When is Form 8975 due?

A: Form 8975 is generally due by the due date, including extensions, of the MNE group's federal income tax return for the fiscal year.

Q: Are there any penalties for not filing Form 8975?

A: Yes, there can be penalties for failure to file Form 8975 or for filing an incomplete or inaccurate report. The penalties can vary depending on the circumstances.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8975 through the link below or browse more documents in our library of IRS Forms.